LATIN AMERICA

TTR Deal Tracker is a monthly email update identifying M&A trends in Latin America and compiling YTD rankings of leading financial and legal advisors

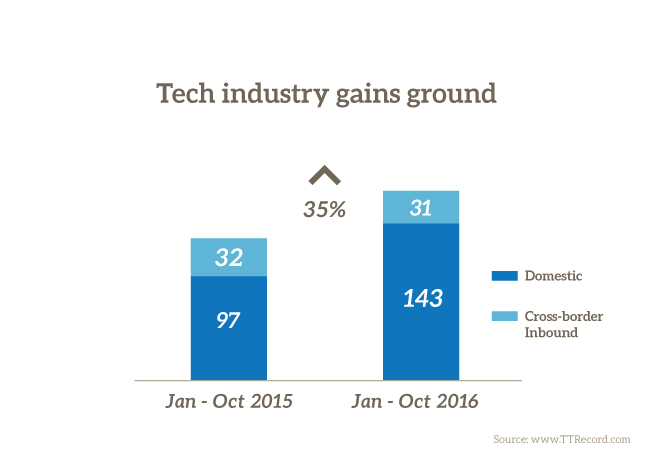

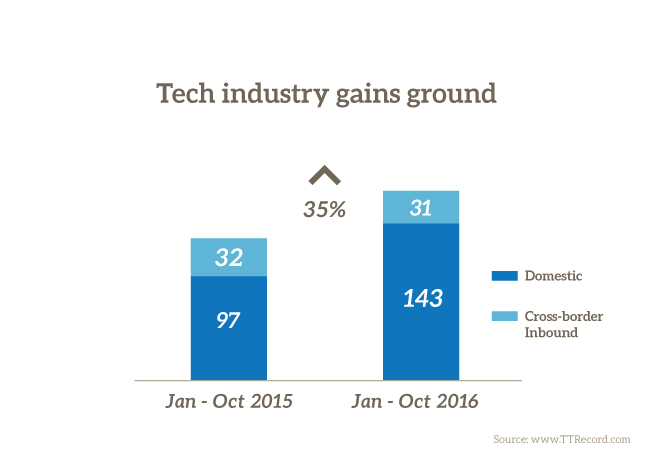

BRAZIL: Tech industry gains ground

Transaction volume in Brazil’s tech industry grew 35% in the first 10 months of 2016 compared to the same period last year, according to TTR data (www.TTRecord.com).

The share of deals led by international buyers declined, meanwhile, from 24% to the close of October 2015 to 17% in the corresponding period this year.

The largest transaction YTD in the sector was the USD 1.26bn acquisition of Serviços e Tecnologia de Pagamentos (STP) by CCR.

