TTR Deal Tracker

www.TTRecord.com

BRASIL

O TTR Deal Tracker Brasil é um email mensal que contém tendências do mercado transacional brasileiro, além de incluir um ranking Year to Date (YTD) dos principais assessores jurídicos e financeiros.

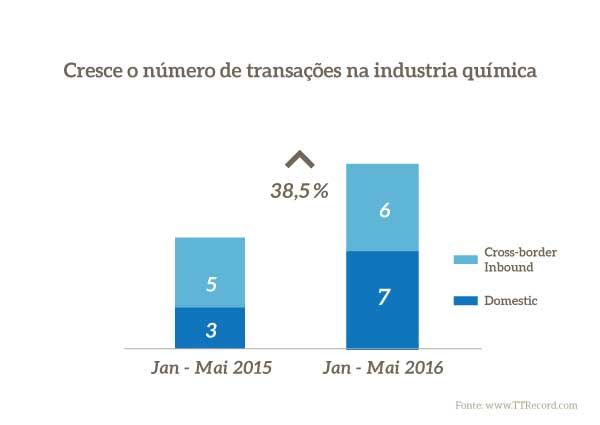

BRASIL: Transações ganham impulso no setor químico

O volume de transações envolvendo empresas que atuam no setor químico ganhou impulso nos cinco primeiros meses de 2016, com um aumento de 38,5% no número de transações, se comparado com o mesmo período de 2015, segundo dados do TTR (www.TTRecord.com).

Os investidores internacionais continuam interessados nesse setor, onde foram registradas 13 transações de aquisição de empresas brasileiras por parte de empresas estrangeiras até agora em 2016, frente as cinco registradas no mesmo período de 2015.

|

Rankings / League Tables

|

Brasil Ranking – 2016

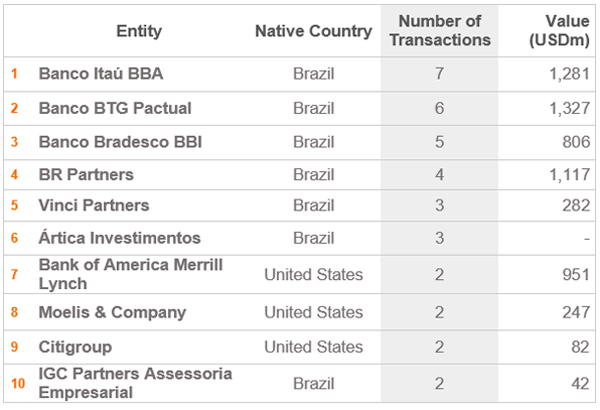

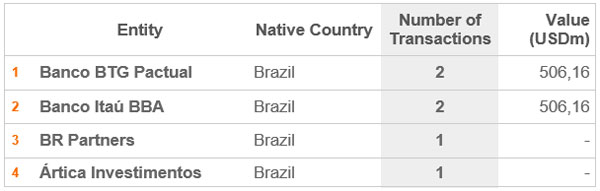

Assessoria Financeira – Year to Date (YTD)

O Banco BTG Pactual lidera o Ranking TTR de Assessores Financeiros, elaborado com dados de janeiro a maio de 2016, com oito mandatos e um valor agregado de USD 9,3bi, o que representa uma diminuição de 11% em volume e 63% em valor agregado se comparado ao mesmo período de 2015, onde esteve em segunda posição. O BTG Pactual destituiu o Banco Itaú BBA da sua posição de líder de um ano atrás graças apenas ao maior valor agregado em 2016 YTD, já que o banco rival também tem oito mandatos até agora em 2016, com um valor agregado de USD 6,3bi, o que representa uma redução de 50% no volume e de 85% no valor agregado de um ano atrás, quando liderou o ranking com 16 negócios no valor de USD 41bi. O Banco Bradesco BBI ocupa a terceira posição, com sete mandatos, frente aos cinco negócios assessorados um ano atrás. O BAML ocupa a quarta posição na tabela, também com quatro mandatos, depois de não aparecer entre os top 10 no mesmo período de 2015. O BR Partners, em quinto, também assessorou quatro transações nos cinco meses de 2016, o mesmo volume que tinha registrado no final de Maio de 2015, entretanto registrou um aumento de 400% no valor agregado saltando de USD 895m para USD 4,5 bi. O Morgan Stanley segue em sexto com três mandatos no acumulado do ano, empatado em volume com o Vinci Partners que está em sétimo. O IGC Partners Assessoria Empresarial está em oitavo, a Magma está em nono e Ártica Investimentos em décimo. Destes últimos, apenas o IGC esteve classificado entre as top 10 de um ano atrás, quando tinha assessorado em quatro transações.

