BRAZIL: US buys on the increase

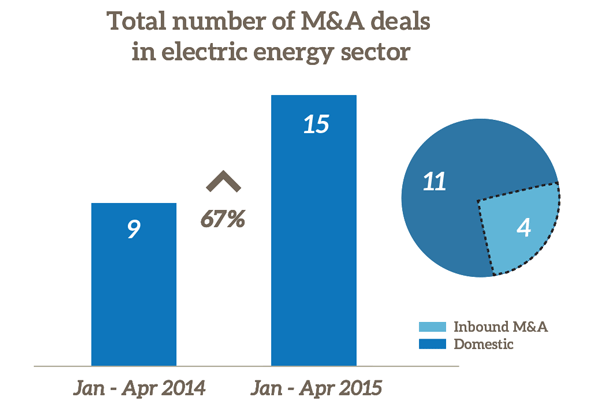

The number of deals led by US buyers in Brazil has increased 36.67% between January and May this year compared to the same period in 2014. Private equity led transactions in Brazil have also grown as a percentage of total deals from 30% to 41% over the same period.

MEXICO: Energy reform catalyzes oil and gas deals

Energy reform launched by the Mexican government in the past year allowing for greater participation of foreign investors in the oil and gas sector has begun to bear fruit. Between January and May the combined deal value in the oil and gas industry shot up 86.6% compared to the same period in 2014 from USD 750m to USD 1.4bn, while deal volume in the sector increased accordingly from one to four transactions.

|

Rankings / League Tables

|

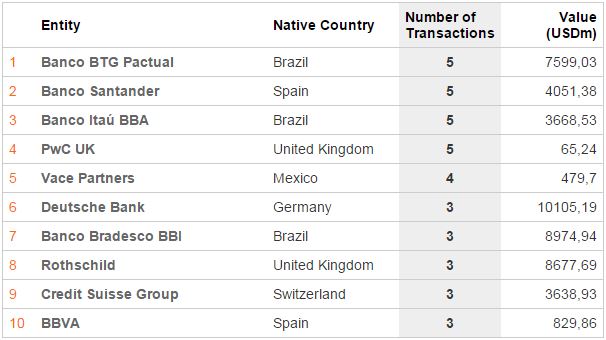

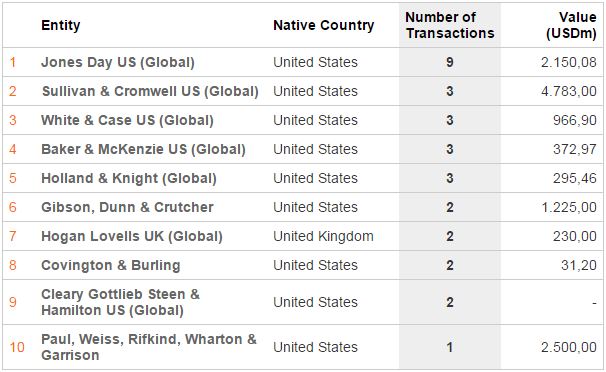

Latin America Ranking – 2015

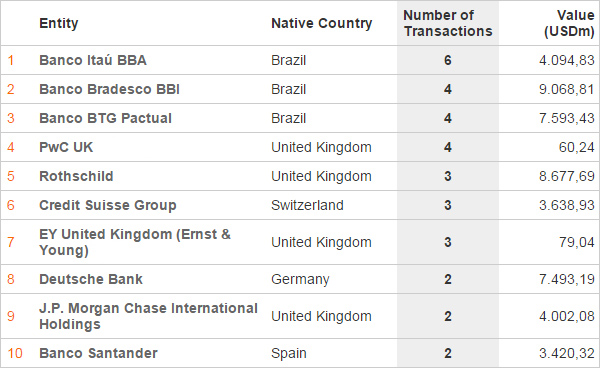

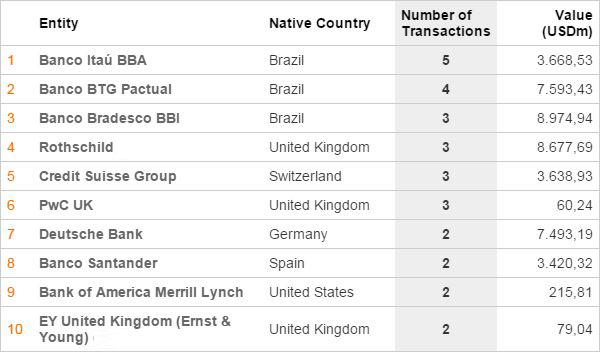

Financial Advisory – Year to Date (YTD)