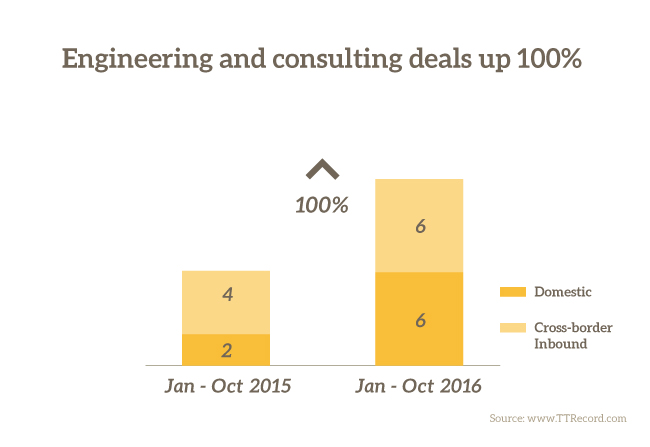

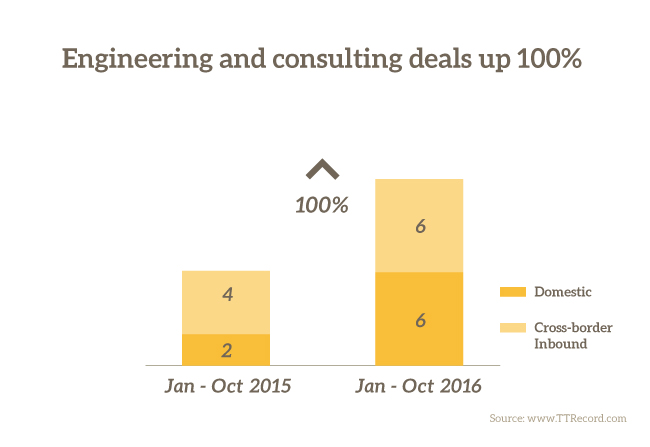

COLOMBIA: Engineering and consulting deals up 100%

M&A among engineering and consulting firms in Colombia jumped 100% in the first 10 months of 2016 over the same period last year, according to TTR data (www.TTRecord.com).

The number of cross-border deals led by international firms targeting Colombian peers grew from four in the first 10 months of 2015 to six in the same 10-month period this year, meanwhile.

Among the inbound cross-border deals YTD was the USD 18m complete takeover of Laboratorios Contecon Urbar by Switzerland-based SGS Group.

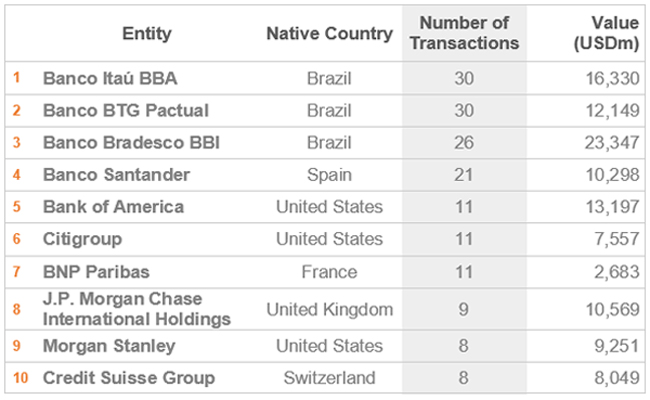

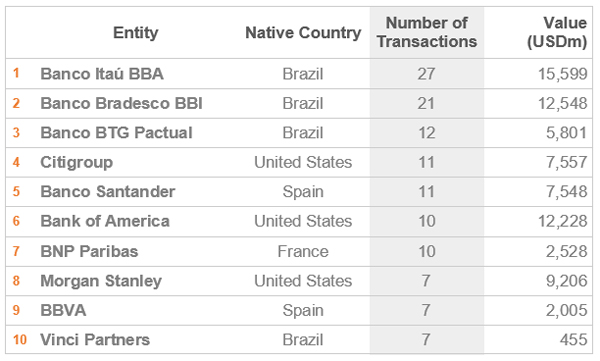

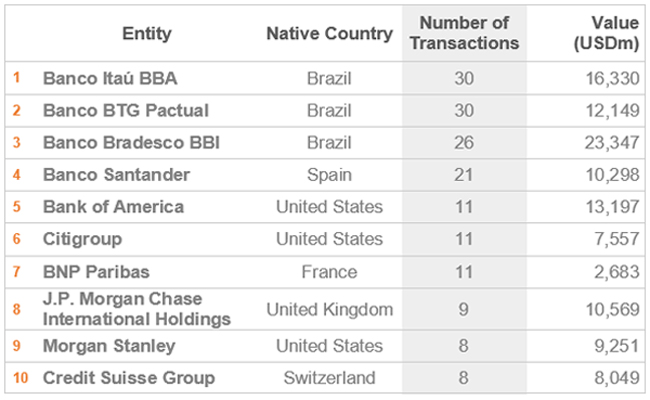

Latin America Ranking – 2016*

Financial Advisory – Year to Date (YTD)

