BRAZIL: Technology on a Roll

The volume of technology sector acquisitions in Brazil rose 150% in the first two months of 2015 compared to the same period last year.

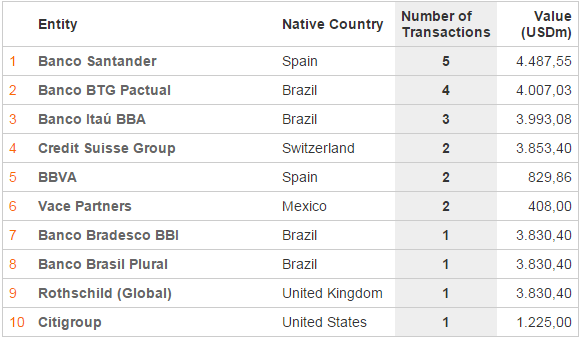

BTG was ousted from its top spot in the Latin America financial advisory ranking by Banco Santander, which advised on five deals valued at USD 4.49bn in the first two months of 2015.

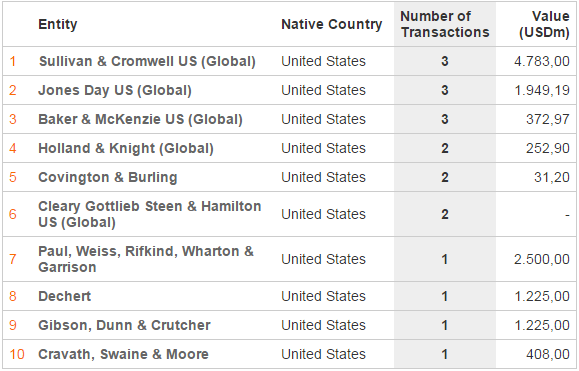

Legal Advisory – Year to Date (YTD)

A completely new set of US legal advisors comprised the top-10 ranking for the first two months of 2015 compared to the same period last year. Cleary Gottlieb Steen & Hamilton was the only legal advisor with a repeat appearance, falling from fifth to sixth in the top-10 ranking between the two periods.

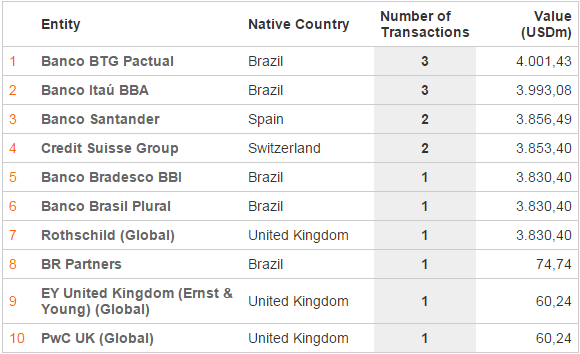

Brazil Ranking – 2015

Financial Advisory – Year to Date (YTD)

BTG Pactual rose to the top of the financial advisory ranking in Brazil for the first two months of 2015, bumping Itau, which held the top position for the corresponding period of 2014, to second place. Spain’s Banco Santander rose from eighth to take the number three spot over the same period of 2014.

Legal Advisory – Year to Date (YTD)

Mattos Filho jumped from fourth in January-February, 2014 beating out the competition to take the leading position in the first two months of 2015 by advising on seven deals worth USD 3.92bn. For the same period in 2014 it advised on eight transactions worth USD 2.48bn.

Mexico Ranking – 2015

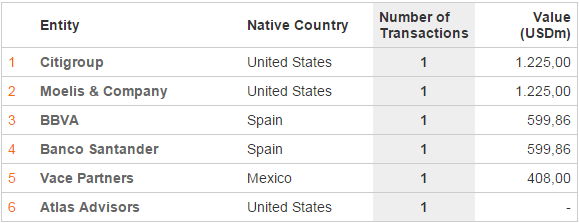

Financial Advisory – Year to Date (YTD)

Citigroup moved into the top financial advisory position with its sole USD 1.23bn transaction in the first two months of 2015. In the same period of 2014 it shared the top spot with Centerview partners, also with one deal valued at USD 1.68bn.

Legal Advisory – Year to Date (YTD)

Creel, Garcia-Cuéllar, Aiza y Enriquez rose from number two to top Mexico’s legal advisory ranking in the first two months of 2015, advising on four deals worth a combined USD 2.48bn. Galicia rose from the number four stop to take the number two position in the YTD ranking by number of deals, while topping the chart by value with a whopping USD 5.2bn combined deal value from three transactions.