BRAZIL: Food and beverage deals spike

The number of food and beverage distribution deals in Brazil has increased by 143% YTD compared to the same period in 2014, according to TTR data (www.TTRecord.com). In both periods, transactions were mostly led by Brazilian buyers acquiring local peers.

COLOMBIA: Domestic firms demonstrate appetite for acquisitions abroad

Colombian buyers have been increasingly looking abroad for growth with 20 acquisitions of foreign targets YTD in 2015 compared to 13 in the same period of 2014, according to TTR data (www.TTRecord.com). Among the most popular target markets for Colombian buyers are Chile, Panama, Brazil, and the US, with three acquisitions in each country, and two in Mexico, YTD.

|

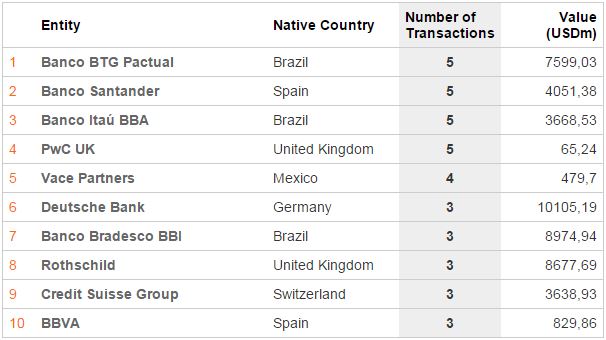

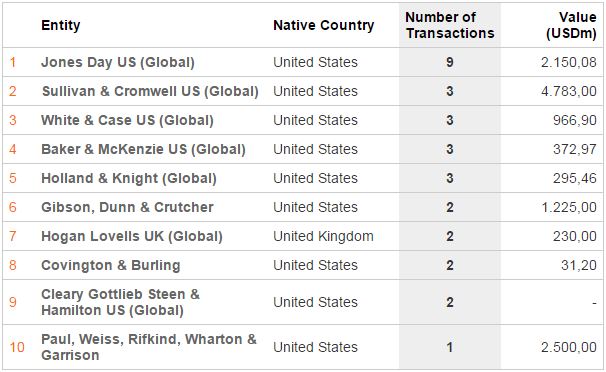

Rankings / League Tables

|

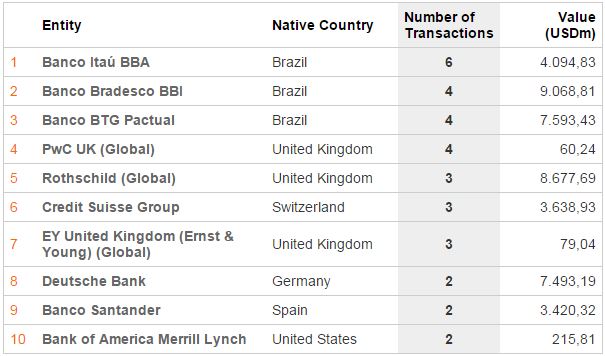

Latin America Ranking – 2015

Financial Advisory – Year to Date (YTD)

Legal Advisory – Year to Date (YTD)

Brazil Ranking – 2015

Financial Advisory – Year to Date (YTD)

Legal Advisory – Year to Date (YTD)

Mexico Ranking – 2015

Financial Advisory – Year to Date (YTD)

Legal Advisory – Year to Date (YTD)