Transactional Impact Monitor: Andean Region – Vol. 3

15 October 2020

TTR’s Transactional Impact Monitor (TIM) is a Special Report combining local knowledge and market visibility from top dealmakers developed to address extraordinary situations affecting the macroeconomic stability and M&A outlook in core markets

INDEX

CHILE

– M&A Outlook

– Handling the Crisis

COLOMBIA

– M&A Outlook

– Handling the Crisis

PERU

– M&A Outlook

– Handling the Crisis

– Dealmaker Profiles

CHILE

The mood among investors in Chile, and those looking on from abroad at what has long been considered the darling of Latin America for its political stability and liberal trade policies, is tenuous. The plebiscite on constitutional reform, originally scheduled for April, will be held on 25 October, a year after protesters filled the streets of Santiago following a public transit hike to voice their discontent on a range of matters. Among the grievances that led to widespread unrest were human rights abuses, the exclusion of a large swath of the population from the economic gains the country has enjoyed over the last three decades, and a generalized disenchantment with Chile’s form of pro-business, neoliberal democracy.

The economic crisis that gripped the world in 1Q20 caught Chile, and much of Latin America, mid-downward cycle, noted Banmerchant Deputy Manager of Corporate Finance Ignacio Rodríguez. Like other investment banks across the region, Banmerchant had several sale processes underway that were put on hold, Rodríguez said, noting that as the M&A work began to decline, restructuring became the firm’s core business.

“Many companies stopped generating revenues, but their liabilities still needed to be serviced,” he said. Chile’s banks stepped up to support the private sector, funneling low-interest loans with extended grace periods before borrowers had to begin repaying. In September, those grace periods began to expire, Rodríguez said, and if corporate revenues don’t normalize in October and November, a wave of insolvencies will hit Chilean shores.

The uncertainty surrounding the economic recovery is complicated by the October plebiscite, which has investors, and Chileans in general, anxious. “Everybody wants to restructure their liabilities long-term, but many won’t be able to,” Rodríguez said. “They will either go under or seek fresh capital. That’s where M&A will reactivate, representing an opportunity for foreign investors to enter Chile at very low valuations.”

M&A Outlook

… Click here to access the third issue of Transactional Impact Monitor: Andean Region – Vol. 3

COLOMBIA

Restrictions governing economic activity in Colombia are easing with all businesses except bars, nightclubs and gyms permitted to open daily as of 22 September, though opening hours continue to be limited for specific sectors. Business confidence has accordingly turned slightly positive for the first time since March, according to the local press.

“We can now turn the page,” said César Gutiérrez, Managing Director of boutique investment bank Bastion Capital Advisors. After six months of near paralysis, the private sector is ready to get back to business, he said. Many Colombian companies in certain industries are entering restructuring processes, refinancing their debt, looking for capital or exploring sale options after six months of little-to-no business activity, however, he noted.

Tourism and hospitality and related industries like aviation and catering, have been decimated, said Gutiérrez, and automotive sales are also down sharply. Bastion was recently approached by a company serving the aviation industry that could not continue to finance its overhead when revenue fell flat, Gutiérrez said. Though Colombia’s international airports reopened on 1 September, traffic remains lackluster as the fear of contracting COVID-19 while flying persists, and many corporate entities maintain work-from-home policies, limiting the company’s prospects for a rebound, he noted.

There is no way to maintain fixed costs for five or six months when revenue evaporates overnight, Gutiérrez said, especially for companies that have relied on debt financing. Colombia’s banks have classified virtually every business segment as high-risk, meanwhile, making it difficult for companies to access bridge financing, Gutiérrez said.

This looks to be the start of a wave of consolidation, where private equity funds with firepower can buy on the cheap, he noted, whether diversified domestic fund managers that have longstanding interests in Colombia, or those that have always had an interest in investing in the country. A long-awaited opportunity for private debt could finally find fertile ground in Colombia, Gutiérrez noted.

