LATIN AMERICA

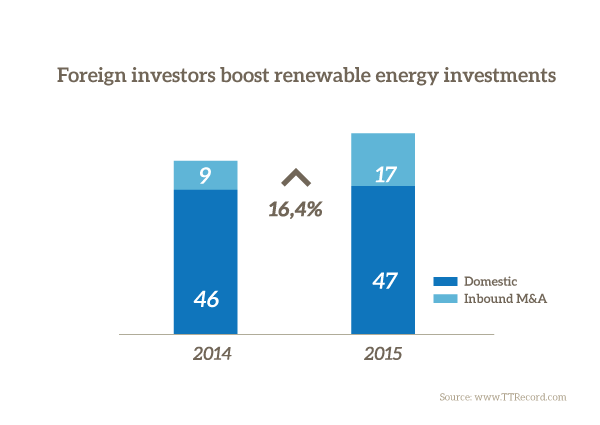

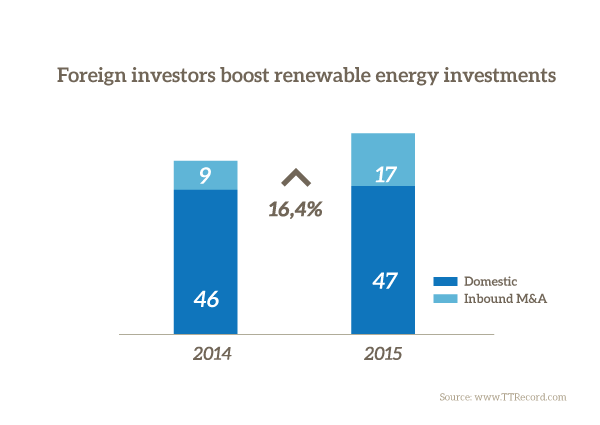

BRAZIL: Foreign investors boost renewable energy investments

The number of transactions in Brazil’s renewable energy segment grew by 16% in 2015 compared to the previous year, according to TTR data (www.TTRecord.com).

The participation of foreign investors in the renewables industry jumped by 89%, meanwhile, with 17 deals led by international buyers in 2015 compared to nine the previous year.