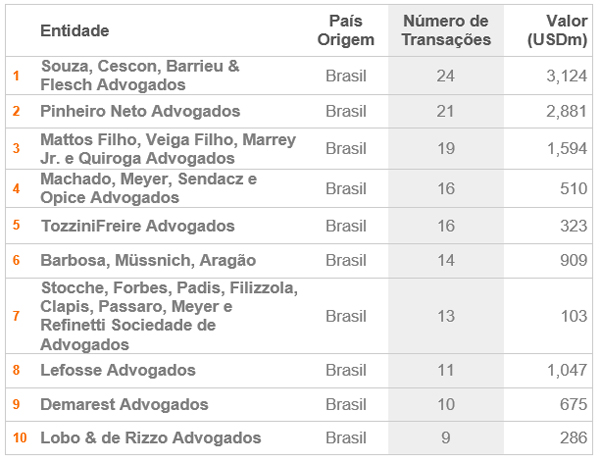

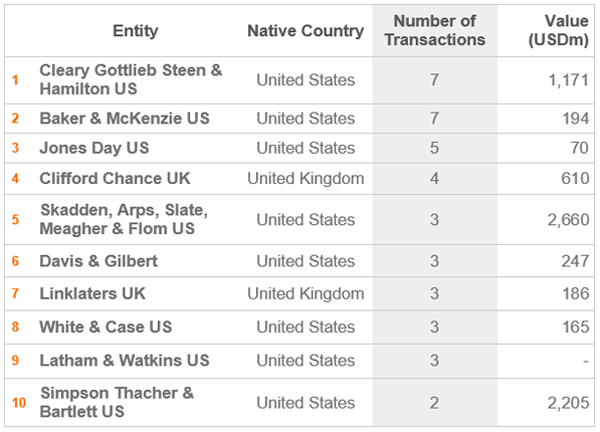

Assessoria Jurídica – Year to Date (YTD)

O Souza, Cescon, Barrieu & Flesch Advogados lidera ranking TTR de assessoria jurídica do Brasil no final de maio, com 24 mandatos no acumulado do ano com um valor agregado de USD 3,1bi. Há um ano atrás o escritório ocupou a terceira posição com 17 transações assessoradas com um valor total de USD 3,9bi. O Pinheiro Neto Advogados ocupa o segundo lugar com 21 mandatos nos primeiros cinco meses do ano com um valor total de USD 2,9bi, tendo subido desde a quinta posição no final de maio de 2015, quando assessorou 15 transações pelo valor total de USD 8,7bi. O Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados está em terceiro lugar com 19 mandatos no valor de USD 1,6bi. O Machado, Meyer, Sendacz e Opice Advogados, que estava em primeiro lugar há um ano atrás, ocupa a quarta posição com 16 transações assessoradas com um valor agregado de USD 510m, o que representa uma queda de 11% em volume e uma queda de 96% em valor agregado. O TozziniFreire Advogados subiu uma posição em relação ao ano passado, ocupando agora a quinta posição com 16 transações cujo valor agregado é de USD 323m. O Barbosa, Müssnich, Aragão, na sexta posição, desceu duas posições em relação ao ano passado, tendo no acumulado do ano 14 mandatos com valor agregado de USD 909m, frente aos USD 8,6bi de um ano atrás. O Stoche, Forbes, Padis, Filizzola, Clapis, Passaro, Meyer e Refinetti Sociedade de Advogados está em sétimo, com 13 negócios no valor de USD 103m, colocando-o entre os Top 10, já que não estava entre eles há um ano atrás. O Lefosse Advogados, que está em oitavo, também esteve ausente do ranking de maio de 2015. O Demarest aparece em nona posição com 10 mandatos cujo valor agregado é de USD 675m, frente aos 11 mandatos no valor de USD 79m no total, um ano atrás. O Lobo & de Rizzo Advogados completa os top 10 com nove mandatos que em conjunto somam USD 286m, um aumento de 80% em volume e 129% em valor agregado em comparação com um ano atrás.

* Os Rankings TTR deste report são elaborados com transações anunciadas e/ou concluídas em 2016 Year to date. Estão incluídas transações de investimento e desinvestimento de Private Equity / Venture Capital, compra/venda de ativos e formação de Joint Ventures. Os Rankings de assessores jurídicos do México e do Brasil consideram apenas assessorias nas respectivas leis locais. Em todos os rankings são considerados apenas deals onde alguma empresa do respectivo país tenha sido target na transação, no caso do ranking LATAM, algum país latinoameircano. No ranking LATAM não há especificação sobre a lei da assessoria, além disso o filtro considera apenas firmas de UK/US.

Em caso de empate o critério de desempate é: empate por número de transações, se desempata com o valor total; empate por valor total, se desempata por número de transações. E quando exista um empate em número e valor, será mantida a mesma posição e a ordem será alfabética.