Mercado transaccional en México cae un 14% hasta julio de 2020

En julio se han registrado 20 transacciones en el país por USD 749,30m

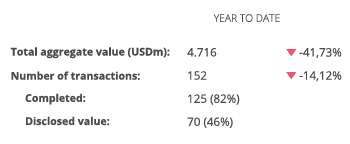

A lo largo de 2020 se han registrado 152 transacciones por USD 4.716m

Sector Financiero y de Seguros e Internet, los sectores más destacados del año

Empresas estadounidenses invirtiendo en México han aumentado un 16% en 2020

Patrocinado por:

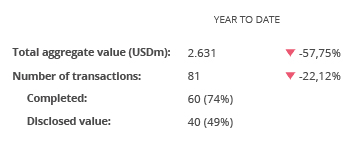

El mercado de M&A en México ha contabilizado en julio de 2020 un total de 20 fusiones y adquisiciones, entre anunciadas y cerradas, por un importe agregado de USD 749,30m, de acuerdo con el informe mensual de Transactional Track Record en colaboración con Intralinks.

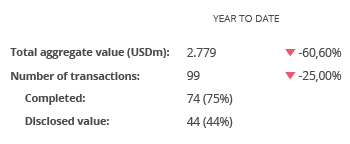

Por su parte, en los siete primeros meses del año se han producido un total de 152 transacciones, de las cuales 70 registran un importe conjunto de USD 4.716m, lo que implica un descenso del 14,12% en el número de operaciones y una disminución del 41,73% en el importe de estas, con respecto al mismo período de 2019.

En términos sectoriales, el Financiero y de Seguros ha sido el más activo del año, así como el de Internet, con un total de 28 transacciones en cada sector, seguido por el de Tecnología, con 11

Ámbito Cross-Border

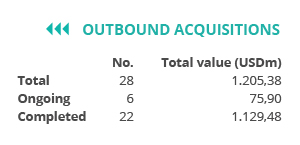

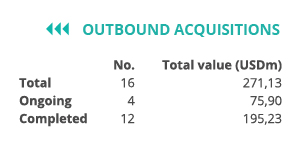

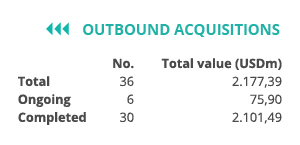

Por lo que respecta al mercado cross-border, a lo largo de 2020 las empresas mexicanas han apostado principalmente por invertir en Estados Unidos, con 13 operaciones, seguido de España, con 8 transacciones. Por importe destaca España, con USD 1.025,83m.

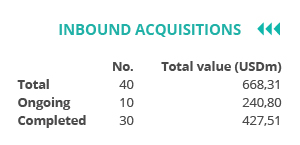

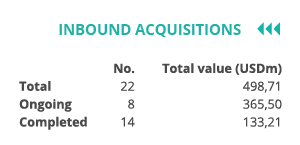

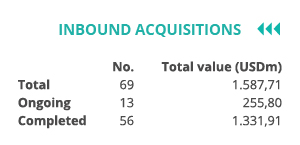

Por otro lado, Estados Unidos, es el país que más ha apostado por realizar adquisiciones en México, con 37 operaciones (Un aumento del 15,63%), seguido de Canadá y Chile con 9 y 7 transacciones, respectivamente. Por importe, se destaca Estados Unidos, con USD 1.080,82m.

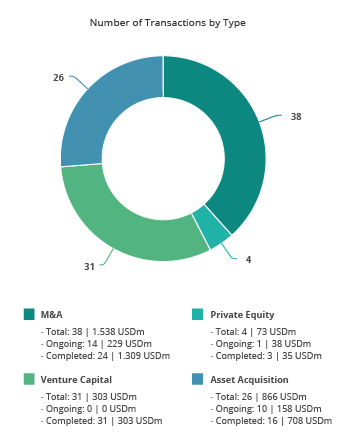

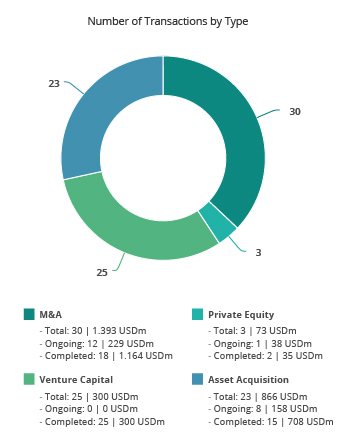

Private Equity, Venture Capital y Asset Acquisitions

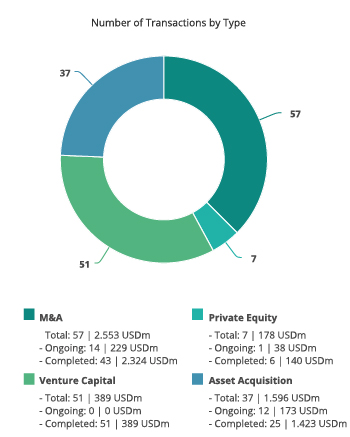

Hasta julio de 2020 se han contabilizado un total de 7 operaciones de Private Equity por USD 178m, lo cual supone un descenso del 36,36% en el número de operaciones y un aumento del 164,26% en el importe de éstas, con respecto al mismo periodo del año anterior.

Por su parte, en el segmento de Venture Capital se han contabilizado hasta julio un total de 51 operaciones con un importe agregado de USD 389m, lo que implica un aumento del 15,91% en el número de operaciones y un descenso del 14,15% en el importe de las mismas en términos interanuales.

En el segmento de Asset Acquisitions, hasta el mes de julio se han registrado 37 operaciones, por un valor de USD 1.596m, lo cual representa una disminución del 17,78% en el número de operaciones, y un descenso del 43,11% en el importe de estas, con respecto a julio de 2019

Transacción del mes

Para julio de 2020, Transactional Track Record ha seleccionado como operación destacada la adquisición de Cornershop en Latinoamérica por parte de Uber.

La operación, valorada en USD 459m ha estado asesorada por DLA Piper Chile; Greenberg Traurig México; y Creel, García-Cuéllar, Aiza y Enríquez.

Ranking de asesores financieros y jurídicos