TTR DealMaker Q&A with Clifford Chance Partner Guillermo Guardia

Guillermo Guardia – Clifford Chance (Barcelona office)

Law degree from Universidad de Barcelona (1996).

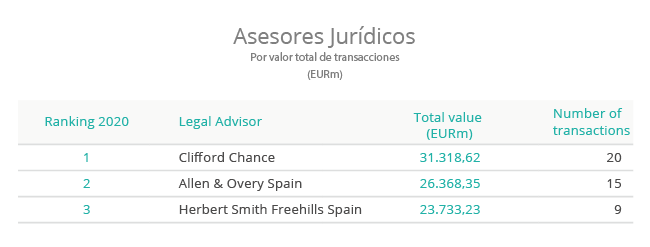

Guillermo joined Clifford Chance in January 2000 and has an extensive experience in international mergers and acquisitions, private-equity and joint-venture transactions.

He has also advised several national and international financial institutions and corporations on acquisition finance, corporate financing and project finance transactions both in the energy and in the infrastructure sector. In 2007 he was seconded to the Private Equity Group of the London office of Clifford Chance.

Lecturer at the Law Faculty of the Universidad de Barcelona.

Ranked in Chambers & Partners.

TTR: M&A activity was very strong in Spain in early 2020, but things changed considerably by the close of 1Q20. How would you describe the current situation in the transactional market in Spain?

G. G.: We are facing an unprecedented situation in all areas, and M&A is no exception.

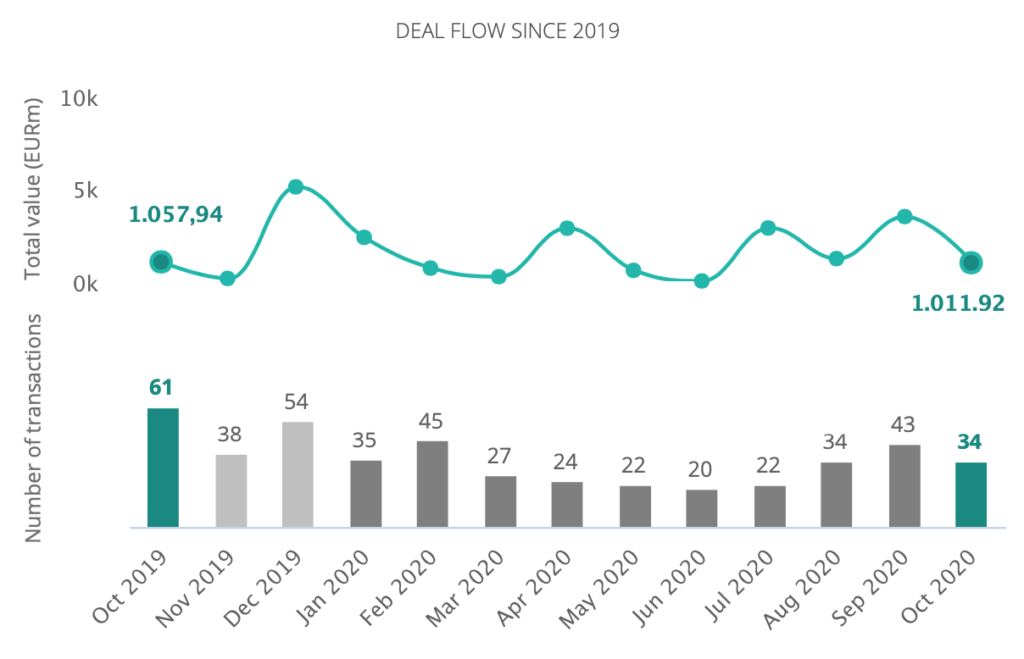

We cannot apply a market situation reading across all sectors, since many of them are facing very different situations. While certain sectors, such as renewables, telecoms and healthcare, are seeing a boom in transactions and are clearly in a phase of expansion, others are focusing on reordering or consolidating their activities in order to increase their profitability at medium and long term. There is also a third group, the most damaged by the health crisis, in which distress sales are becoming ever more frequent.

This is probably one of the most striking aspects of the current situation, since in other times of changing circumstances, all sectors have generally experienced the same situation of crisis or expansion.

TTR: What is the current situation in Spain and what are the prospects for the coming months where corporate restructurings are concerned?

G. G.: The health crisis took many companies by surprise, and those most affected have had to obtain immediate liquidity facilities. As the year has gone on, more and more companies have had to restructure their debt at short and medium term and offer certain non-core business units for sale.

We believe that this trend will continue into at least the first half of 2021.

TTR: Clifford Chance has advised numerous renewable energy transactions in 2020. How do you explain the strong deal volume in this segment and what opportunities have you come across in recent months within this context? What factors will need to coincide for this trend to hold in the medium-to-long term?

G. G.: The renewable energy sector has indeed demonstrated extraordinary resilience in the current circumstances, and Clifford Chance has advised on numerous transactions, both in relation to assets under development and the purchase and sale of consolidated projects on the secondary market.

A fundamental factor in this situation is the enormous liquidity present in the market. There are other factors that have buoyed the sector, however, such as a regulatory framework that fosters legal certainty and contractual instruments that ensure a project’s credit quality.

Renewable and efficient energy technologies will be one of the largest beneficiaries of the EU funds earmarked to alleviate the Covid-19 crisis. To the extent that the markets’ liquidity remains stable, this will continue to be a particularly active sector at medium and long term.

TTR: Which three sectors do you expect to be most attractive to investors with firepower in 4Q20 and early 2021?

G. G.: In addition to renewables, as mentioned above, we would highlight the healthcare and infrastructure sectors.

We believe that there are various factors at work in the healthcare sector that will allow for significant transactional activity in the future. First of all, the consolidation of the trend towards specialisation and segmentation among the major Spanish pharma companies. This will lead to sales of non-core assets (typically the division of generics and manufacturing for third parties) as well as strategic acquisitions of product portfolios. To this must be added the greater interest in the healthcare sector among private equity funds. We believe that private capital will be an increasingly important player in the sector over the next few years.

The infrastructure industry, meanwhile, which has been very active in 2020 despite the health crisis, is beginning to show signs of slowing down, which could have a

decisive impact in 2021. While demand remains stable and funds continue to show interest in investing in this type of asset, the problem could come from the supply side. Tenders for new infrastructure projects have been decreasing substantially over the last few years, which will inevitably lead to fewer assets available to investors or to lower-quality assets.

TTR: Which regulatory measures could help the Spanish M&A market recover more quickly?

G. G.: One measure that would doubtless aid in the recovery of the M&A market would be the revision of legislation on foreign investment. The changes introduced in this area create a lot of doubt among international investors, and it would of course be helpful to devise a clear, effective and transparent system. We believe that certain areas for improvement have become clear since this legislation came into force.

Second, the administration should take advantage of the EU’s Recovery and Resilience Facility to drive investment in new infrastructure projects in the sustainable mobility, water and environment and health areas.