Pedro Ester es socio del departamento de Derecho mercantil de Ashurst España, firma en la que ha desarrollado toda su carrera profesional desde la apertura de su oficina en Madrid en el año 2001. Se especializa en operaciones mercantiles y private equity, tanto nacionales como internacionales, operaciones de inversión y acuerdos de joint venture. Ha participado también en operaciones inmobiliarias.

¿Cómo definiría la actividad del mercado de M&A en España en lo que va de año?

¿Cómo definiría la actividad del mercado de M&A en España en lo que va de año?

Intensa. El mercado ha vuelto a niveles de actividad que habíamos dejado de ver en años anteriores. Creo que ello se debe a varios motivos: la recuperación de la confianza en el mercado español por parte de inversores extranjeros, el ánimo inversor de industriales y fondos españoles por continuar buscando buenas oportunidades de crecimiento, la liquidez no empleada en los últimos años, el apetito de la banca por volver a financiar la actividad de M&A en España en condiciones favorables y la calidad de muchas compañías y activos en nuestro país.

Hasta ahora todos los factores han sido positivos y han contribuido a que se hayan generado más operaciones, a que los inversores hayan podido tomar una posición más “decidida” en su análisis y a que la fase de ejecución de las mismas haya encontrado menos dificultades y haya podido llevarse a buen fin en plazos más eficientes.

Está usted especializado en el segmento de private equity, que ha mostrado cifras muy positivas durante el año 2017. A este respecto, ¿cree que hemos alcanzado un máximo estable en el mercado español o existe potencial para seguir batiendo registros?

No cabe duda que 2017 está siendo un muy buen año para el capital riesgo en España. Todas las semanas estamos viendo cobertura en los medios sobre operaciones de private equity, con una gran variedad de actores y sectores objeto de inversión, lo que sin duda pone en valor el buen hacer de los profesionales del capital riesgo en nuestro país.

Creo que el sector ha conseguido consolidar un nivel de actividad recurrente, y la entrada de nuevos fondos españoles en los últimos años en determinados segmentos del mercado ha incrementado exponencialmente la competencia en los mismos, con lo que el potencial de crecimiento existe.

A lo largo de su carrera ha participado usted en operaciones relevantes de adquisiciones de centros comerciales, dentro del sector inmobiliario. En este tipo de adquisiciones habitualmente los compradores son players internacionales, ¿por qué cree que existe este interés extranjero en este tipo de activos? ¿Y por qué no suele haber compradores nacionales?

El nuevo ciclo del sector inmobiliario en general y del segmento de los centros comerciales en particular está siendo protagonizado por inversores extranjeros, sin perjuicio de que en los últimos años también haya habido fondos y empresas españolas que han hecho operaciones relevantes tanto de inversión directa como de inversión conjunta con inversores internacionales, mediante alianzas de inversión a medio y largo plazo a través de joint ventures.

Aunque es cierto que siempre ha habido presencia de fuertes enseñas internacionales (con fondos específicamente dedicados, con liquidez disponible, mucha experiencia y la ventaja de contar con relaciones muy consolidadas con las entidades bancarias), sigue habiendo un incremento en el número de inversores internacionales interesados en este tipo de activos. La ayuda de gestores españoles con conocimiento y experiencia en nuestro mercado permite a estos inversores buscar oportunidades en la expectativa del incremento de rentas esperado como consecuencia de la recuperación del consumo.

¿Cree usted que en el corto y medio plazo seguirán produciéndose operaciones en este sector? ¿Qué otros sectores considera que contarán con protagonismo en los próximos meses?

Sí, sin duda. Creo que hay numerosos fondos internacionales que continúan analizando multitud de oportunidades y que están decididos a aumentar su inversión en España y a que su cartera en España adquiera un tamaño que permita poner en marcha con ciertas garantías otro tipo de operaciones (como la venta global de carteras o lotes de activos a otro inversor de mayor tamaño o su cotización en un mercado secundario).

Otro sector que lleva muy activo desde hace meses y que sin duda contará con protagonismo a corto y medio plazo es el sector de las infraestructuras. Tenemos la suerte de que las empresas españolas del sector están sin duda entre las mejores del mundo, con modelos de gestión probados y pioneros en la expansión internacional de sus negocios, lo que hace que, como se está viendo, generen un grado de atracción de grandes inversores financieros e institucionales internacionales muy alto.

