Conteúdo disponível em Português e Inglês

TTR DealMaker Q&A com Marcelo G. Ricupero, sócio de Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados

Marcelo G. Ricupero – Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados

Marcelo G. Ricupero assessora clientes nacionais e estrangeiros em operações de fusões e aquisições e fundos de private equity. Sua atuação engloba, também, a representação de investidores, credores e devedores em operações complexas de reestruturação de dívidas. Foi advogado no escritório de Nova Iorque da Skadden, Arps, Slate, Meagher & Flom (EUA). Bacharel em Direito pela Universidade de São Paulo (USP), também possui especialização em Valores Mobiliários pela mesma universidade.

TTR: As fusões e aquisições em 2020 tiveram um primeiro trimestre “recorde” no Brasil, mas no início da crise de saúde COVID-19, a tendência mudou consideravelmente: como você descreveria a situação atual dos players no mercado transacional no Brasil nesta nova etapa?

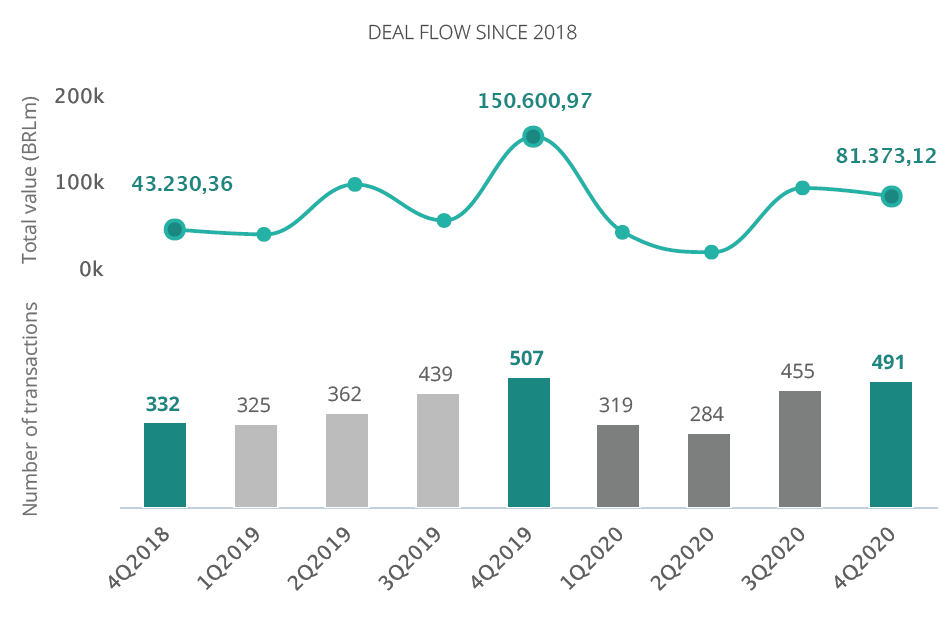

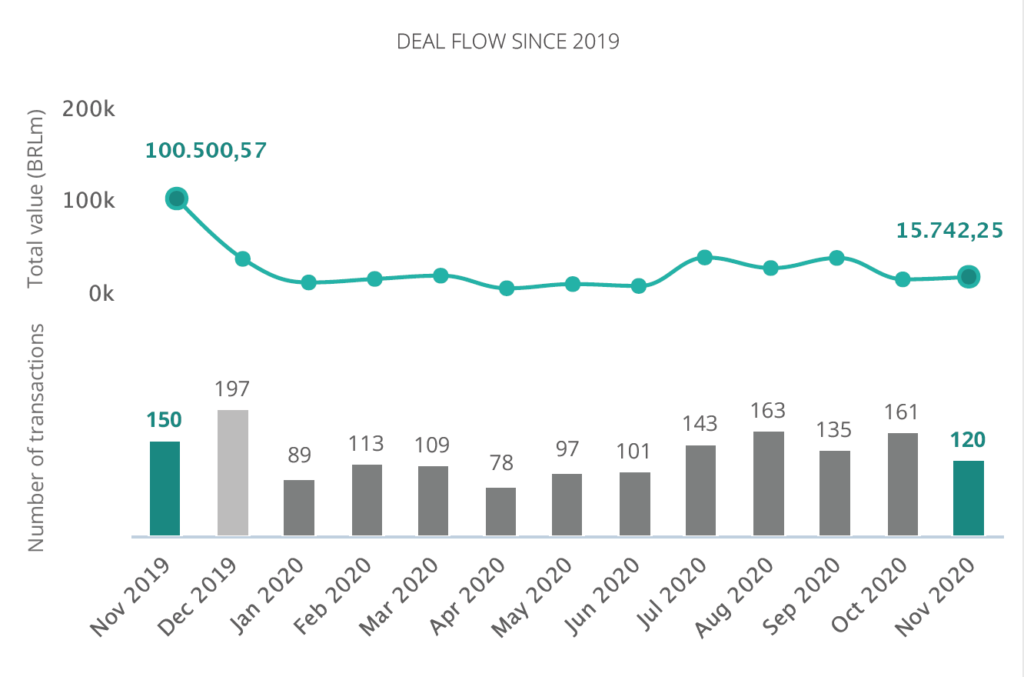

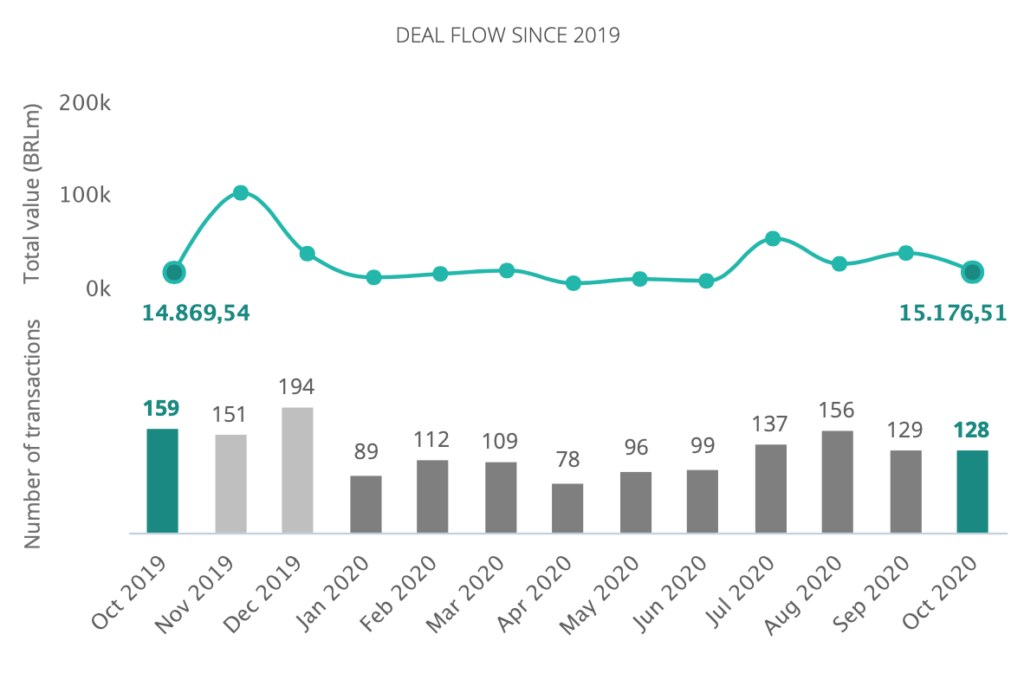

M. G. R.: Acho que o mercado de fusões e aquisições no Brasil já deu algumas provas de que é um mercado maduro e sofisticado, ainda mais considerando as crises e dificuldades enfrentadas nos últimos anos. Embora seja verdade que, com a pandemia, as operações tiveram uma queda, acho que a maioria já voltou e novas operações também surgiram. Acho este um ponto importante. Há alguns anos, quando havia uma crise internacional, o mercado normalmente esperava a crise terminar para reaquecer. Agora, ele reaquece mesmo durante a crise. Nós estamos esperando um último trimestre bastante movimentado, embora existam fatores que podem comprometer essa expectativa.

TTR: Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados é um dos principais assessores do mercado de capitais do Brasil de acordo com o ranking jurídico do TTR. Como você avalia o grande número de empresas que buscam abrir capital no Brasil em 2020 e quais oportunidades elas encontraram nos últimos meses pela situação atual do mercado local? Essa tendência de alta poderia prevalecer no médio e longo prazo?

