Informe trimestral sobre el mercado transaccional latinoamericano

- En total en los tres primeros meses del año se han registrado 461 transacciones

- El volumen de inversión en este periodo alcanza los USD 29,020.7m

- Norteamérica y Europa, las que más adquisiciones han realizado en la región

Madrid, 13 de abril de 2015.- Las cifras de los tres primeros meses del año dejan ver un escenario positivo en el mercado de fusiones y adquisiciones en América Latina y el primer trimestre del año el número de operaciones ha aumentado un 7.7% respecto al mismo periodo del año anterior, según el informe anual de TTR (www.TTRecord.com) ). En total, se han registrado 461 transacciones por un importe total de USD 29,020.7m.

Por países, Brasil sigue como líder indiscutible con 213 operaciones y un aumento interanual de cerca del 18%. Le sigue México que ha registrado 75 operaciones, lo que supone un crecimiento del 4.2% y Chile que con 46 deals ha crecido un 17.9%.

Entre las transacciones más relevantes destaca la compra por parte de Tiendas Soriana de un conjunto de establecimientos de retail que estaban en manos de Controladora Comercial Mexicana – CCM por un importe de USD 2,612m; así como el cierre de la adquisición por parte de AT&T de Iusacell por USD 2,500m.

En el ámbito cross-border, destaca el apetito inversor de las compañías latinoamericanas en el exterior especialmente en Europa, donde han llevado a cabo 17 adquisiciones y Norteamérica, con 11 compras. En cambio, las compañías que más transacciones estratégicas han realizado en América Latina procedían de Europa, con 71, Norteamérica (61), Asia (12) y Oceanía (3).

En el segmento de private equity, en el primer trimestre del año se han registrado 27 transacciones por un importe total de USD 722.53m. Por países, Brasil ha sido el más activo con 20 operaciones protagonizadas por private equities seguido por México y Colombia, ambos con 4.

En el mercado de capitales, a pesar de no haberse registrado aún salidas a bolsa en América Latina, sí se han llevado a cabo siete ampliaciones de capital por un valor total de USD 666.71m.

Transacción destacada

En el primer trimestre de 2015, TTR ha seleccionado como transacción destacada la compra por parte de la argentina Pluspetrol de la estadounidense Apco Oil & Gas International por un importe de USD 427m. En la operación han intermediado como asesores legales la firma estadounidense Weil, Gotshal & Manges y la argentina Pérez Alati, Grondona, Benites, Amtsen & Martínez de la Oz. En la parte financiera ha participado la consultora estadounidense Jefferies.

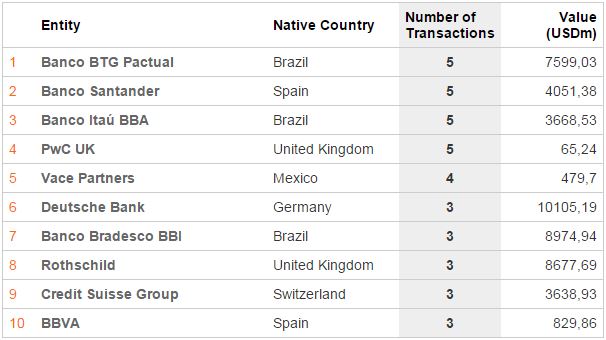

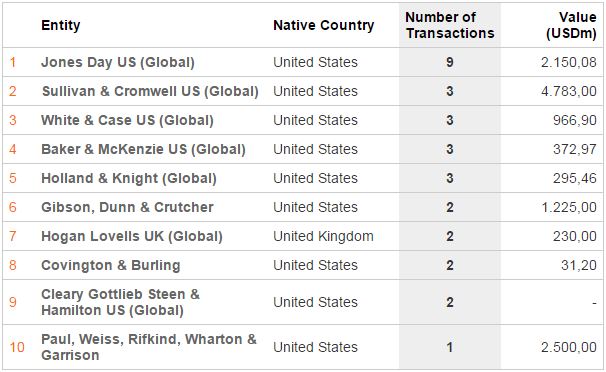

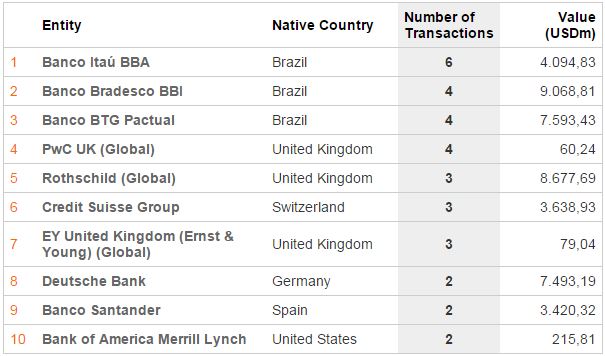

Ranking de asesores financieros y jurídicos

El informe publica los rankings de asesoramiento financiero y jurídico del primer trimestre de 2015 de M&A y Mercado de capitales, donde se informa de la actividad de las firmas destacadas por número de transacciones y por importe de las mismas.

Para más información:

Leticia Garín

TTR – Transactional Track Record

Tlf. + 34 91 279 87 59

leticia.garin@TTRecord.com

www.TTRecord.com

TTR – Transactional Track Record es un servicio premium online de apoyo a las decisiones de inversores, empresarios y asesores. Incluye la mayor base de datos de transacciones del mercado hispano-portugués, así como el acceso a los detalles financieros de las empresas implicadas.