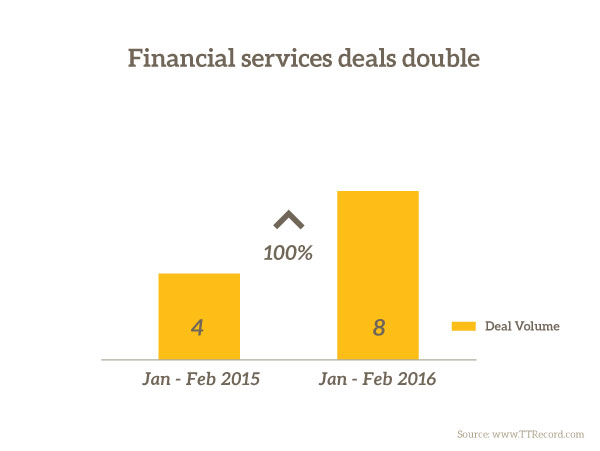

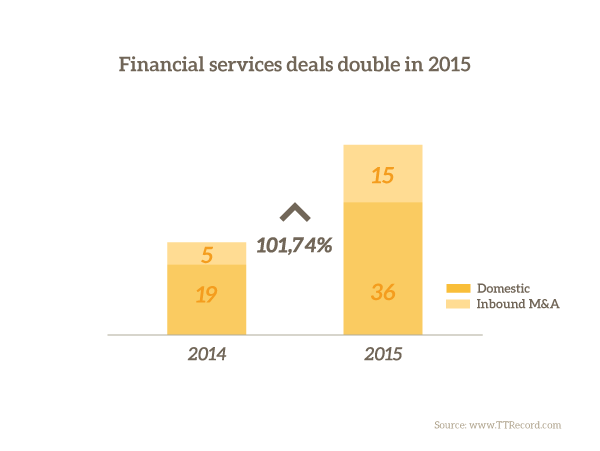

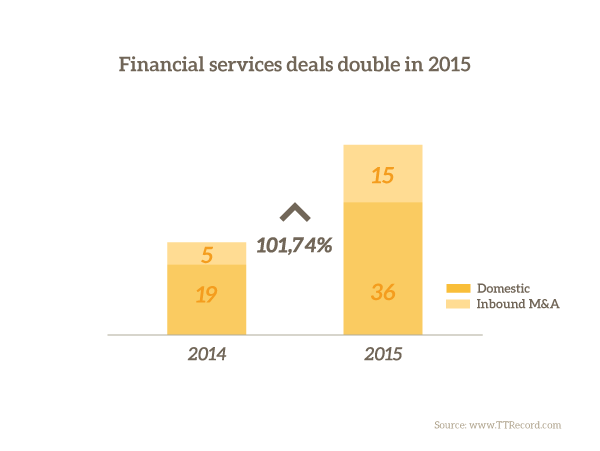

CHILE: Financial services deals double in 2015

The volume of financial services deals in Chile more than doubled in 2015 compared to the previous year, with a 122% increase according to TTR data (www.TTRecord.com).

The number of financial services deals led by international investors jumped by 200%, meanwhile, with 15 such transactions in 2015 compared to five in 2014.

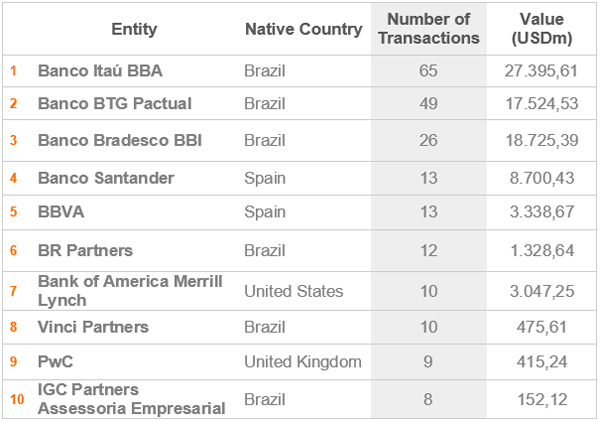

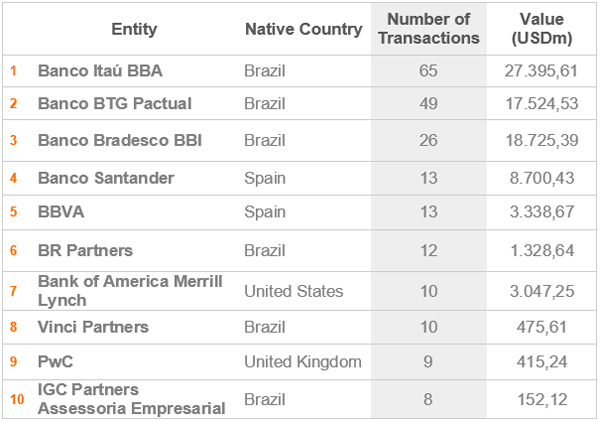

Latin America Ranking – 2015

Financial Advisory – Full year Rankings

Banco Itaú BBA leads TTR’s Latin America financial advisory ranking for the full year of 2015 with 65 transactions together worth USD 27.4bn, a 4% decline in deal volume and a 23% increase in combined deal value compared to 2014, when it advised on 68 deals together worth USD 22.2bn. Banco BTG Pactual follows in second place, as it did in 2014, with 49 transactions worth a combined USD 17.5bn, representing a 29% increase in deal count and a 17% increase in combined deal value relative to its performance the previous year when it advised on 38 deals, together worth USD 15bn. Banco Bradesco BBI climbed one position relative to its 2014 performance to take third place with 26 transactions worth a combined USD 18.7bn compared to 17 worth USD 6.7bn in 2014, representing a 53% jump in volume and a 179% increase in aggregate value. Banco Santander fell from third in 2014 to fourth in 2015, meanwhile, closing 13 deals worth a combined USD 8.7bn in 2015 compared to 19 worth USD 8.3bn in 2014, a 32% decline in deal volume and a 5% increase in aggregate value. BBVA, in fifth, also with 13 deals in 2015 region-wide, in its case worth USD 3.3bn, was not among the top 10 financial advisors in the region in 2014. BR Partners climbed from its tenth place ranking in 2014 to take sixth for the 12 months ending 31 December 2014, with 12 transactions under its belt together worth just over 1.3bn compared to 11 worth just under USD 1.4bn the previous year. BAML fell from fifth in the 2014 chart to seventh in the 2015 ranking, its deal volume down 38% from 16 transactions to 10, its aggregate value falling 78% from USD 13.6bn to USD 3bn. Vinci Partners ranks eighth, PwC ninth and IGC Partners Assessoria Empresarial tenth in the 2015 chart, none of the three having placed among the top 10 in 2014.

