TTR Deal Tracker

www.TTRecord.com

LATIN AMERICA

TTR Deal Tracker is a monthly email update identifying M&A trends in Latin America and compiling YTD rankings of leading financial and legal advisors

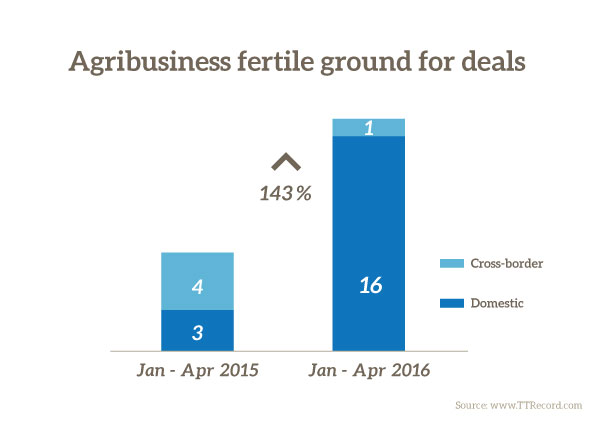

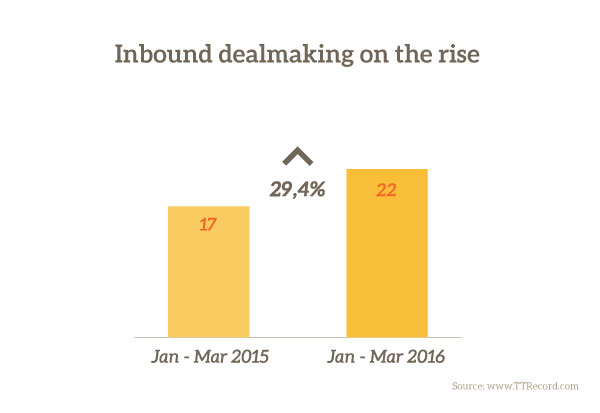

BRAZIL: Agribusiness fertile ground for deals

Agribusiness transactions have shot up 143% in the first four months of 2016 relative to the corresponding period in 2015, according to TTR data (www.TTRecord.com).

The number of international buyers in the space fell in relative and real terms, however, from four of seven in the first four months of 2015 to one of 17 YTD.

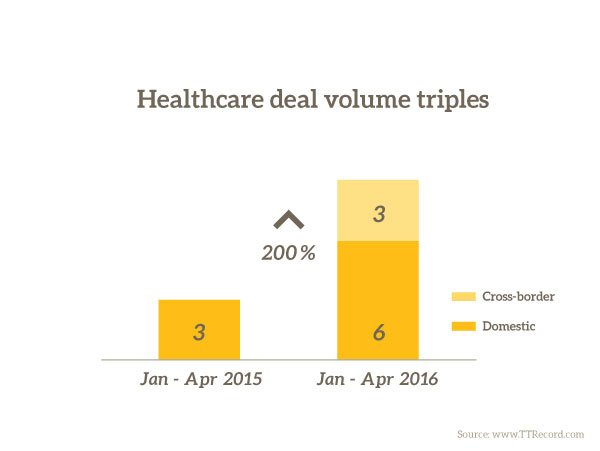

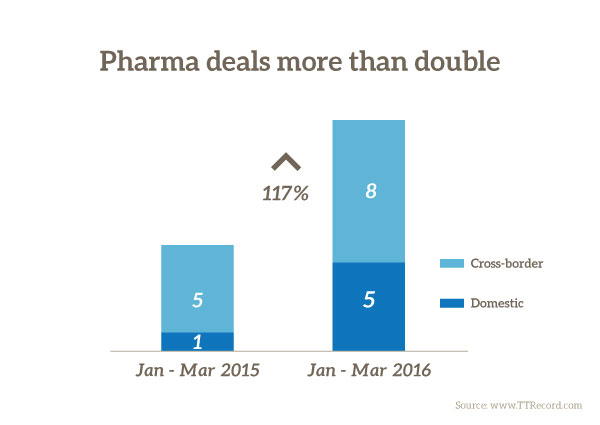

MEXICO: Healthcare deal volume triples

Heathcare, hygiene and cosmetics deal volume has increased 200% in the first four months of 2016 compared to the same period in 2015, according to TTR data (www.TTRecord.com).

