Content available in English and Spanish (scroll down)

TTR DealMaker Q&A with Allen & Overy Partner Fernando Torrente

Fernando Torrente – Allen & Overy

Fernando Torrente with more than 30 years of experience is specialized in Spain in M&A and Equity Capital Markets, including takeovers, IPOs, flotations, securities issue and placement, secondary offerings and follow-on capital offerings. Additionally he is an expert in corporate governance and formed part of the group of lawyers that advised the Comisión Nacional del Mercado de Valores (CNMV) in preparing the Code of Good Governance of Listed Companies approved in February 2015

TTR: How do you see the M&A market after the current crisis and what are your main conclusions for 2020?

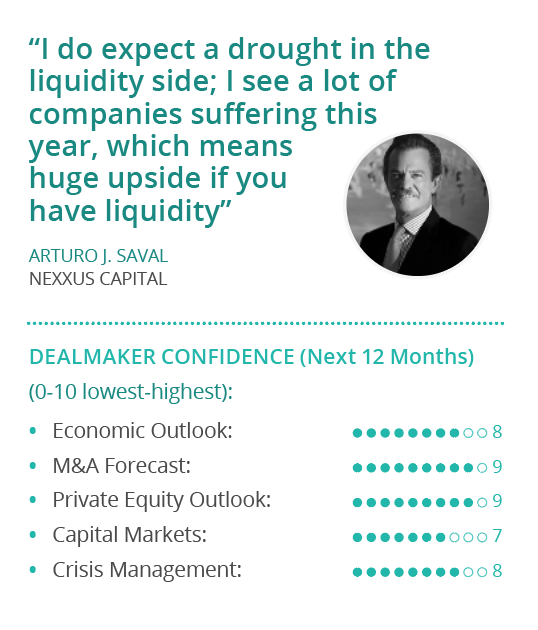

F. T.: Unfortunately, the crisis is not over and many of its worst effects, the most damaging affecting employment and a dramatic destruction of the business network, will be aggravated in 2021. However, the positive results obtained in the research and development processes of different vaccines have produced a very relevant change in the perception that companies and investors have about the development of the crisis and the recovery. This has led them to take decisions to search for investment opportunities, initiate consolidation processes, restructure their balance sheets, segregate areas of activity to open them to the participation by investors, put non-strategic assets up for sale or request a rescue of public funds. If the vaccine protection provides the expected response, this is going to be a determining factor in making 2021 a very active year, in which the market is going to offer a significant variety and number of transactions.

TTR: Many Spanish companies have taken on large debts or depend on government support to stay in business. How do you think this situation will crumble and how will this affect the M&A market?

It will depend a lot on market behaviour and the evolution of consumption and business recovery. There will be very difficult situations in which it will not be possible to repay the debt, which will involve restructuring and conversion processes and it will be necessary to take measures from the political, monetary and fiscal points of view. It is inevitable, unfortunately, that many companies will not be able to pay their debts, and this will cause divestments of assets or corporate spin-offs, rescue operations, consolidation processes, restructuring and insolvency proceedings, and distressed M&A transactions.

TTR: Up to November, the total value of transactions in Spain rose by 37%, according to TTR data, while the number of transactions decreased by 23%. How do you understand this divergence?

It is probably explained by the extraordinary situation that the world went through in 2020 due to the pandemic and the serious crisis caused by that, in which we are still immersed. The year 2020, without Covid-19, seemed uncertain after previous years with high growth in the M&A market. However, the total standstill of the economic activity, resulting from the general lockdown, had a pertinent impact on this market. Only a few transactions continued during this period, those that made strategic and business sense and which were led by very strong players in the financial field. The end of the first wave meant that the transactions, which had been paralysed, continued because it still made sense, as they were led by companies or investors with the capacity to deal with them, because of their strength, and because they took place in sectors that had proved resistant to the crisis. After the summer, we also saw consolidation transactions in the banking sector and the reactivation of the M&A market for smaller companies, which had been more affected. Logically, in such a difficult environment, opportunities are taken by those who are stronger and have a higher investment capacity. Besides, due to the huge liquidity existing in the market, particularly in private equity funds, there are fewer transactions but these have a higher volume.

TTR: Technology was the only sector that had more agreements this year than in 2019. What will be the next engine of consolidation in this sector once the wave of digital transformation has developed?

I think that the process of digital transformation, which started before the pandemic and which was accelerated by Covid-19 in a very intense way, still has a long way to go and I do not dare to predict when it might end.

The strongest companies have made very important investments in order to boost their development and will continue to do so, combining that with other investment and development elements, which are going to be a priority, such as sustainability. Those companies that have not had that financial strength but will survive the crisis, will continue with the digitalisation processes. I believe that the dynamism of this sector and its key role in the economy and society will continue to give it an enormous role.