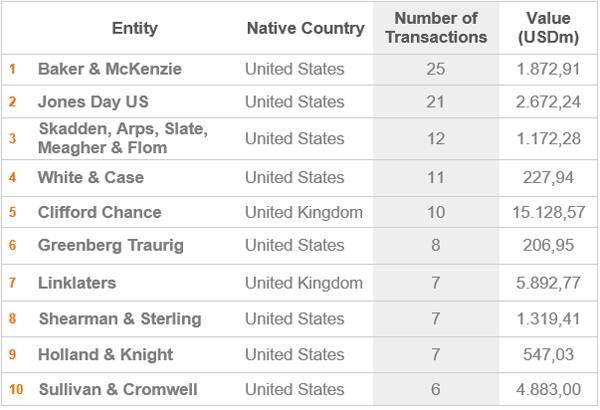

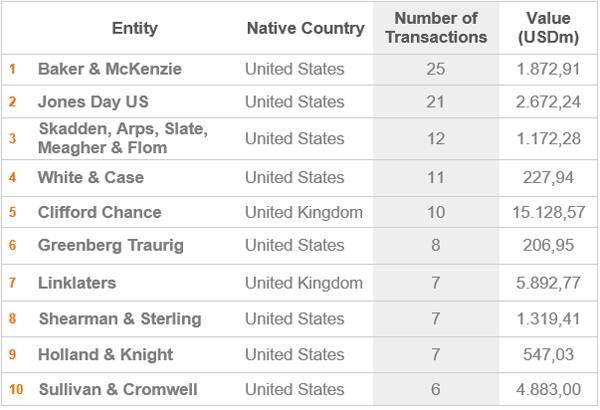

Legal Advisory – Full year Rankings

Baker & McKenzie leads TTR’s Latin America legal advisory ranking for 2015, as it did in 2014, despite its deal volume for the year falling 26% from 34 to 25 deals and the aggregate value of those transactions falling 82% from USD 10.5bn to USD 1.9bn. Jones Day ranks second with 21 deals under its belt in 2015 worth a combined USD 2.7bn, up 50% in deal volume and 37% by aggregate value from 14 transactions worth a combined USD 2bn in 2014, when it ranked fourth. Skadden, Arps, Slate, Meagher & Flom ranks third with 12 deals together worth USD 1.2bn, up 300% by volume and 253% by aggregate value compared to its performance in 2014, when it didn’t rank among the top 10 firms practicing in the region. White & Case fell from second in 2014 to fourth in 2015, its deal volume down 42% to 11 deals from 19 the previous year and aggregate deal value down 98% from USD 11bn to USD 228m. Clifford Chance added one deal to its performance of 2014 and climbed from eighth to fifth in the chart, notwithstanding the 39% drop in the aggregate value of its mandates from USD 24.6bn to USD 15.1bn. Greenberg Traurig fell from fifth in 2014 to sixth in 2015, its deal volume falling from 13 to eight, the aggregate value of its mandates down 87% from USD 1.6bn to 207m. Linklaters climbed from ninth to seventh in the chart, despite deal volume falling from nine to seven and its combined deal value falling 48% from USD 11.2bn to USD 5.9bn. Shearman & Sterling climbed two positions in the chart from tenth in 2014 to take eighth in 2015, also with seven deal mandates compared to nine the previous year, its aggregate deal value falling 29% from USD 1.9bn to USD 1.3bn. Holland & Knight, in ninth, was not among the top 10 firms in 2014, nor was Sullivan & Cromwell, bringing up the rear in tenth place.