Banco Itaú BBA and Banco BTG Pactual are tied neck and neck by deal volume in TTR’s Latin America financial advisory ranking at the close of October, with 30 deal mandates apiece YTD, the former ahead only by aggregate deal value of USD 16.3bn compared to USD 12.1bn for its top rival. Itaú held a more comfortable lead a year ago when it had advised on 40 transactions to the close of October, compared to BTG Pactual’s 27. Both have seen declines in aggregate value between the corresponding 10-month periods, Itaú down 8% from USD 17.8bn, BTG Pactual also down about 8% from USD 13.1bn. Banco Bradesco BBI follows in third with 26 deals YTD, up from 14 a year ago when it held the same place in the chart. The combined value of Bradesco’s deals grew by nearly 118% from USD 10.7bn to USD 23.3bn, meanwhile, putting it in the lead by aggregate value. Banco Santander gained one position in the ranking to take fourth with 21 transactions, up from fifth a year ago when it had advised on nine deals in the first 10 months of the year. Santander grew its aggregate deal value by 33%, meanwhile from USD 7.7bn to USD 10.3bn between the two periods. BAML jumped from tenth to fifth in the chart, increasing deal volume from seven to 11 and growing the combined value of its transactions from USD 1.4bn to USD 13.2bn. Citigroup, in sixth, also with 11 mandates YTD, was not among the top 10 financial advisors in Latin America a year ago, nor was BNP Paribas, also with 11 deals, ranked seventh. JPMorgan, in eighth, was also absent from the top 10 ranking a year ago, as was Morgan Stanley, in ninth, and Credit Suisse Group, pulling up the rear in tenth.

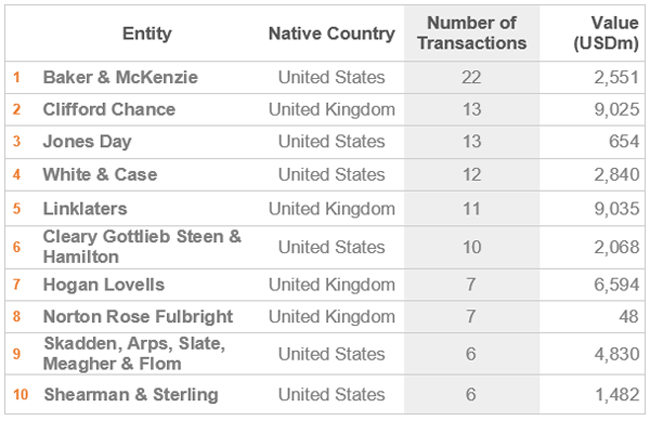

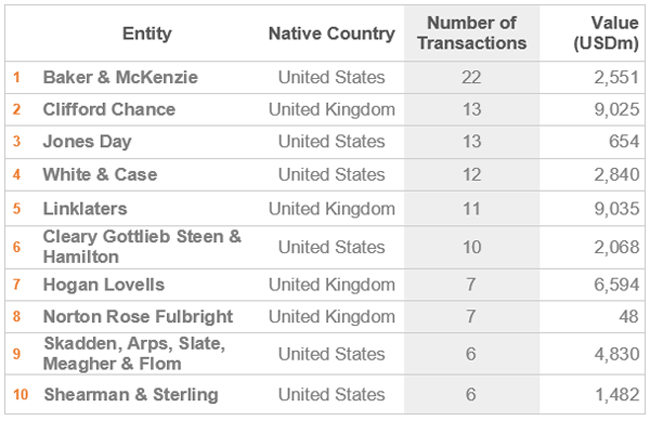

Baker & McKenzie leads TTR’s Latin America legal advisory ranking at the close of October with 22 transactions together worth USD 2.6bn, representing a 27% decline in volume and a 22% increase in aggregate value relative to its 30 mandates on transactions worth a combined USD 2bn in the first 10 months of 2015. Clifford Chance gained six positions in the chart to take second with 13 mandates in the region YTD, more than double its six of a year ago, while the combined value of its deals is up 8% to USD 9bn. Jones Day fell one position in the chart to take third, its deal volume down from 19 a year ago to 13, the combined value of its deals down 76% from USD 2.7bn to USD 654m. White & Case also slipped one position in the ranking, despite adding two transactions to its tally, placing fourth with 12 mandates YTD. The firm’s aggregate value is up 127%, meanwhile, from USD 1.2bn to USD 2.8bn between the two 10-month periods. Linklaters, in fifth, was not among the top 10 law firms advising on M&A in Latin America to the close of October 2015, nor was Clearly Gottlieb Steen & Hamilton, in sixth, Hogan Lovells in seventh or Norton Rose Fulbright, in eighth. Skadden, Arps, Slate, Meagher & Flom fell from fourth to take ninth, it’s deal volume down by three transactions, its aggregate value up 389% from USD 988m to USD 4.8bn. Shearman & Sterling lost one transaction from its tally of a year ago, falling from fifth to tenth to close October 2016 with six deals, the combined value of its transactions up 32% from USD 1.1bn to USD 1.5bn.