International bidders have demonstrated appetite for the space this year, with three of nine transactions led by overseas investors whereas none of the three deals in the corresponding period of 2015 were cross-border.

|

Rankings / League Tables

|

Latin America Ranking – 2016

Financial Advisory – Year to Date (YTD)

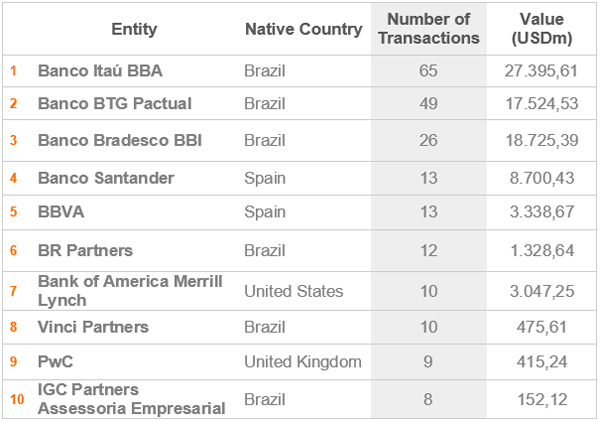

Brazil’s Banco Itaú BBA holds its position at the top of TTR’s Latin America financial advisory ranking at the close of April with nine mandates YTD worth a combined USD 3.7bn, a 40% decline by volume and a 19% dip in aggregate value compared to its performance in the first four months of 2015 when it’d advised on 15 deals together worth USD 4.6bn. Banco BTG Pactual follows close behind with six mandates in the first four months of 2016 on deals worth a combined USD 1.3bn, representing a 33% decline in volume and an 83% fall in aggregate value relative to its nine mandates on deals worth USD 7.9bn in aggregate in the first four months of 2015, when it also placed second in the chart. Citigroup ranks third with five deals worth USD 2.4bn in aggregate after not placing among the top 10 of the regional ranking at the close of April 2015. BBVA jumped two positions to take fourth, also with five deals YTD, in its case worth USD 1.9bn, compared to four worth USD 1.3bn a year ago when it ranked sixth. Banco Bradesco BBI ranks fifth, also with five mandates YTD, the same volume as at the close of April 2015, the aggregate value of its deals dropping 91% meanwhile from USD 9.1bn to USD 806m. BR Partners ranks sixth with four advisory mandates YTD worth USD 1.1bn combined, and Ártica Investimentos seventh, also with four deals under its belt. Neither placed among the top 10 at the close of April 2015, nor did BAML, in eighth, Vinci Partners in ninth nor Goldman Sachs, in tenth.