Despite the uncertainty about the timing and speed of the recovery, there will always be appetite for good assets, Gutiérrez said. “When some cry, others make handkerchiefs,” he noted, citing a popular saying. This is the moment for opportunistic investors, both strategic and financial, he added. “I’m very optimistic. This has been a moment to reflect, to analyze where industries are headed, and understand the new opportunities; companies need to get ready for what comes next.”

M&A Outlook

… Click here to access the third issue of Transactional Impact Monitor: Andean Region – Vol. 3

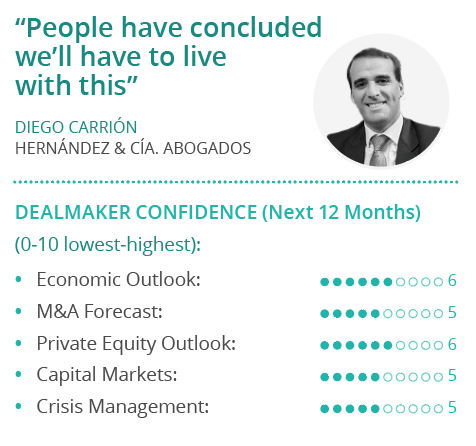

PERU

Following months of strict isolation, the Peruvian government announced it would permit air traffic between Peru and seven countries, namely Bolivia, Chile, Colombia, Ecuador, Panama, Paraguay and Uruguay, beginning the first week in October. The reopening of the country’s airspace comes despite an official death toll attributed to SARS-CoV-2 that puts Peru at the top of the list of nations globally by a significant margin, at over 1,000 per million inhabitants. Despite the health crisis, Peruvian companies are beginning to get back to business, and stalled transactions are getting back on track, according to Hernández & Cía. Abogados Partner Diego Carrión.

Peru was awash with M&A deals in 2015, when Carrión was appointed partner. That wave of transactions hit a bump when the “Lava Jato” scandal in Brazil spilled over into Peru, where Odebrecht and other large Brazilian and Spanish construction firms had large contracts underway in partnership with local entities, many of them, it turned out, won by corrupt means.

The construction sector was paralyzed as a result of this, with project finance transactions arrested midstream. This was followed by some opportunistic M&A when Odebrecht and other large international construction firms needed to exit some projects, Carrión recalled, while M&A activity in other sectors of the economy continued at a good pace.

Hernández & Cía. Abogados was never involved with Odebrecht, which gave it a great upside, as many clients began to search the firm out for its clean record, said Carrión. Among the important new clients garnered as a result was Graña y Montero, Carrión noted. In 2017, the firm was retained by the company’s new board to guide it through a reorganization, and it has continued to work hand-in-hand with the board and the new management ever since to overcome one of the most dire corporate crises in the country’s history. “They sought us out for the strength of our team, and because we had no conflict of interest,” Carrión said, noting Hernández was part of the “big change” in the company.

The firm’s deal flow isn’t dependent on the construction industry, however, and it has worked on a slew of M&A deals in other sectors in recent years, including several led by private equity investors. Real estate is one sector in which it has invested heavily of late to enhance its expertise. In the midst of the crisis in mid-2020, it poached an entire real estate practice from another law firm to bolster its capabilities in this growing field.

“This gives us an edge amid strong growth in what has become an increasingly sophisticated real estate market,” Carrión said. Real estate lawyers need to speak the language of the engineers and regulators, and Hernández was losing some business without a clear leader in the space, he said. The runway in the real estate market is tremendous, with construction projects that were shut down in 2Q20 now getting underway again and a pipeline of deals spanning the economy, from the development of agricultural lands to malls. “We now have the capacity to ride this wave,” Carrión said, noting the firm took advantage of its strong balance sheet and the lull in the market to make a strategic move that will position it with the right team.

While construction projects in the private sector are underway again, the large infrastructure projects tendered by the Peruvian government, including Line 2 of Lima’s metro and the expansion of Jorge Chávez Airport, are progressing at a snail’s pace, Carrión said, amid bureaucracy that’s worse than ever, inducing skepticism, fear and a lack of confidence among participants and onlookers alike.

M&A Outlook

… Click here to access the third issue of Transactional Impact Monitor: Andean Region – Vol. 3