En 2015 y 2016 participó usted en el asesoramiento de la mayor operación, en términos de importe, del mercado de M&A español: la fusión de las embotelladoras de Coca-Cola, que tuvo que ser aprobada por autoridades regulatorias europeas. Siendo crítico, ¿cree usted que los organismos reguladores actúan normalmente al ritmo de las propias operaciones, o cree que en muchas ocasiones retrasan los cierres de las mismas?

Los organismos reguladores tienen que cumplir con unas reglas de juego prestablecidas para llevar a cabo sus análisis, con lo que creo que no tienen el margen o las alternativas que otros intervinientes en las operaciones si pueden y deben aprovechar, sobre todo teniendo en cuenta que esas reglas de juego deben ser conocidas por todos ellos. No creo que los organismos reguladores ralenticen voluntariamente las operaciones, pero sí tengo claro que los intervinientes en las mismas y, sobre todo, sus asesores legales, tienen un papel clave para evitar que los organismos reguladores, en el cumplimiento de sus obligaciones, puedan suponer un retraso en el cierre de las operaciones.

Por ejemplo, cuando es probable que una operación deba ser notificada a las autoridades de competencia, desde las fases más incipientes se incluye en el calendario de la misma el plazo necesario para obtener la correspondiente autorización. Es esencial involucrar desde esos primeros momentos a abogados de competencia que sean capaces de explicar bien la operación a las autoridades, de acordar con ellas una definición del mercado relevante que sea acertada (tanto para obtener autorización en el menor plazo posible como para no limitar innecesariamente las posibilidades de crecimiento futuro de la compañía de que se trate) y de llevar a cabo todo el trabajo previo a la notificación colaborando muy estrechamente con las autoridades para tratar de “recortar” días al calendario propuesto y, en la medida de lo posible, acelerar los plazos.

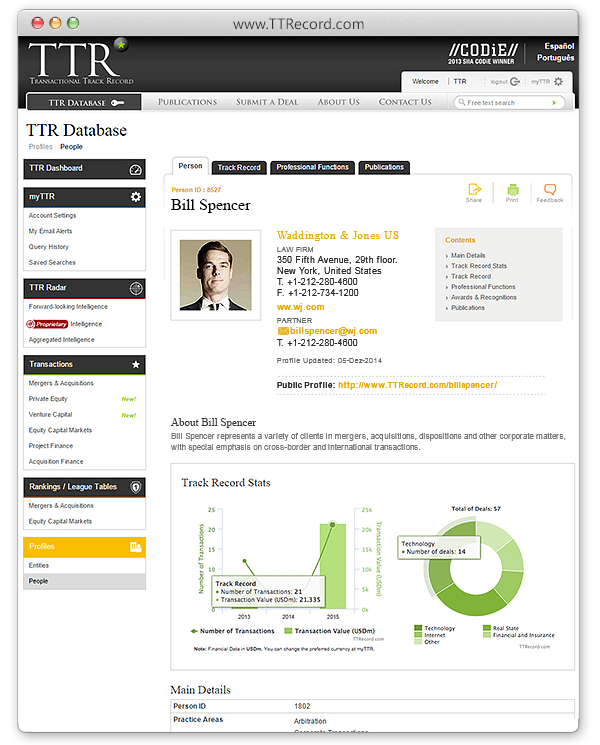

Para saber más de Pedro Ester y sus transacciones, haga click aquí.

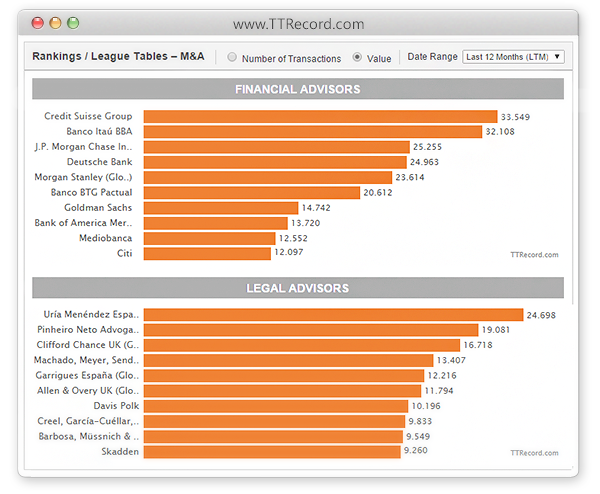

Para saber más de la firma Ashurst España, haga click aquí.