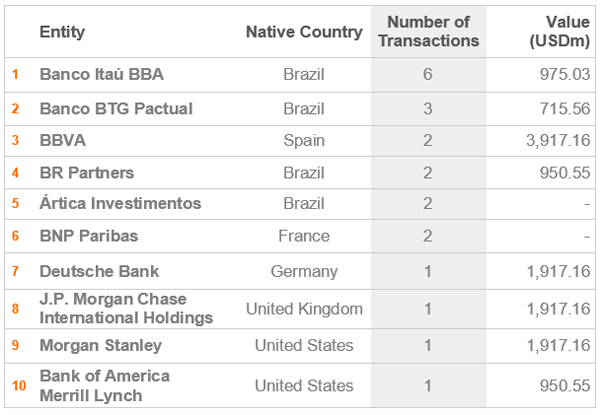

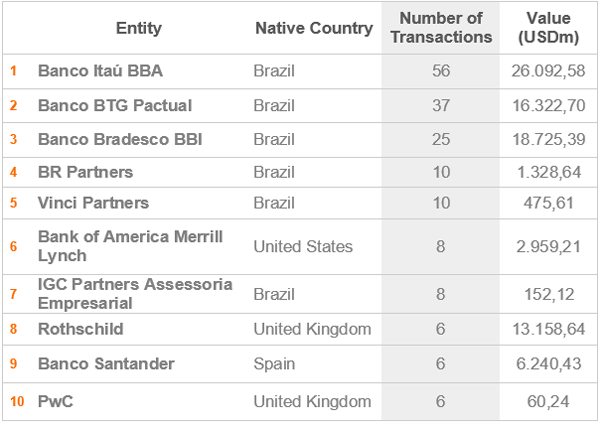

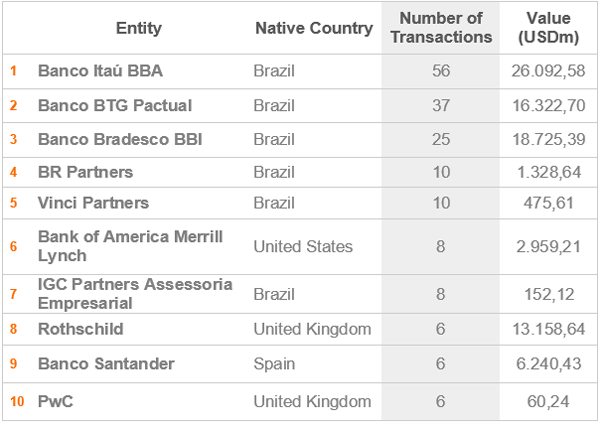

Brazil Ranking – 2015

Financial Advisory – Full year Rankings

Banco Itaú BBA leads TTR’s Brazil financial advisory ranking for 2015 with 56 transactions worth a combined USD 26bn, just one deal behind its 2014 performance when it also led the chart. The leading bank’s aggregate deal value jumped 238% meanwhile, from USD 7.7bn in 2014. Banco BTG Pactual follows in second with 37 advisory mandates in 2015, up from 34 in 2014, when it also ranked second. BTG Pactual grew aggregate deal value by 17% from USD 14bn to USD 16.3bn between 2014 and 2015, meanwhile. Banco Bradesco BBI climbed one position relative to 2014 to take third place in the chart, its volume up 47% from 17 to 25 deals, the aggregate value of its transactions up 179% from USD 6.7bn to USD 18.7bn. BR Partners climbed from fifth to take fourth, despite advising on one deal less in 2015 than the previous year and a drop in its aggregate deal value from USD 1.4bn to USD 1.3bn. Vinci Partners, in fifth, advised on 10 deals in both 2014 and 2015, the aggregate value of those deals up 45% from USD 328m to USD 476m from one year to the next. BAML climbed from eighth to sixth, despite volume falling from nine to eight deals and the combined value of its transactions down 26% from USD 4bn to USD 3bn. IGC Partners Assessoria Empresarial, in seventh, also advised on eight deals in 2015, in its case worth USD 152m. IGC was not among the top 10 financial advisors in Brazil in 2014. Rothschild climbed from ninth to eighth despite advising on one deal less in 2015. Its aggregate deal value was up 188% from USD 4.6bn to USD 13.2bn. Banco Santander fell from third in 2014, when it advised on 34 deals in Brazil, to ninth in 2015, when it advised on six transactions, while the combined value of its transactions fell 20% from USD 7.8bn to USD 6.2bn. PwC brings up the rear in tenth place, also with six transactions, in its case worth USD 60m. PwC was not among the top 10 financial advisors in Brazil in 2014.