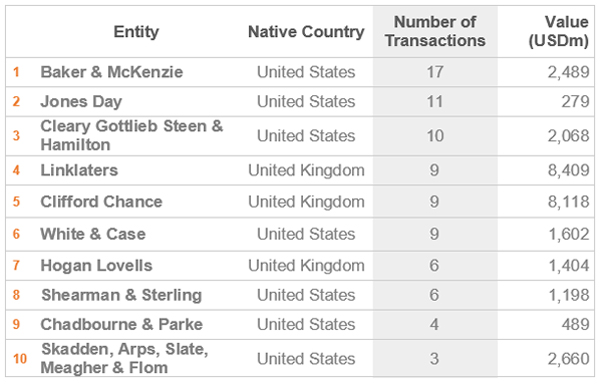

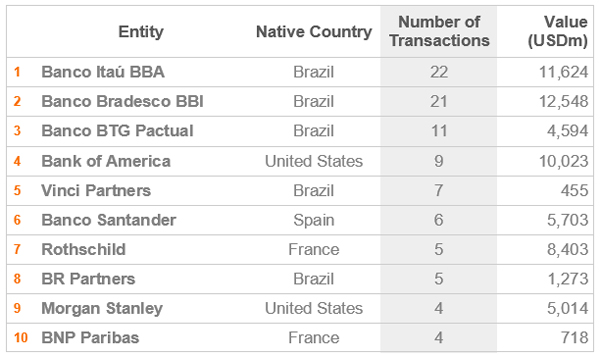

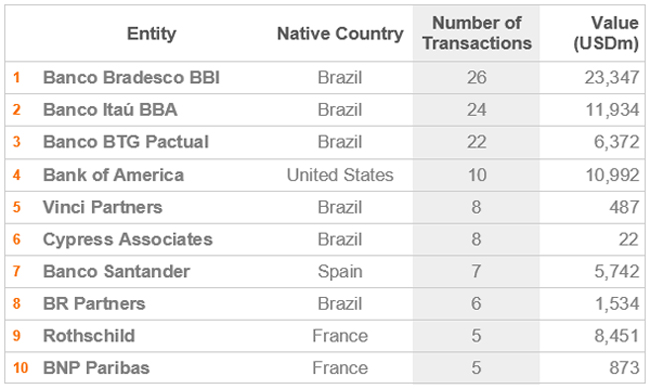

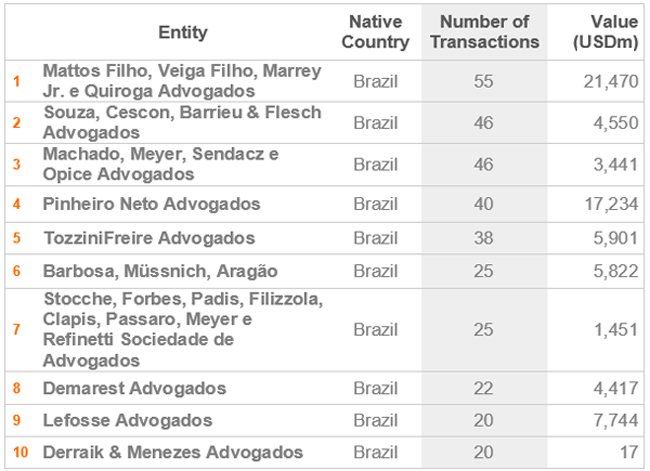

Brazil Ranking* – 2016

Financial Advisory – Year to Date (YTD)