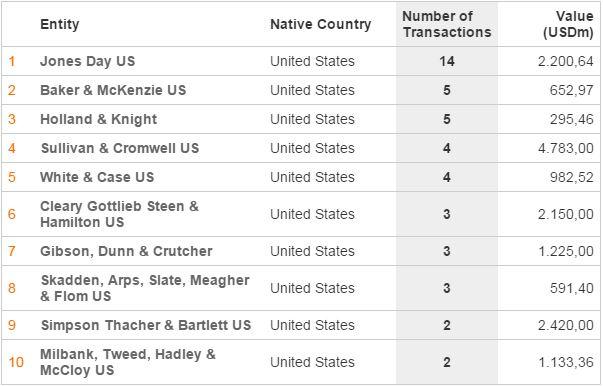

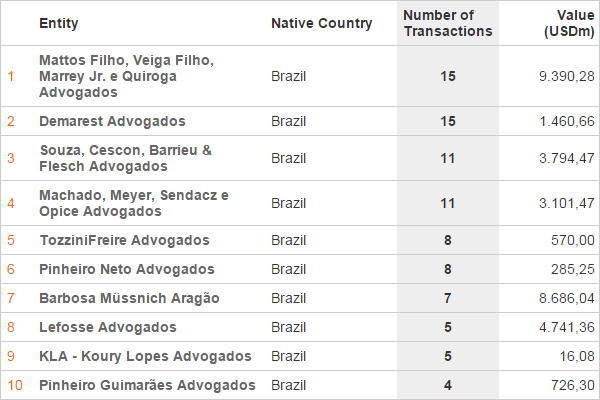

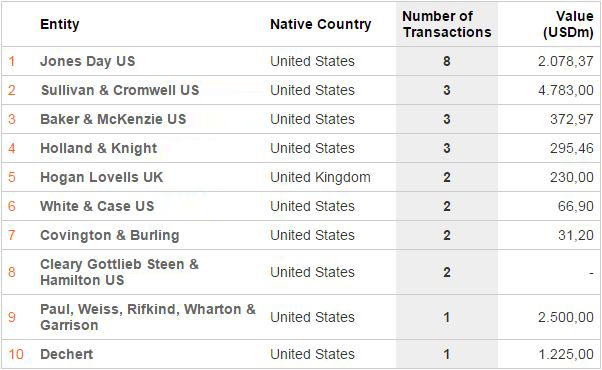

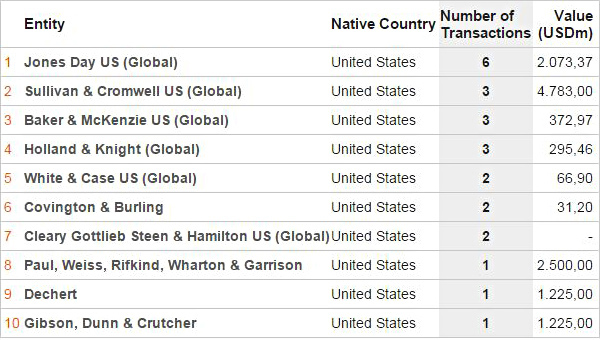

Legal Advisory – Year to Date (YTD)

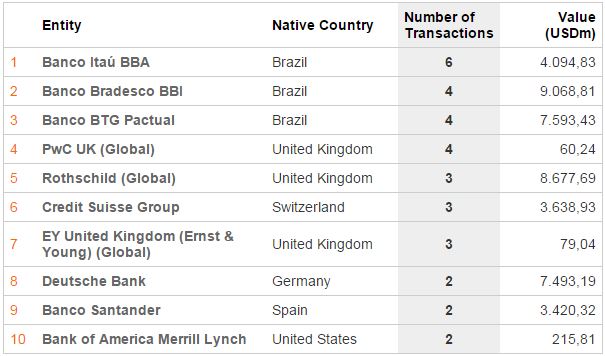

Brazil Ranking – 2015

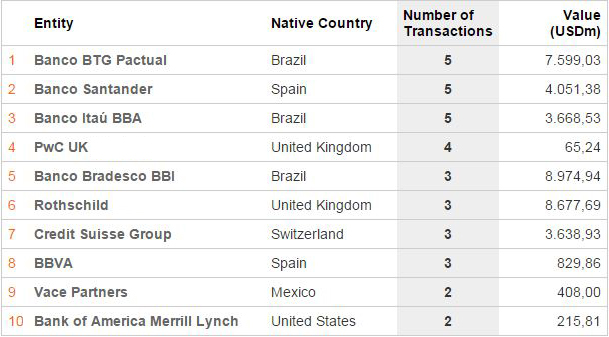

Financial Advisory – Year to Date (YTD)