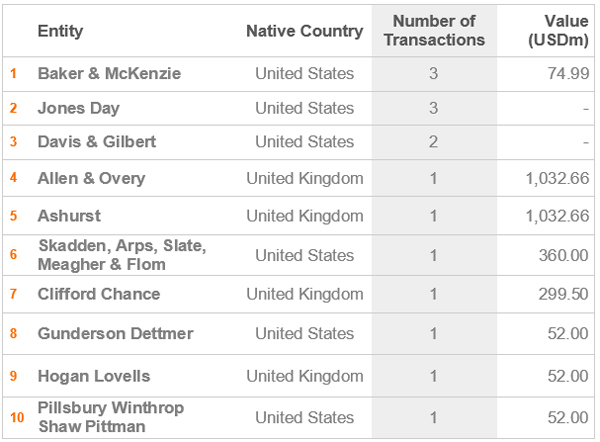

Legal Advisory – Full year Rankings

Pinheiro Neto Advogados leads TTR’s Brazil legal advisory ranking for 2015 with 71 transactions worth a combined USD 17.2bn, compared to 72 in 2014 together worth USD 11.8bn. Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados ranks second, as it did in 2014, with 63 deals together worth USD 13.6bn, an 11% decline in volume and a 26% drop in aggregate value relative to its 71 mandates worth USD 18.4bn combined in 2014. Machado, Meyer, Sendacz e Opice Advogados ranks third, as it did for 2014, its deal volume down from 56 transactions to 51, its aggregate deal value up 277% from USD 3.7bn to USD 14bn. Souza Cescon Advogados climbed from seventh in 2014 to take fourth in 2015, advising on 47 deals worth USD 8.3bn in aggregate, compared to 35 worth USD 11.5bn the previous year. Veirano Advogados ranks fifth, as it did in 2014, also with 47 deals in 2015, in its case worth a combined USD 1.7bn, representing a 45% decline in aggregate deal value from USD 3bn the previous year. Barbosa, Müssnich, Aragão ranks sixth with 38 transactions in 2015 together worth USD 11bn, compared to 34 the previous year worth USD 11.6bn when it ranked ninth. Demarest Advogados follows in seventh with 36 deals worth USD 2.8bn in aggregate, up from 34 worth USD 9.4bn combined in 2014, when it ranked tenth. TozziniFreire Advogados ranks eighth with 30 deals in 2015 worth USD 1.2bn combined, compared to 42 in 2014 worth USD 7.2bn, when it ranked sixth. Pinheiro Guimarães Advogados, in ninth, and Azevedo Sette Advogados, in tenth, were not among the top 10 M&A firms practicing in Brazil in 2014.

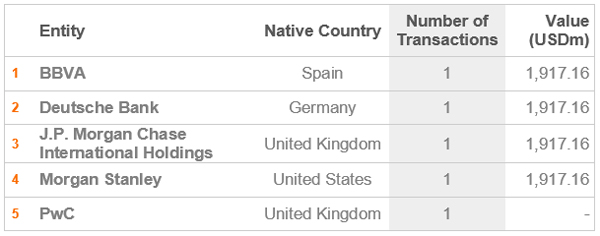

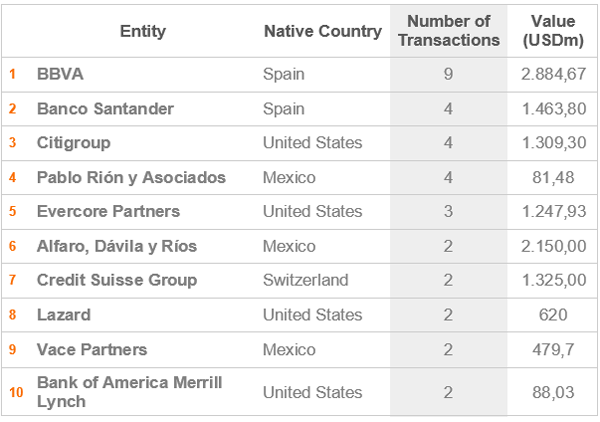

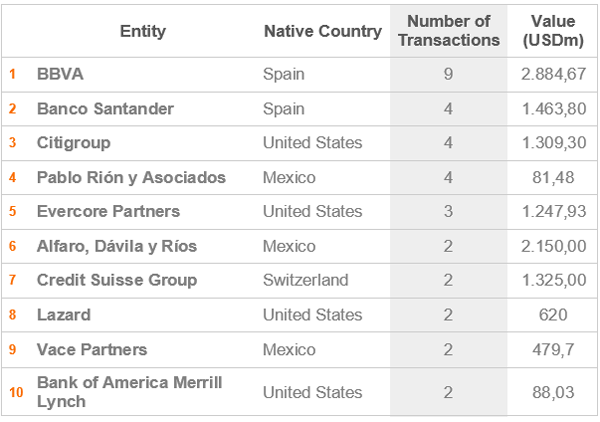

Mexico Ranking – 2015

Financial Advisory – Full year Rankings

BBVA leads TTR’s Mexico financial advisory ranking for 2015 with nine transactions worth a combined USD 2.9bn, compared to six worth USD 239m in 2014 when it also led the chart. Banco Santander follows in second with four deal mandates for the year worth USD 1.5bn combined, up from one in 2014 worth USD 1.3bn when it ranked tenth. Citigroup, in third, also advised on four deals in Mexico in 2015, in its case worth USD 1.3bn, up from two the previous year worth USD 1.7bn, when it ranked fifth. Pablo Rión y Asociados closed 2015 ranked fourth, also with four mandates for the year. Evercore Partners ranks fifth with three transactions and Alfaro, Dávila y Ríos sixth with two. Credit Suisse Group ranks seventh, advising on two deals for the year in Mexico, as did Lazard, ranked eighth, and Vace Partners, in ninth. BAML, in tenth, was the only firm below third place that appeared among the top 10 in 2014, when it ranked seventh for its two deals worth USD 634m combined.