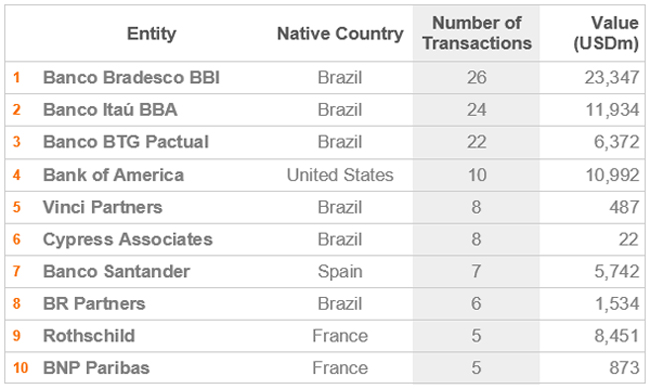

Banco Bradesco BBI leads TTR’s Brazil financial advisory ranking at the close of October with 26 mandates YTD, nearly double the 14 of a year ago that had put it in third place. Brazil’s leading investment bank has grown the aggregate value of its transactions by 118%, meanwhile, from USD 10.7bn to USD 23.3bn between the two 10-month periods. Banco Itaú BBA fell from its lead a year ago to take second, its deal count down from 35 to 24, the combined value of its deals down 31% from USD 17.2bn to USD 11.9bn. Banco BTG Pactual fell from second to third, meanwhile, despite an increase in deal count form 19 to 22, while its aggregate value slipped 46% from USD 11.8bn to USD 6.4bn. BAML, in fourth, was not among the top 10 investment banks advising in Brazil in the first 10 months of 2015. Vinci Partners fell one position in the chart to take fifth, its tally down by one, its aggregate value up from USD 184m to USD 487m. Cypress Associates, in sixth, was absent from the top 10 ranking a year ago, as was Banco Santander, in seventh. BR Partners is down by two deals and one place in the chart, notwithstanding its 341% increase in aggregate value from USD 347m to USD 1.5bn. Rothschild, in ninth with five deals, fell one position in the chart despite maintaining its deal count and growing aggregate value by 4% from USD 8.1bn to USD 8.5bn. BNP Paribas, in tenth with an equal number of mandates, was not among the leading 10 banks advising on M&A in Brazil at the close of October 2015.Legal Advisory – Year to Date (YTD)

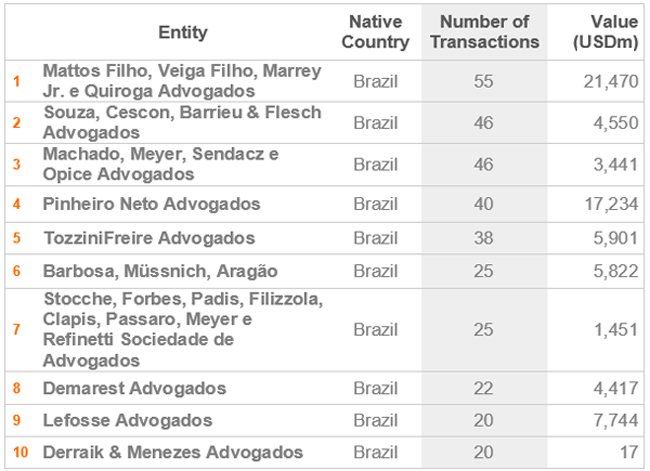

Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados leads TTR’s Brazil legal advisory ranking at the close of October by volume and value, with 55 mandates, up from 44 a year ago when it ranked second. Brazil’s top M&A firm grew its aggregate deal value by 25% between the two 10-month periods, from USD 10.7bn to USD 21.5bn, meanwhile. Souza, Cescon, Barrieu & Fleisch Advogados jumped from fourth to second in the chart, its deal count up from 37 to 46, the combined value of its transactions down 21% from USD 5.8bn to USD 4.6bn. Machado, Meyer, Sendacz e Opice Advogados ranks third, as it did a year ago, after adding nine transactions to its count of 37 to close October 2016 with 46 advisory mandates too. The third-ranked firm’s aggregate deal value fell 73%, meanwhile, from USD 12.8bn to USD 3.4bn. Pinheiro Neto Advogados lost six deals from its tally of a year ago, falling from its leading position in the chart to place fourth, notwithstanding a 61% increase in aggregate deal value from USD 10.7bn to USD 17.2bn. TozziniFreire Advogados climbed from eighth to fifth, increasing deal count from 24 to 38 and increasing the combined value of its deals from USD 798m to USD 5.9bn. Barbosa, Müssnich, Aragão fell one position to take sixth, its deal count down by 10 from 35 to 25, its aggregate value down 38% from USD 9.3bn to USD 5.8bn. Stocche, Forbes, Padis, Filizzola, Clapis, Passaro, Meyer e Refinetti Sociedade de Advogados ranks seventh, also with 25 mandates YTD, after not placing among the top 10 M&A firms to the close of October 2015. Demarest Advogados is down one place in the chart to take eighth, its deal count lower by two, its aggregate value up from USD 261m to USD 4.4bn. Lefosse Advogados, in ninth, was absent from the top 10 at the close of October a year ago, while Derraik & Menezes Advogados holds the same tenth ranking, its tally up by one transaction, its aggregate value down 76% from USD 71m to USD 17m.