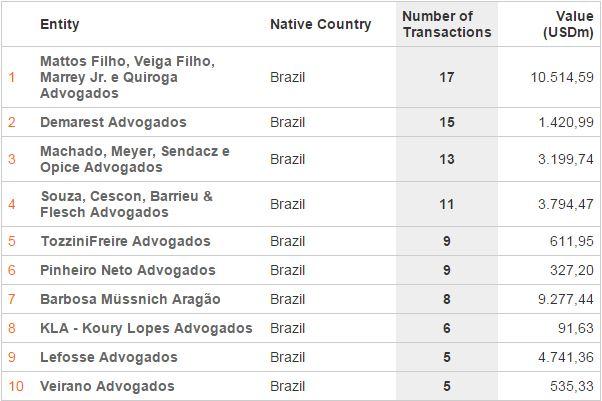

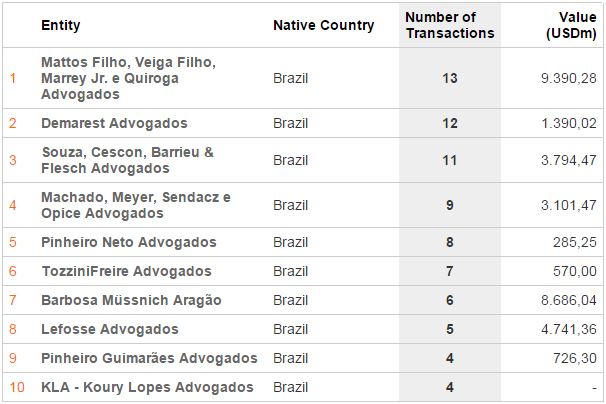

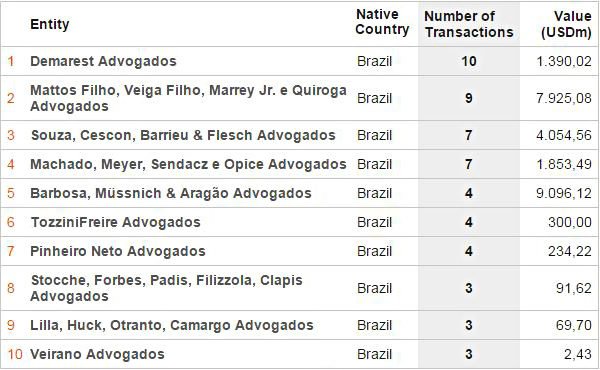

Legal Advisory – Year to Date (YTD)

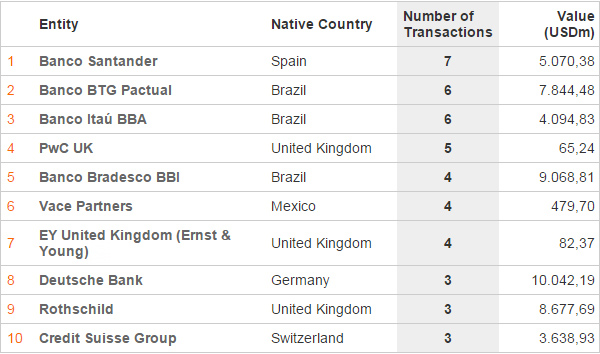

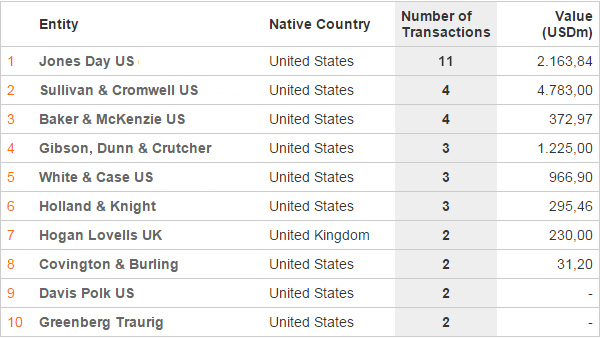

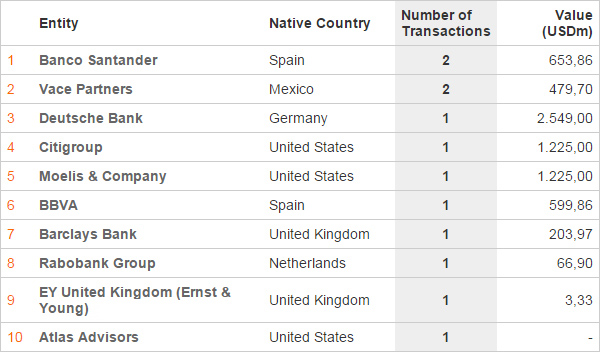

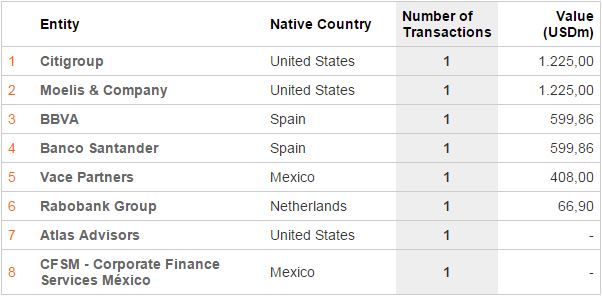

Mexico Ranking – 2015

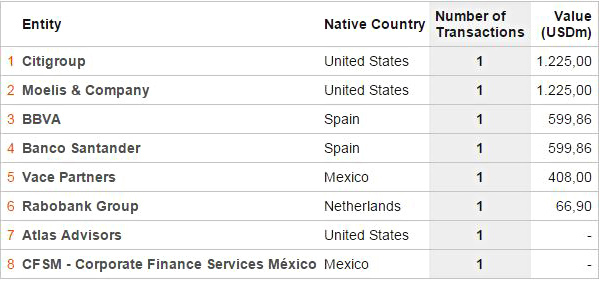

Financial Advisory – Year to Date (YTD)

Legal Advisory – Year to Date (YTD)