English

Pedro is a partner in the corporate department of Ashurst Spain, where he has developed his entire career since the opening of the Madrid office in 2001. He specializes in all types of M&A and private equity transactions, investment and joint venture agreements. He has also acted in transactions involving real estate investments.

How would you define the M&A market in Spain so far this year?

Intense. The market has returned to activity levels that had not been seen in previous years. I believe that it is due to several grounds: the recovery of confidence in the Spanish market by foreign investors, the investment will of industrials and Spanish funds to continue looking for good growth opportunities, the liquidity not used in the last years, the renewed appetite of banks to finance M&A activity in Spain in favourable terms and the good condition of many companies and assets in our country.

Until now all factors have been positive and have contributed to the generation of more transactions, to investors being able to take a more decided position in their analysis and to the execution phase of transactions being less problematic and allowing to be completed within more efficient time frames.

You specialize in private equity, which has shown very positive figures in 2017. In this regard, do you think the Spanish market has reached a stable peak or is there potential to continue breaking records?

There is no doubt that 2017 is being a very good year for private equity in Spain. There is media coverage of private equity transactions every week, with a great variety of players and sectors subject of investment, which undoubtedly puts in value the good work carried out by the professionals of the private equity industry in our country.

I believe the sector has managed to consolidate a recurring level of activity, and the entrance of new Spanish funds in the last years in certain segments of the market has exponentially increased competence, so the growth potential exists.

Throughout your career, you have taken part in relevant acquisitions of shopping centers, in the real estate sector. Normally, the buyers in those transactions are international players: why do you think there is foreign interest in that type of assets? And why aren’t there usually domestic buyers?

The new cycle in the real estate sector in general and of the shopping centre segment in particular is being led by foreign investors, without prejudice to the fact that in the last years there have also been Spanish funds and companies completing significant transactions, both in direct investment and in joint investment with international players pursuant to mid and long-term investment alliances through joint ventures.

Even though it is true that there has always been presence of strong international players (with funds specifically dedicated to these investments, with available liquidity, a lot of experience and the advantage to have very consolidated relationships with banks), the number of foreign investors interested in these type of assets continues to increase. The contribution of Spanish management companies with knowledge and experience in our market allows these investors to seek opportunities in the expectation of rent increases as a consequence of the recovery of consumer consumption.

Do you think there will still be transactions in that sector in the short and medium term? What other sectors do you think will attract attention in the coming months?

Yes, no doubt. I believe there are numerous international funds that continue to analyse many opportunities and that are decided to increase their investment in Spain and to increase its Spanish portfolio up to a size which allows to begin other types of transactions with a certain guarantee of success (such as a global portfolio or asset lots sale to a bigger investor or its listing in a secondary market.

Another sector that has been very active for months now and that will for sure be a star sector in the short and mid-term is the infrastructure sector. We are lucky that Spanish infrastructure companies are within the best of the world, with tested management models and pioneers in the international expansion of their businesses which, as is being seen, is generating a very high degree of attraction of international financial and institutional investors.

In 2015 and 2016, you were part of the largest transaction of the Spanish M&A market in terms of deal value, the merger of Coca-Cola’s bottling companies, which required the approval of the European regulatory authorities. From a critical standpoint, do you think regulatory bodies usually act at the same pace as transactions? Or do you believe they sometimes delay the deal closure?

Regulatory authorities have to comply with pre-established rules to carry out their analysis, and accordingly they do not have the margin or alternatives that other actors in transactions can and should take advantage of, given that said rules shall be known to all of them. I do not think that regulatory authorities voluntarily slow down transactions, but it is clear to me that the parties intervening in a transaction and, specifically, their legal advisors, play a key role to avoid that regulatory authorities, in the exercise of their duties, can cause a delay in the completion of transactions.

As an example, when it is likely that a transaction requires competition clearance, from the early stages of the transaction process the time required to obtain clearance is factored in the transaction calendar. It is essential to involve from the very beginning competition lawyers which can accurately explain the transaction to the authorities, agree with them a correct definition of the relevant market (both to obtain clearance in the shortest period possible and also to avoid unnecessary limitations to the future growth possibilities of the relevant company) and to carry out all the work related to the pre-filing closely cooperating with the authorities, trying to reduce the calendar and, to the extent possible, to accelerate the time required to obtain clearance.

To know more about Pedro Ester and his transactions, click here.

For more information about Ashurst España and its transactions, click here.