TTR: Allen & Overy Spain has advised on renewable energy and technology transactions in Spain this year. What will drive consolidation in each of these sectors in 2021 and in the medium to long term?

Energy and technology are sectors in which there has been a lot of activity for a long time. Oil and electricity companies have long been undertaking a process to adapt their business to the energy transition, which has intensified in recent years, especially in 2020, for those who had not faced it decisively. These are sectors in continuous evolution, in which management teams have high capacity and the investors have great interest in their different aspects, infrastructures, core and secondary business, and so it is logical that consolidation processes take place through acquisitions or mergers, as well as through the appearance of new players.

TTR: What role do you expect Spanish telecommunications companies to play in mergers and acquisitions, nationally and internationally, in the next year?

Telecommunications companies have an extraordinarily important role, due to their business relevance, because they are providers of essential services, the very high qualification of their teams, their technological nature, and the fact that they are a driving force in innovation and development. During the last year we have seen very relevant transactions, such as the merger/combination of Liberty and Telefónica UK, and the takeover bid for Masmovil and Cellnex’s transactions. We will probably continue to see important transactions of very different types this year, for these reasons and the great interest they rouse among private equity funds searching for investment opportunities.

TTR: What do you expect to be the main challenges for law firms advising on M&A transactions in Spain over the next 12 to 18 months?

The market is moving very fast facing the opportunities that arise and there is going to be a very wide variety of transactions for which the law firms’ teams have to be ready to give advice of extraordinary quality and speed.

We are going to see distressed transactions, restructuring, processes of segregation of business units or branches of activity in which total or partial disinvestments will be sought, public to private transactions, mergers responding to sector consolidation processes, shareholder activism, dual tracks in which shareholders will seek to maximise the profitability of their investment through an IPO or a private M&A transactions. The international component will be very relevant and, until the Covid-19 pandemic stabilises, the environment will be very volatile. All this will demand the best from our teams and we have to be able to give our clients the best of us.

Spanish version

Fernando Torrente – Allen&Overy

Fernando Torrente, con 30 años de experiencia, es uno de los abogados más reconocidos de España en fusiones y adquisiciones y en mercado de capitales tales como OPAs, salidas a bolsa, emisión y colocación de valores, OPV y OPS. Además Fernando tiene amplia experiencia en gobierno corporativo y formó parte del Grupo de abogados que asesoró a la CNMV en la elaboración del Código de Buen Gobierno de las Sociedades Cotizadas aprobado en febrero de 2015.

TTR: ¿Cómo ve el mercado de fusiones y adquisiciones después de la crisis actual? ¿Cuáles son sus principales conclusiones de 2020?

Desgraciadamente la crisis no ha terminado y muchos de sus peores efectos, los más lesivos porque afectan al empleo y a una dramática destrucción de tejido empresarial, se van a agudizar en este año 2021. No obstante, los buenos resultados obtenidos en los procesos de investigación y elaboración de las distintas vacunas – a pesar de la incapacidad que están evidenciando muchos dirigentes políticos en el diseño e implementación de los procesos de vacunación de la población que esperemos se corrija – han producido un cambio muy relevante en la percepción por empresas e inversores sobre el desarrollo de la crisis y la recuperación, que les ha llevado a tomar decisiones para buscar oportunidades de inversión, iniciar procesos de consolidación, reestructurar sus balances, segregar áreas de actividad para abrirlo a la participación de inversores, poner en venta activos no estratégicos o solicitar un salvamento de fondos públicos. Ello va a ser determinante para que el año 2021 sea, si la protección de la vacuna da la repuesta esperada, un año muy activo en el que el mercado va a ofrecer una variedad y un número de operaciones importante.

TTR: Muchas empresas españolas han asumido grandes deudas o dependen del apoyo del gobierno para mantenerse en el negocio. ¿Cómo cree que se desmoronará esta situación y cómo afectará esto al mercado de fusiones y adquisiciones?

Dependerá mucho del comportamiento del mercado y de la evolución del consumo y la recuperación empresarial. Va a haber situaciones muy difíciles en las que no va a ser posible devolver la deuda, ello implicará procesos de reestructuración y reconversión y será necesario que se adopten las medidas adecuadas desde el punto de vista político, monetario y fiscal. Va a ser inevitable, desgraciadamente, que muchas empresas no tengan capacidad para afrontar el pago de sus deudas, y ello provocará desinversiones de activos o divisiones de negocio, operaciones de salvamento, procesos de consolidación, reestructuraciones y concursos y operaciones de distressed M&A.

TTR: Hasta noviembre, el valor total de las transacciones en España subió un 37%, según datos de TTR, mientras que el número de transacciones disminuyó un 23%. ¿Cómo interpreta esta divergencia?