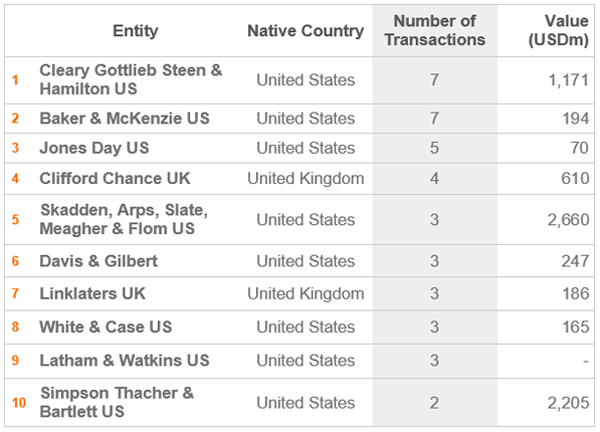

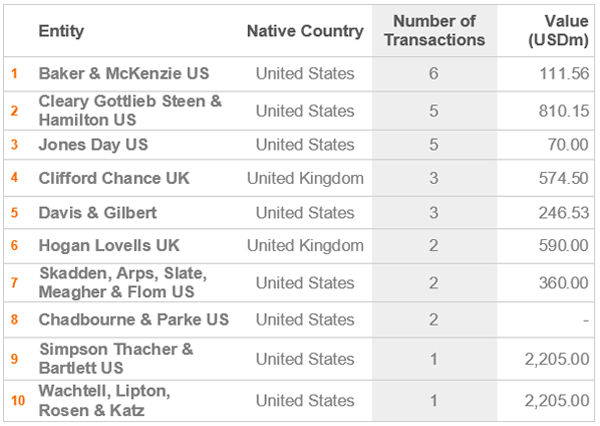

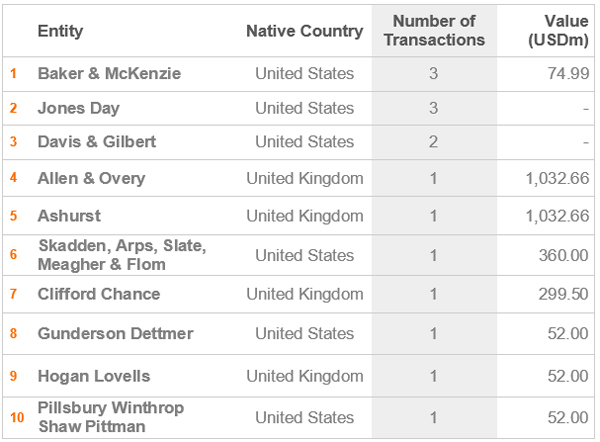

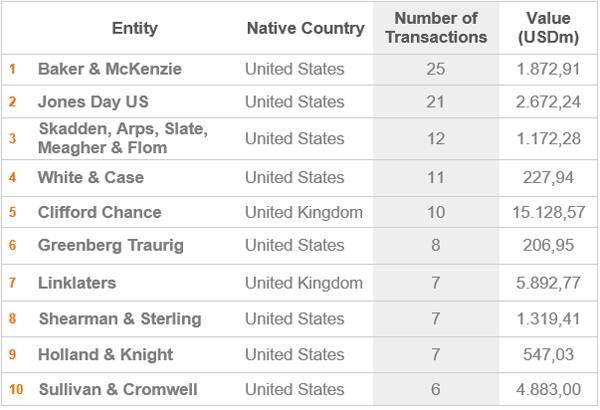

Cleary Gottlieb Steen & Hamilton leads TTR’s Latin America legal advisory ranking at the close of April with nine advisory mandates YTD on deals worth a combined USD 1.2bn. The top international firm in the region was not among the leading 10 at the close of April 2015. Baker & McKenzie is tied by volume but lags far behind by aggregate value, the combined consideration of its deals worth USD 194m, a 97% decline from the USD 795m its 11 deals were together worth a year ago when it also ranked second. Jones Day fell to third from first with five mandates YTD together worth USD 70m compared to 13 worth USD 2.3bn in the first four months of 2015. Clifford Chance climbed one position to take fourth, though its deal volume remained constant. Skadden, Arps, Slate, Meagher & Flom ranks fifth, with three advisory mandates YTD, tied by volume with Davis & Gilbert, Linklaters, White & Case and Latham & Watkins, of which only White & Case placed among the top 10 in the first four months of 2015 when it advised on four deals together worth USD 983m to take fourth in the chart. Simpson Thacher & Bartlett brings up the rear, advising on two deals YTD after not appearing among the top 10 for the four-month period ending a year ago.

