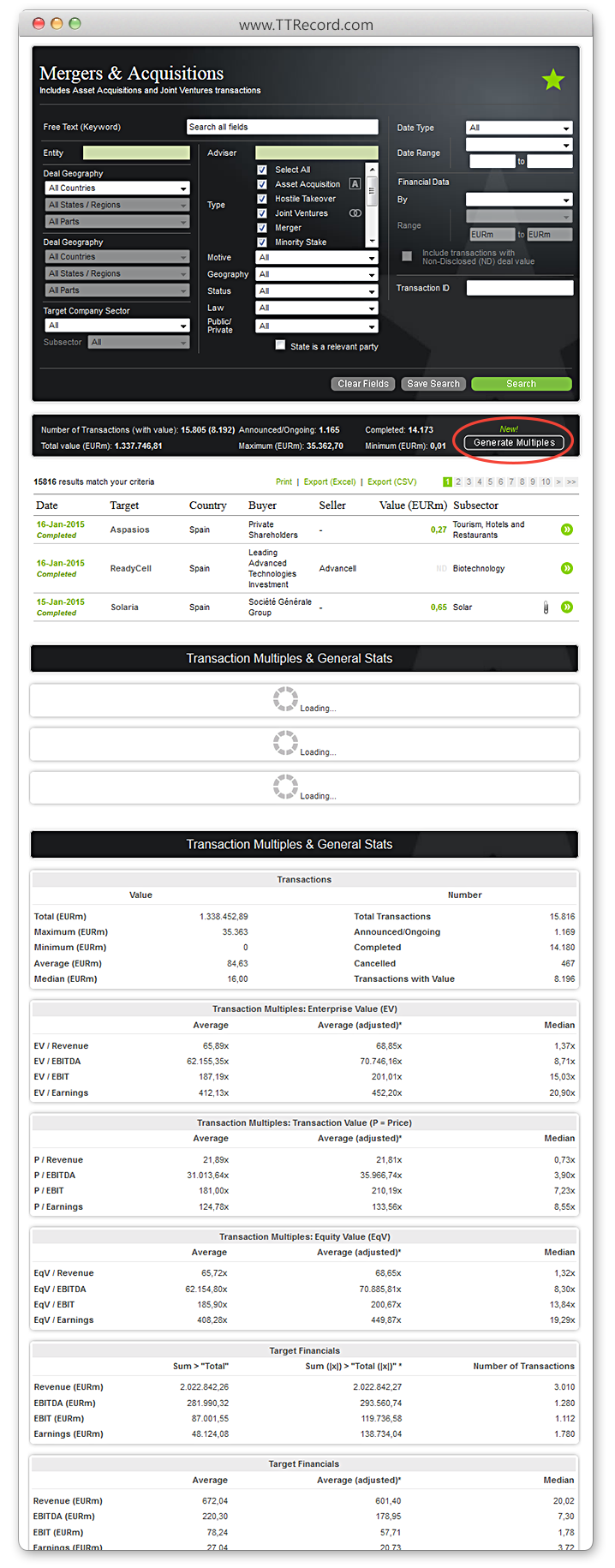

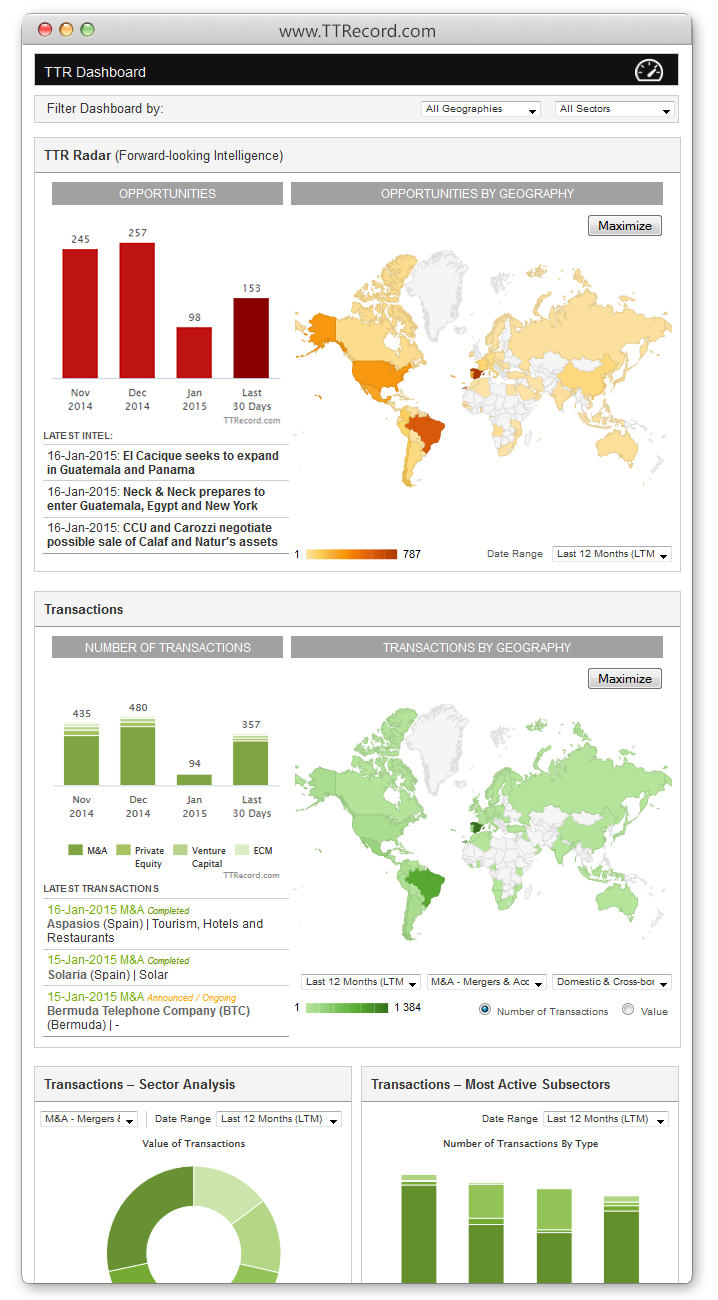

In 2014, the Mexican transactional market was particularly dynamic, with a total of 225 mergers and acquisitions, both announced and closed, which represents a 28.6% increase compared with the previous year. However, the investment volume generated was USD 30.10bn compared with USD 43.83bn in 2013, but, it is important to take into account that in 2013 we recorded the acquisition of Grupo Modelo, for USD 20.10bn.

Regarding market segments, there was a slight increase in the number of deals registered in the high-end market in deal size (>USD 500m), 16 deals in 2013 compared with 18 this year, which denotes an increasing interest in this type of deals. Highlights include the acquisition by US-based PPG Industries of Mexico-based Consorcio Comex, for USD 2,300m.