Probablemente se explica por la extraordinaria situación que el mundo ha vivido en el año 2020 como consecuencia de la pandemia y la gravísima crisis que ha provocado en la que seguimos inmersos. El año 2020, sin COVID, se presentaba con ciertas incertidumbres después de años previos de gran crecimiento del mercado de M&A. Sin embargo, la paralización total de la actividad económica que se derivó del confinamiento general, tuvo el correspondiente impacto en este mercado. Solo algunas operaciones continuaron en ese periodo, las que tenían sentido estratégico y empresarial y estaban protagonizadas por actores muy fuertes económicamente. El fin de la primera ola hizo que operaciones que se habían paralizado pero que seguían teniendo sentido continuaran, de nuevo por estar protagonizadas por empresas o inversores con capacidad para afrontarlas, por su fortaleza, y por tener lugar en sectores que se han mostrado resistentes a la crisis. A la vuelta del verano hemos asistido también a operaciones de consolidación del sector bancario y se reactivó el mercado de M&A de empresas de menor tamaño que se había visto más afectado. Es lógico que en un entorno tan difícil, las oportunidades sean aprovechadas por quienes son más fuertes y disponen de mayor capacidad de inversión y que, por la muy elevada liquidez que existe en el mercado, particularmente en fondos de private equity, haya menos operaciones pero estas sean de mayor volumen.

TTR: La tecnología fue el único sector que tuvo más acuerdos este año que en 2019. ¿Cuál será el próximo motor de consolidación en este sector una vez que se haya desarrollado la ola de transformación digital

Pienso que el proceso de transformación digital que había empezado antes de la pandemia y que el COVID 19 ha acelerado de forma muy intensa, tiene todavía mucho por hacer y no me atrevo a ponerle fin. Las empresas más fuertes han hecho inversiones muy importantes para potenciar su desarrollo y van a seguir haciéndolo, combinándolo con otros elementos de inversión y desarrolllo que van a ser prioritarios como es la sostenibilidad. Pero las empresas que no han dispuesto de esa fortaleza financiera pero sobrevivan a la crisis, seguirán con los procesos de digitalizacion. El dinamismo de este sector y su papel tan determinante en la economía y en la sociedad creo que van a seguir dándole un enorme protagonismo.

TTR: Allen & Overy España ha asesorado este año en operaciones de renovables y tecnología en España. ¿Qué impulsará la consolidación en cada uno de estos sectores en 2021 y en el mediano y largo plazo?

Energía y tecnología son sectores en los que se está produciendo desde hace tiempo mucha actividad. Petroleras y eléctricas llevan tiempo emprendiendo un proceso para adaptar su negocio a la transición energética, que se ha visto intensificado en los últimos años, especialmente en el 2020 para aquellos que no lo habían afrontado con decisión. Son sectores en continuan evolucion, en los que existe una gran capacidad de los equipos gestores y un gran interés de los inversores en sus distintas vertientes, infraestructuras, negocio principal y accesorios en los que es lógico que se produzcan procesos de consolidación mediante adquisiciones o fusiones así como la aparición de nuevos actores.

TTR: ¿Qué papel espera que desempeñen las empresas de telecomunicaciones españolas en las fusiones y adquisiciones, a nivel nacional e internacional, en el próximo año?

Las empresas de telecomunicaciones tienen un papel extraordinariamente relevante, por su relevancia empresarial, por ser proveedores de servicios esenciales, la altísima cualificación de sus equipos, por su carácter tecnológico y ser motor en el plano de innovación y desarrollo. Hemos visto este año pasado operaciones muy relevantes, como han sido la fusión/combinación de Liberty y Telefónica UK, la Opa sobre Masmovil y las operaciones de Cellnex. Seguramente este año seguiremos viendo operaciones importantes de muy distinto tipo, por estas razones y el gran interés que despiertan entre los fondos de private equity que buscan oportunidades de inversión.

TTR: ¿Cuáles espera que sean los principales retos para los despachos de abogados que asesoran en operaciones de M&A en España durante los próximos 12 a 18 meses?

El mercado se mueve con mucha rapidez ante las oportunidades que se presentan y va a existir una variedad muy amplia de operaciones para las que los equipos de los despachos de abogados debemos estar muy preparados para dar un asesoramiento de extraordinaria calidad y respuesta. Vamos a ver convivir operaciones distress, reestructuraciones, procesos de segregación de divisiones de negocio ó ramas de actividad en los que se buscarán desinversiones totales o parciales, operaciones Public to private, fusiones que responden a procesos de consolidación sectorial, activismo accionarial, dual tracks en el que los accionistas buscarán maximizar la rentabilidad de su inversión a través de un IPO o de una operación de M&A privado. El componente internacional será muy relevante y hasta que la pandemia COVID se estabilice, el entorno va a ser muy cambiante. Todo ello va a exigir lo mejor de nuestros equipos y deberemos ser capaces de dar a nuestros clientes lo mejor de nosotros.