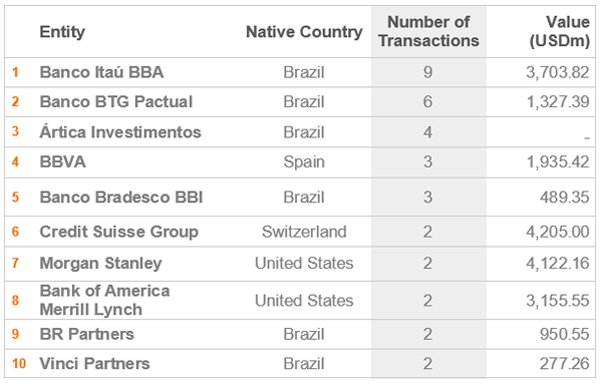

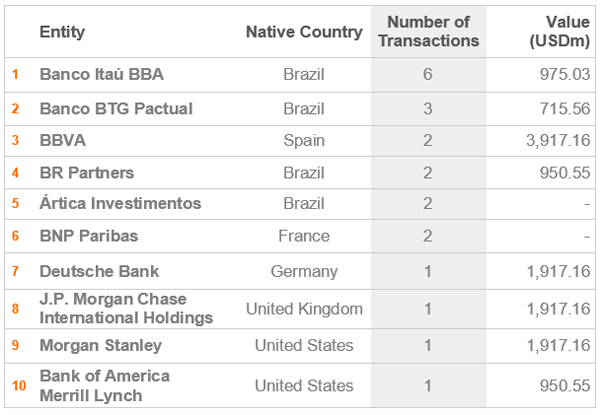

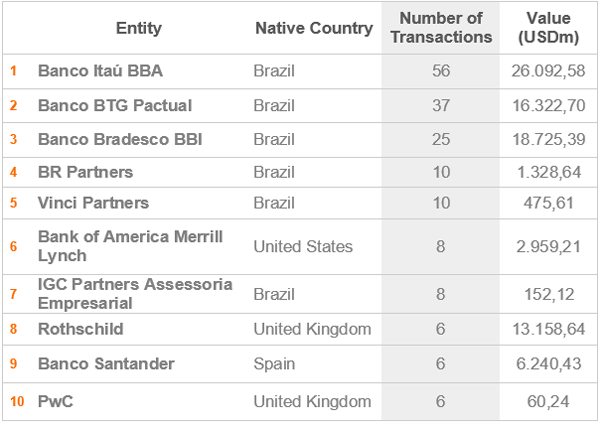

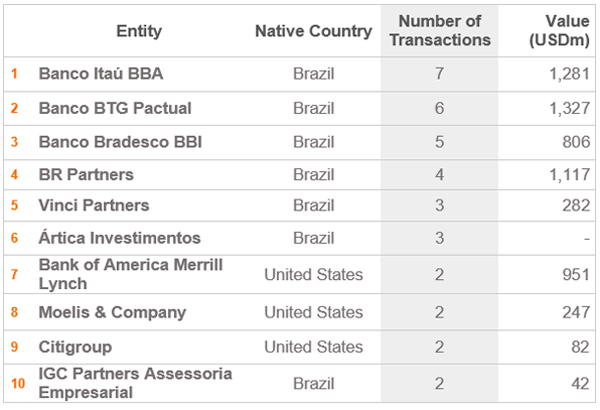

Financial Advisory – Year to Date (YTD)

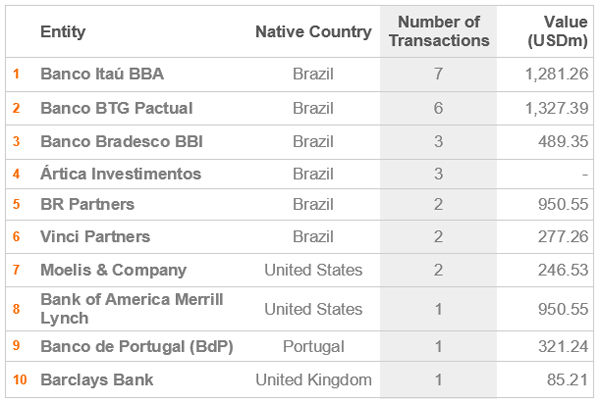

Brazil’s top three banks, Banco Itaú BBA, Banco BTG Pactual and Banco Bradesco BBI hold to their first-, second- and third-place positions of a year ago in TTR’s Brazil financial advisory ranking at the close of April 2016. All three faced a heavy decline in aggregate deal value, which fell 71%, 83% and 91%, respectively, though only Itaú’s deal volume declined as that of its peers remained constant. BR Partners ranks fourth after not appearing among the top 10 for the first four months of 2015. Vinci Partners climbed from seventh to fifth, its deal volume remaining constant in each four-month period while the aggregate value of its three deals grew from USD 22m to USD 282m. Ártica Investimentos, BAML, Moelis & Company and Citigroup, in sixth, seventh, eighth and ninth, respectively, were not among the top 10 at the close of April 2015. IGC Partners Assessoria Empresarial fell five positions to bring up the rear, its deal volume cut in half.

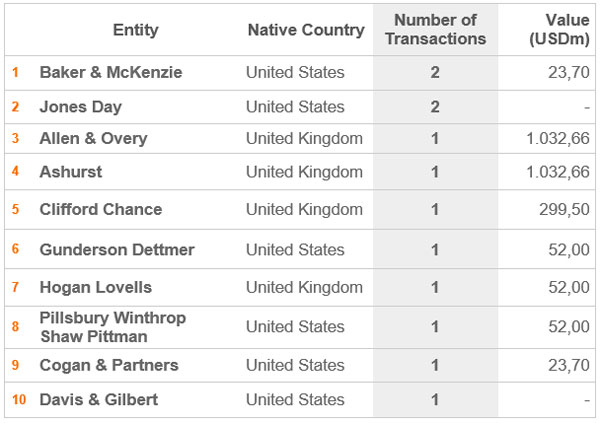

Legal Advisory – Year to Date (YTD)