M. G. R.: O grande catalisador das operações de abertura de capital no Brasil em 2020 me parece ser a taxa de juros, que atingiu seu ponto mais baixo na história. Com a redução das taxas de juros, houve uma migração muito grande de investidores que saíram de outros investimentos, atrelados à taxa de juros, para investimento em bolsa. Isso também explica a importância do mercado local nas ofertas recentes. Acho que essa tendência pode continuar para 2021, dependendo, claro, da taxa de juros permanecer baixa, que, por sua vez, depende de uma série de outros fatores, como fluxo de investimento estrangeiro, a discussão sobre o teto de gastos do governo, etc. Tudo está caminhando relativamente bem, e estamos esperando que as ofertas continuem em 2021. Depois de 2021, é difícil de dizer. Esse movimento é muito positivo, não só para o mercado de capitais, como também para operações de fusões e aquisições, pois as companhias que realizam as ofertas, normalmente, se capitalizam e procuram por oportunidades de consolidação.

TTR: Em relação à reestruturação societária, como está a situação atual e quais as perspectivas para os próximos meses no Brasil?

M. G. R.: Na minha visão, reestruturações societárias são instrumentais, ou seja, são feitas como parte de algum outro objetivo, seja vender um ativo, segregar negócios com perfis de risco diferentes, consolidar bases acionárias. Sendo assim, quanto maior o volume de operações, seja de M&A ou de aberturas de capital, maior será o número de reorganizações societárias, especialmente no caso de aberturas de capital, em que uma reorganização societária prévia à operação é muito comum.

TTR: Quais as três mudanças mais importantes que o mercado de fusões e aquisições pode apresentar no Brasil para o quarto trimestre e início de 2021? Quais setores poderiam oferecer maiores oportunidades para investidores com potencial financeiro?

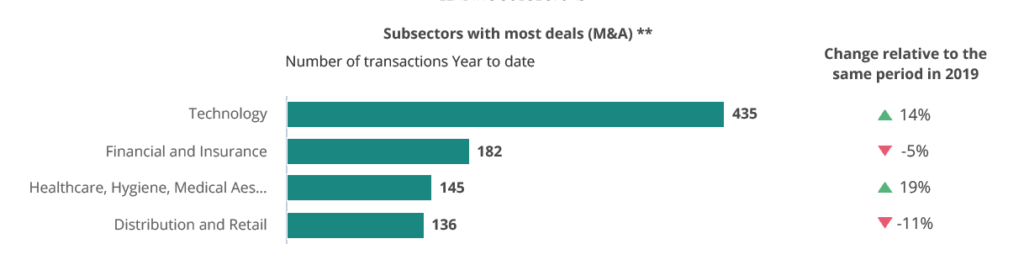

M. G. R.: Boa pergunta. Acho que uma tendência que vamos ver será justamente o incremento de operações de M&A envolvendo companhias que acessaram o mercado de capitais em 2020. Já estamos vendo um pouco disso, com aquisições menores, mas imaginamos que devem se intensificar. Acho que outra tendência é de operações de consolidação. Com a pandemia esperou-se que muitas companhias passariam por dificuldades, esperava-se até uma onda de pedidos de recuperação judicial, que ainda não se concretizou. Mas o fato é que, certamente, há grupos que foram afetados pela crise e isso deve representar oportunidades de consolidação. Outra tendência, já entrando na segunda questão, é de operações em mercados e indústrias que se mostraram resilientes a uma crise sem precedentes, como é esta que estamos passando. Eu destacaria alguns setores, como tecnologia, especialmente fintechs, biotechs e outras techs, life science (hospitais e farmas) e infraestrutura, especialmente energia (mercado que se mostrou quente o ano todo), saneamento (que parece ser uma das apostas da vez), e logística, incluindo ferrovias, portos, etc.

TTR: Como você descreveria as medidas tomadas pelo governo brasileiro para enfrentar a crise empresarial causada pelo impacto do combate à COVID-19? Que outras medidas são necessárias no curto prazo para garantir a recuperação econômica?

M. G. R.: Muito tímidas e de certa forma confusas, focadas nos aspectos errados. Sem entrar nas questões de saúde pública, do ponto de vista de ações para enfrentamento da crise empresarial, as medidas tomadas foram, em sua maioria, para lidar com questões emergenciais e, às vezes, até pontuais, sendo que várias MPs e projetos de lei se perderam no caminho (como o projeto de lei que mudava a Lei de Falências e Recuperação de Empresas em função da pandemia, que ficou conhecido como o projeto emergencial, pois surgiu quando já havia outro em tramitação mais avançada). Outras poucas acabaram virando lei e, de fato, lidando com temas importantes (como as que regularam assembleias virtuais, por exemplo). O que se esperava e, de certa forma, ainda se espera, é que o foco se volte para as medidas estruturais, como a questão do teto de gastos públicos, retomada da agenda de privatizações, além da aprovação de projetos de lei importantes, como a reforma – esta mais abrangente – da Lei de Falências e Recuperação de Empresas.

