Transactional Impact Monitor: Andean Region – Vol. 1

15 April 2020

TTR’s Transactional Impact Monitor (TIM) is a Special Report combining local knowledge and market visibility from top dealmakers developed to address extraordinary situations affecting the macroeconomic stability and M&A outlook in core markets

INDEX

CHILE

– Private Equity

– Equity Capital Markets

– Handling the Crisis

COLOMBIA

– Private Equity

– Equity Capital Markets

– Handling the Crisis

PERU

– Private Equity

– Equity Capital Markets

– Handling the Crisis

– The View from Milan

– Dealmaker Profiles

CHILE

Summer vacation was just coming to an end in Chile when the government ordered the closing of non-essential businesses and told citizens to stay inside their homes for an indefinite period of self-isolation on Sunday 15 March. Schools remained closed the next day and Chileans remained homebound until the quarantine began lifting in certain areas on 13 April. Outings required citizens obtain a permit online wherever stay-at-home orders were in place.

Chile faced the business lockdown from the unique perspective of having hosted a destabilizing social upheaval in late 2019, which Carey Partner Francsico Guzmán likened to the “yellow vest” movement in France, in that it had no apparent leader or organized structure.

The social upheaval led to a plethora of tangible demands, including a review of Chile’s constitution, with labor and water rights among the politically sensitive issues surfacing, Guzmán said.

Investors were cautious in the face of the economic and political uncertainty in 4Q19, he noted. Nonetheless, a strong dollar and cross-border prospects gave Carey a lot of work at the outset of 2020, he said. “That’s when coronavirus hit, and with it a global change.”

Chile was paralyzed by the social movement, and then by the threat of a pandemic, said Guzmán. “The political focus changed from addressing the demands of the social movement to surviving this as best we can,” he said.

“Fortunately in our case, what we’ve seen is that there’s still work to be done, only the nature of the work is different; it’s more strategic,” Guzmán said. Clients are calling to consult on how best to proceed and to explore restructuring business units, he said.

Renewable energy transactions Carey was working on have continued and even closed in the midst of travel restrictions, Guzmán said, noting this segment had proved particularly resilient to the impacts the crisis was having on Chile.

Retail transactions were held up though, he said. “It’s not as if they’ve fallen apart, but if there was an MOU, the two parties have said, ‘let’s see what happens.’” Retail and infrastructure deals are still being negotiated, but the pace has slowed, he said. “Nobody wants to make a mistake by committing.” More attention is being paid to MAC and force majeure clauses to protect buyers, he noted.

Private Equity

… Click here to access the first issue of Transactional Impact Monitor: Andean Region

COLOMBIA

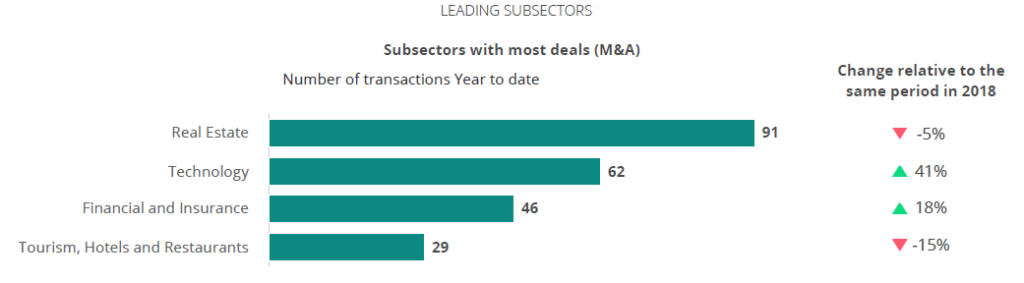

In Colombia, 2019 was a strong year for M&A with growth in deal volume in all but the second quarter and significant growth in aggregate value in all but the fourth quarter. The first two months of 2020 began at a similar pace with several transactions underway and a strong pipeline, said Brigard Urrutia Partner Darío Laguado. The energy and health sectors were particularly active, he noted, and in mid-February, the outlook was still good, despite indications of a pandemic on the horizon. Now, there’s absolute uncertainty about the implications of the economic shutdown, and most of all, about the duration of the crisis it has produced, Laguado said.

On 17 March, the government of Colombia declared a state of emergency and announced a countrywide quarantine beginning on 24 March and extended through 27 April. In Bogotá, the quarantine began on 20 March. “Companies aren’t thinking short-term, they’re thinking immediate-term,” Laguado said.

Some sectors will take an especially hard hit; in others there will be opportunities, Laguado said. Everything that adapts everyday activities for the virtual world will do well, like food delivery app companies, he noted. On a whole, M&A transactions have been difficult to advance working remotely, however, he said.