Mexico Ranking* – 2016

Financial Advisory – Year to Date (YTD)

BBVA leads TTR’s Mexico financial advisory ranking at the close of October with six mandates, up from four a year ago when it also led the chart. The Spanish bank’s aggregate deal value is up 282%, meanwhile, from USD 869m to USD 3.3bn. Citigroup, in second with four mandates YTD together worth USD 4.5bn, is up from a sole transaction a year ago worth USD 1.2bn when it ranked ninth. Deutsche Bank, in third, did not place among the top 10 investment banks advising in Mexico to the close of October 2015, nor did JPMorgan in fourth, or Morgan Stanley, in fifth. Lazard too was absent from the top 10 a year ago, now in sixth ahead of seventh-ranked Credit Suisse, which also failed to make the chart in the corresponding 10-month period last year. Alfaro, Dávila y Ríos fell from fifth to eighth, despite maintaining the same tally of two, its aggregate value down 73% from USD 2.2bn to USD 575m. RIóN M&A ranks ninth compared to third a year ago, its tally down by one transaction. Goldman Sachs ranks tenth, its sole transaction in Mexico YTD worth USD 2.3bn. Goldman didn’t place among the top 10 a year ago.

Creel, García-Cuéllar, Aiza y Enríquez leads TTR’s Mexico legal advisory ranking at the close of October, as it did a year ago, despite losing two transactions on its total for the first 10 months of 2015 and a 74% dip in aggregate value from USD 13bn to USD 3.4bn. Galicia Abogados is up by one deal and one position in the chart to take second, the combined value of its transactions increasing 61% between the two 10-month periods from USD 2.8bn to USD 4.5bn. Mijares, Angoitia, Cortés y Fuentes slid from second a year ago to third, its tally down from 15 to eight, its aggregate deal value down 23% from USD 2.4bn to USD 1.8bn. White & Case México holds onto the same fourth-place ranking it held a year ago, despite losing one transaction in its tally and a 21% decline in aggregate value from USD 1.2bn to USD 973m. Jones Day México is up one place in the chart after maintaining its deal count of seven between the two 10-month periods, while its aggregate value fell 73% from USD 2.2bn to USD 584m. Ritch, Mueller, Heather y Nicolau, in sixth, was not among the top 10 M&A firms advising in Mexico a year ago, nor was Santamarina y Steta Abogados, in seventh, González Calvillo Abogados in eighth or Von Wobeser y Sierra, in ninth. Basham Ringe y Correa is down by three deals and two positions in the chart to bring up the rear, its aggregate value down 93% from USD 1.4bn to USD 91m.

* TTR Rankings are generated with transactions announced or closed in 2016 year-to-date. The ranking includes sales and acquisitions of shares and of assets, creation of joint ventures, and Private Equity/Venture Capital investments. The legal advisor rankings for Brazil and Mexico take into consideration advisory services regarding domestic laws. All rankings only include deals where a company of the respective country was the target of the transaction. In the case of LATAM, it would be a Latin American country. The LATAM ranking does not specify the origin of the advisory law, so the filter only considers firms from the UK/US.

In case of a draw, the adopted criteria will be the following: if the draw is due to number of transactions, the total deal value prevails; if it is due to deal value, the number of transactions prevail. When a draw of both number of transactions and deal value occurs, the same position will be retained and the deals will be arranged alphabetically.