Versão em inglês

TTR: Brazil registered record M&A activity 1Q20, but the trend changed considerably with the onset of the COVID-19 health crisis,: how would you describe the current M&A situation and outlook in Brazil?

M. G. R.: I believe the M&A market in Brazil has already proved that it is mature and sophisticated, especially considering the crises and difficulties faced in recent years. While it is true that, with the pandemic, the number of transactions has dropped, most of them have returned to normal and new transactions have also emerged. I think this is an important point to notice. A few years ago, when there was an international crisis, the market normally waited for the crisis to end before warming up again. Now, it warms up even during a crisis. We are expecting a very busy last quarter, although there are factors that could affect this expectation.

TTR: Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados is among the top capital markets advisory firms in Brazil, according to TTR’s legal ranking. How would you characterize the large number of companies that have been looking to pursue an IPO in Brazil in 2020 and what opportunities have they been seeing in local market in recent months? Will this upward trend persist in the medium and long term?

M. G. R.: The great trigger for the IPO and follow on transactions in Brazil in 2020 seems to be the drop in the interest rate, which has reached its lowest point in history. With the reduction in interest rates, investors have migrated from other investments, linked to the interest rate, to the stock market. This also explains the relevance of the local market in recent offers. I think this trend could continue for 2021, depending, of course, on the interest rate remaining low, which, in its turn, depends on several other factors, such as the flow of foreign investment into the country, the discussion about the government spending cap, etc. Everything going relatively well, we expect offers to continue in 2021. After 2021, it is difficult to say. This movement is very positive, not only for the capital market but also for M&As, as the companies are usually capitalized after the offering and look for consolidation opportunities.

TTR: What is the current situation where your restructuring practice is concerned and what are the prospects for the coming months in Brazil in this area?

M. G. R.: In my view, corporate restructurings are instrumental to other transactions, be it selling an asset, segregating businesses with different risk profiles, consolidating shareholder bases. Therefore, the greater the volume of transactions, whether M&A or IPOs, the greater the number of corporate reorganizations, especially in the case of IPOs, where corporate reorganizations before the transaction are very common.

TTR: What are the three most important changes that the M&A market will undergo in Brazil in 4Q20 and early 2021?, Which sectors should investors with ample firepower be focused on?

M. G. R.: Good question. I think that a trend that we will see is precisely the increase in M&A transactions involving companies that accessed the capital market in 2020. We already see some of this with smaller acquisitions, but we imagine that they should intensify. I think that another trend are consolidation transactions. With the pandemic it was expected that many companies would face difficulties, even a wave of requests for judicial reorganization was expected, which has not yet materialized. But the fact is that there are groups that have certainly been affected by the crisis more than others and this should represent opportunities for consolidation. Another trend, moving to the second question, is that of transactions in markets and industries that have proved to be resilient to an unprecedented crisis, such as this one that we are going through. I would highlight some sectors, such as technology, especially fintechs, biotechs, and other techs, life science (hospitals and pharma companies) and infrastructure, especially energy (a market that has been hot all year), sanitation (which seems to be promising at the moment), and logistics, including railways, ports, etc.

TTR: How would you describe the measures taken by the Brazilian Government to support the business community in the wake of the instability caused by the fight against COVID-19? What additional measures are needed in the short term to ensure economic recovery?

M. G. R.: Shy and somewhat confused, focused on the wrong aspects. Without going into public health issues, from the point of view of actions to deal with the business crisis, the measures taken were, for the most part, to deal with emergency issues and, at times, even punctual, with several provisional presidential decrees and bills getting lost along the way (like the bill to amend the Brazilian Bankruptcy Law due to the pandemic, which became known as the emergency bill, since it appeared when there was another one in progress and more advanced). A few others ended up becoming law and, in fact, dealing with important issues (such as those that regulated virtual shareholders meetings, for example). What was expected and, in a way, is still expected, is that the focus will turn to structural measures, such as the issue of the government spending cap, the privatization agenda, in addition to the approval of important bills, such as the reform – this more comprehensive – of the Brazilian Bankruptcy Law.