There are already cases of airlines filing for bankruptcy protection, with entertainment, hospitality, and restaurants taking the brunt of the impact, and the suppliers to those sectors next in line, Laguado said. Textiles, consumer goods and manufacturing companies are also suffering, while the financial structure of major infrastructure projects has been thrown into question, he added. Roadway and airport infrastructure depends on traffic, and projects could be impacted by such a momentous slowdown, Laguado noted. Other segments haven’t felt such a significant impact yet, but everyone is concerned, he said.

“This caught everybody with their pants down. It’s a very new situation, very unique, and there were no protocols in place,” Laguado said, adding, “The major lesson here is to conserve liquidity.”

A few of Brigard Urrutia’s deals that were at an advanced stage were signed, including the sale of Electricaribe assets on 30 March. Others have required finessing to protect buyers, Laguado said. A few other deals in industries that were not very affected have also closed, he said, noting transactions that are countercyclical are still moving forward.

The energy sector was hit simultaneously by the oil price war, Laguado noted, which has strained Colombia’s finances. This crisis hits Colombia at a precarious moment in terms of fiscal stability, he noted, which will limit the resources made available for emergency measures. “Everything is in the air with a lot of uncertainty. Clients are putting things on hold,” he said.

“We do see that there will be large M&A deals, but they will be more strategic,” he said, noting the firm was optimistic for a revitalization of the market in 2H20 if the downtime is limited.

Private Equity

… Click here to access the first issue of Transactional Impact Monitor: Andean Region

PERU

Peru had a very active M&A market over the past 12 months; deal volume grew by 8% in 2Q19 and by 20% in 4Q19 with some very large transactions contributing to a 417% increase in aggregate transaction value in 3Q19, according to TTR data.

Rubio Leguía Normand was working on about six deals of various sizes in sectors ranging from construction to agribusiness to technology, some worth more than USD 100m, with prospective closings between May and August, Partner Carlos Arata told TTR.

The measures imposed in the face of the public health threat have put all those deals on hold, he said. “I don’t expect to see any large deals wrapping up in the next six months, except those that were already very close to closing.”

Buyers are saying that the funds they had allocated for acquisitions need to be reserved for contingencies while sellers are saying that their numbers have fallen. People on both sides are taking a “wait-and-see” approach, Arata said. The agribusiness and health sectors will remain the most active in M&A, he noted.

“The year started out very well; we had a really strong pipeline of deals built from last year,” said Ian Fry Cisneros, Founder and CEO of boutique investment bank UNE Asesores Financieros

Antitrust regulation that was to go into effect in August 2020 was encouraging companies to get deals done beforehand, Fry said. This had accelerated deal flow, with many transactions being finalized in the first two months of the year and many more scheduled to conclude in 1H20 or early 2H20, he noted.

Like Chile and much of the world, Peru has been under mandatory lockdown since 15 March, with outings outside the home permitted only to restock essentials.

The quarantine interrupted the entire chain of payments throughout the economy, and whereas some companies may have sufficient capital to survive for a few months, many Peruvians live day-to-day, Arata pointed out. “The situation over the next six months is going to be complicated.”

Of the eight deals UNE had in its pipeline, one was a sell-side mandate for food and beverage retailer that operated in airports, Fry noted. It was in the eye of the storm and it came as no surprise when the bidder backed out, he said. “They’re still interested, but they’ll want to have another look once the storm has passed.” The firm has been fortunate to put its other deals on ice rather than have them called off, to be reactivated as soon as possible, Fry said.

Depending on the sector, negotiations are more or less impacted, he said. “It’s probable that there will be adjustments; it’s only natural that the buyer would say that the situation has changed, even if they are still interested,” he said.

Tourism, aviation and entertainment are suffering the greatest impact, he said, whereas agro exporters are still attracting interest. Suppliers to the food manufacturing and pharmaceutical industries need to be kept productive to ensure the supply of essential goods, he said, and these segments will continue to garner interest as they have been permitted to carry on with minimal interruption.

In general, M&A will slow down as buyers wait out the crisis, Arata said, unless they’re sitting on a large pile of cash. Deals could continue to close in the most resilient and stable sectors, like energy and construction, he said, but most sectors will face a sharp downturn.

The government of Peru is expected to invest heavily in public infrastructure to help the economy recover over the coming months, and many firms that were impacted by the scandals in the construction industry will be looking for strategic partners in the months ahead, Arata said.

Private Equity

… Click here to access the first issue of Transactional Impact Monitor: Andean Region