Real Estate sector leads Spanish transactional market, although 17.07% falls until December

Spain registered until December 622 operations, related to real estate sector, represents a drop of 17.07% compared to the same period of 2018

July was the month with the highest number of operations in the Spanish real estate market

Real estate market in the country registers a 57.38% decrease in capital mobilized until December 2019

Featured Deal:

TPG Capital closes the acquisition of 75% of Témpore Properties from Sareb

Spain’s real estate sector has registered until December 2019 a total of 622 mergers and acquisitions, between announced and closed, for an aggregate amount of EUR 13,568m, according to Transactional Track Record data (www.TTRecord.com).

Despite a decrease of 17.07% in the number of operations and 57.38% in the amount thereof with respect to the twelve months of 2018, operations in the real estate sector lead the Spanish transactional market, above from the technology sector, with 334 operations; financial and insurance, with 176 transactions; and consulting, auditing and engineering, with 138 businesses carried out.

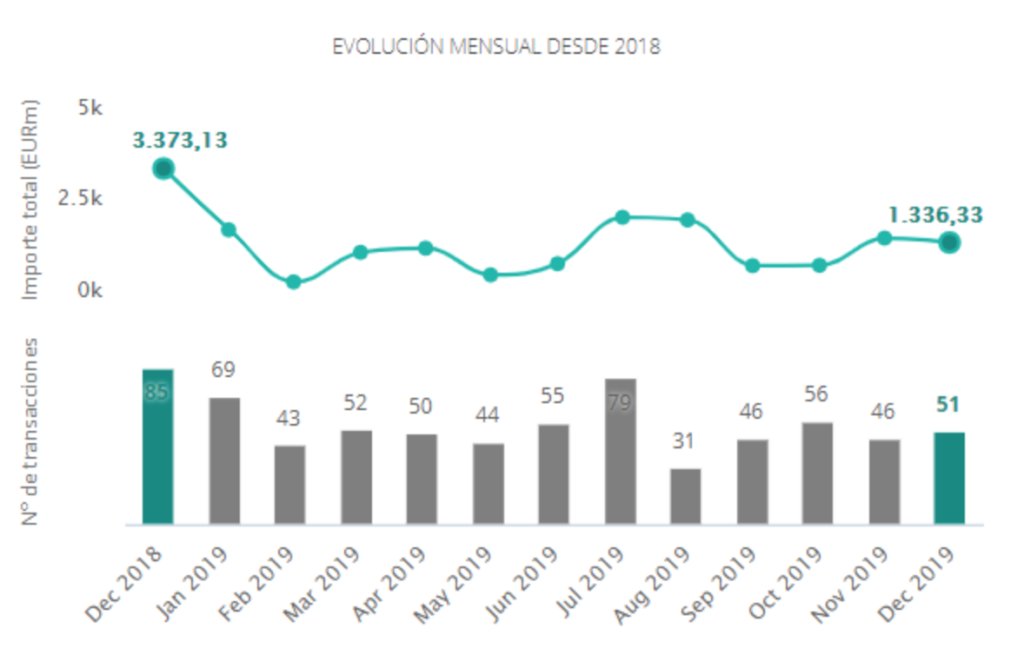

In monthly terms, in December 2019, a total of 51 operations in the Spanish real estate sector have been accounted for with an aggregate amount of EUR 1,336.33m and, in accordance with the evaluation corresponding to the twelve months of 2019 in the Spanish transactional market, July has been the busiest month in the sector, with 79 operations and with EUR 2,030.57m of capital mobilized.

Cross-Border Deals

With regard to Cross-Border transactions in the real estate market, so far this year, Spanish companies have chosen Portugal as the main destinations for their investments with 16 operations. In terms of amount, the United States is the country in which Spanish companies have made a larger disbursement, with a total amount of EUR 1,306.23m.

The United States (54), United Kingdom (42) and France (23) are the countries of origin of the largest number of investments made in Spain throughout the year in real estate. By amount, he leads the United States, with an aggregate amount of EUR 2,987.40m.

Top M&A Deal

One of the most outstanding M&A operations of the year in Spain in real estate has been related to Tempore Holdings in August 2019.

The Luxembourg company, owned by TPG Real Estate Partners III, a fund that is also controlled by the US private equity firm TPG Capital, has closed the acquisition of 75% of the Spanish SOCIMI Témpore Properties a Sareb (Asset Management Company from Bank Restructuring) for a value of EUR 247.32m.

Venture Capital

In the course of the year, 9 Venture Capital operations have been registered in the Spanish real estate sector, of which eight transactions have a disclosed value that together record a capital mobilized for EUR 53m.

Registered operations include those related to the Spanish startup ProntoPiso, which has received EUR 14m of venture debt financing led by Inveready Capital, Sabadell Venture Capital and other private investors. In addition, the startup Housell stands out, which has closed a round of financing of EUR 12m signed by Cerberus Capital Management and the Aviv Group.

Private Equity

Up to December 2019, 12 Private Equity operations have been registered in the real estate sector, of which 11 have a disclosed value that together record a mobilized capital of EUR 2,081m.

Of the registered operations, Oaktree Capital Management stands out, which has agreed to acquire 100% of the Spanish SDIN Residencial from Banco Sabadell for an amount of EUR 882m. The list also includes Tropic Real Estate Holding, which has acquired an additional 18.43% in the Spanish Testa Residencial from Banco Santander for EUR 349.40m.