Souza Cescon Advogados leads TTR’s Brazil legal advisory ranking for the first four months of 2016 with 18 deals together worth USD 2.1bn, representing a 64% increase in volume and a 42% decline in aggregate value relative to its 11 deals worth a combined USD 3.6bn a year ago when it ranked fourth. Pinheiro Neto Advogados follows in second, up from sixth a year ago, its deal volume growing 70% from 10, its aggregate deal value up 538% from USD 271m. Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados lost one position in the chart to rank third, despite growing volume by two deals. Its aggregate deal value fell 85% from USD 7.8bn, meanwhile. TozziniFreire Advogados climbed two positions in the ranking to take fourth, its deal volume up 67% from nine and its aggregate deal value down 44% from USD 570m. Machado, Meyer, Sendacz e Opice Advogados fell from first to fifth as it lost one transaction compared to its performance in the first four months of 2015 and aggregate deal value dipped 84% from USD 3.2bn. Barbosa, Müssnich, Aragão fell from third to sixth in the chart, despite adding one deal to its count of a year ago. The combined value of its deals dropped 92% from USD 7.8bn in the first four months of 2015. Stocche, Forbes, Padis, Filizzola, Clapis, Passaro, Meyer e Refinetti Sociedade de Advogados ranks seventh, Lefosse Advogados eighth and Lobo & de Rizzo Advogados ninth, none of the three having appeared among the top 10 by the close of April 2015. Demarest Advogados brings up the rear, its volume down by one, the aggregate value of its deals up 214% from USD 79m a year ago when it ranked eighth.

Mexico Ranking – 2016

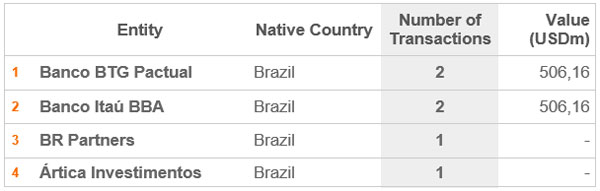

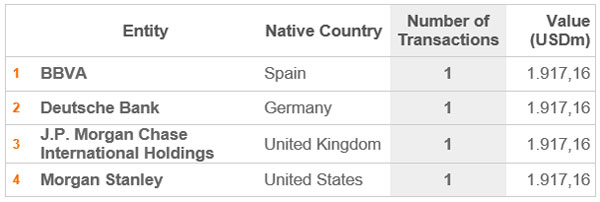

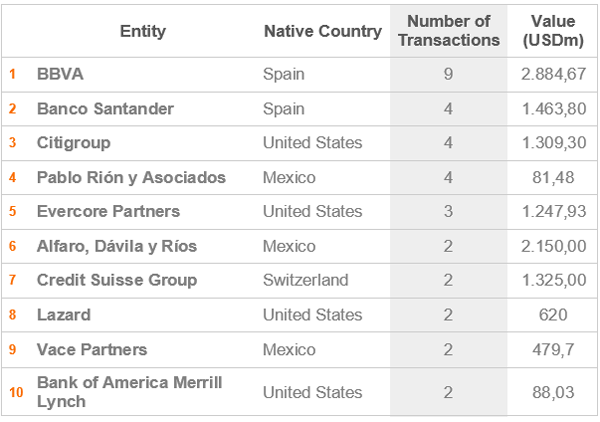

Financial Advisory – Year to Date (YTD)