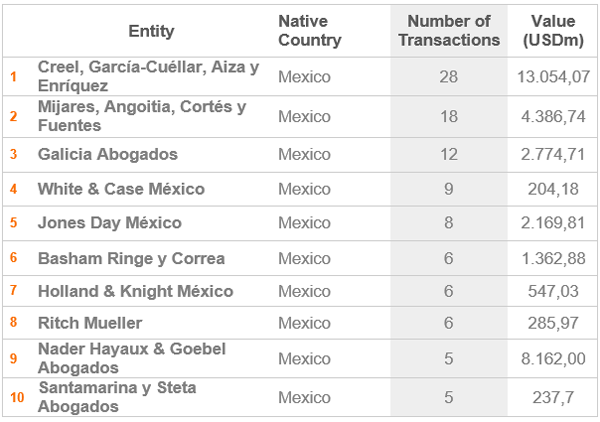

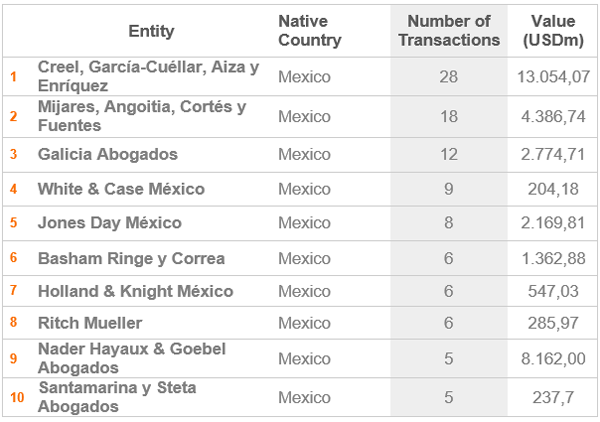

Legal Advisory – Full year Rankings

Creel, García-Cuéllar, Aiza y Enríquez leads TTR’s Mexico legal advisory ranking for 2015, as it did in 2014, with 28 mandates worth a combined USD 13bn compared to 25 worth USD 9bn the previous year, a 12% increase in volume and a 46% increase in aggregate value. Mijares, Angoitia, Cortés y Fuentes follows in second, as it did in 2014, with 18 deals together worth USD 4.4bn, compared to 15 worth USD 3bn the previous year, representing a 20% increase in deal volume and a 48% jump in the combined value of its transactions. Galicia Abogados climbed from fifth to take third, advising on 12 deals together worth USD 2.8bn, compared to eight worth USD 1.2bn in 2014, a 50% upswing in volume and a 138% jump in combined value. White & Case México fell one position to take fourth, its deal volume down 18% from 11, its aggregate deal value down 94% from USD 3.2bn in 2014. Jones Day México takes fifth, advising on eight deals in 2015 worth a combined USD 2.2bn, after not appearing among the top 10 M&A firms practicing in the country in 2014. Basham Ringe y Correa climbed from tenth to take sixth, advising on six transactions worth a combined USD 1.4bn in 2015 compared to four in 2014 worth USD 2.3bn. Holland & Knight México added one deal to its performance the previous year and climbed one position in the chart to take seventh place, with six transactions together worth USD 547m. Its five deals in 2014 were worth USD 2.3bn combined. Ritch Mueller, in eighth, also advised on six deals in 2015, in its case worth a combined USD 286m, representing a 33% decline in volume and a 90% decline in aggregate value from nine the previous year worth USD 2.8bn, when it ranked fourth. Nader Hayaux & Goebel Abogados closed 2015 in ninth place with five deals together worth USD 8.2bn, compared to six worth USD 132m the previous year when it ranked seventh. Despite a modest drop in deal volume, the aggregate value of its transactions grew 6,000%. Santamarina y Steta Abogados, in tenth, rounds out the chart for 2015 after not placing among the top 10 firms practicing in Mexico in 2014.