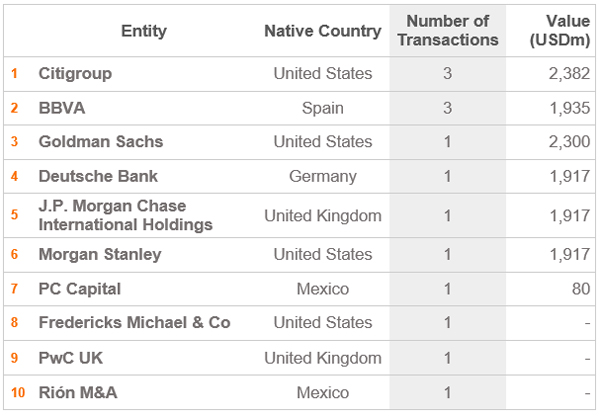

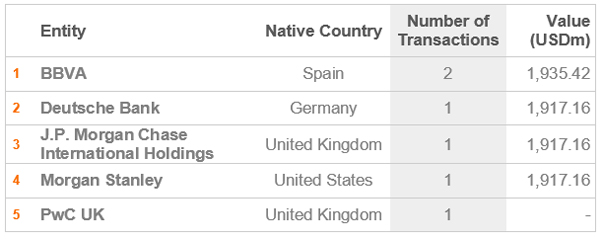

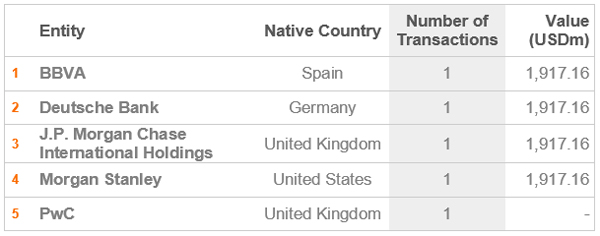

Citigroup leads TTR’s Mexico financial advisory ranking for the first four months of 2016 with three mandates worth a combined USD 2.4bn, up from one deal worth USD 1.2bn for the corresponding period ending a year ago when it ranked fifth. BBVA is tied by volume, its three deals worth USD 1.9bn. BBVA advised on the same number of transactions by the close of April 2015, its three deals then worth USD 1.3bn. Of the remaining financial advisors in the chart, only Rión M&A appeared among the top 10 for the corresponding period ending a year ago, when it had also advised on a single deal.

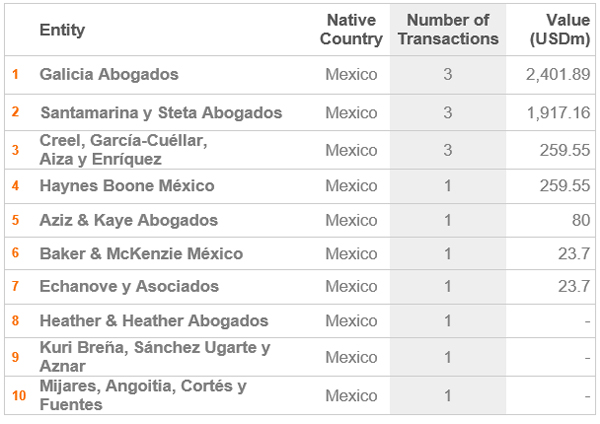

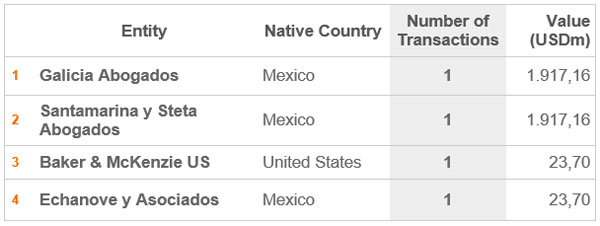

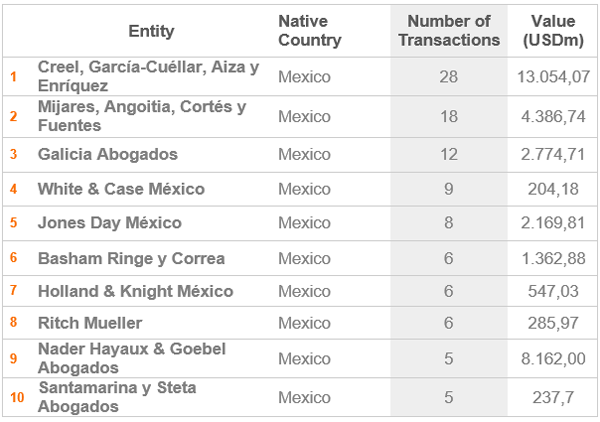

Galicia Abogados leads TTR’s Mexico legal advisory ranking for the first four months of the year with five mandates on deals worth a combined USD 2.4bn, the same volume as in the corresponding period ending a year ago when it ranked fourth. Its aggregate value is down by 12% from USD 2.7bn. Ritch Mueller follows in second with four deals worth a combined USD 82m. The firm did not place among the top 10 in the first four months of 2015. Santamarina y Steta Abogados ranks third, having added one transaction to its tally of a year ago and growing aggregate value by 746% from USD 227m. Creel, García-Cuéllar, Aiza y Enríquez, in fourth, fell from first place a year ago, its volume down 79% from 14 and its aggregate value down 93% from USD 3.6bn. Geenberg Traurig México ranks fifth after not appearing among the top 10 in the first four months of 2015. Robles Miaja Abogados, in sixth, Haynes Boone México, in seventh, Garrigues México in eighth, and Aziz & Kaye Abogados, in ninth, were also absent from the top 10 a year ago. Baker & McKenzie México lost two deals and fell one position in the chart to bring up the rear, its aggregate deal value declining slightly from USD 30m.