The most active sectors, in 2014, were technology and Internet, with 26 deals recorded each, followed by the financial and insurance (23), and distribution and retail (15). This tendency was repeated throughout the year.

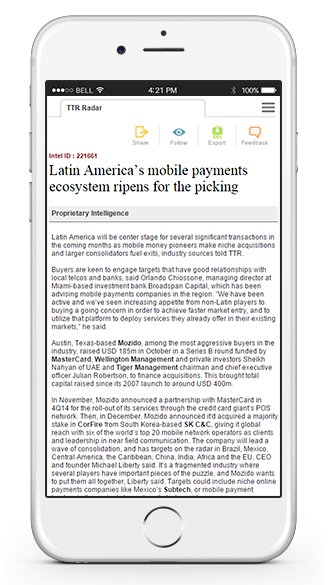

In the cross-border sector, British and US-based companies were the most acquisitive in the Mexican market; however, Mexican companies chose United States and Spain to carry out their international investments.

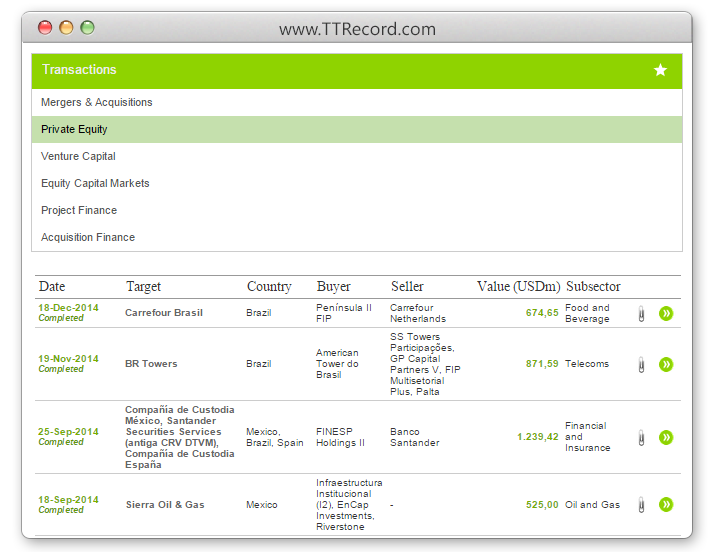

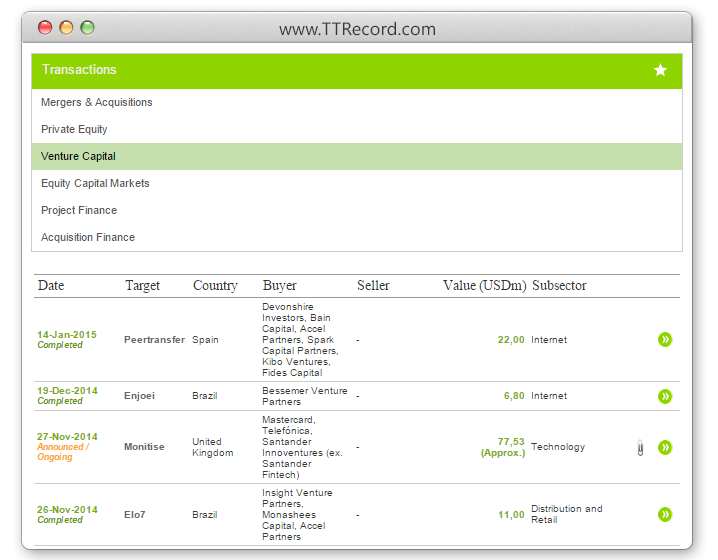

Furthermore, the private equity and venture capital segments were also dynamic, with a 49% increase in the number of deals this year, compared with 2013. Highlights include the acquisition by Swiss private equity fund Partners Group of a majority stake in Fermaca, a Mexican gas company. The deal value was USD 750m.

The capital markets was less active in 2014 compared with the previous year. Nevertheless, several relevant deals were recorded, such as an IPO carried out by Fibra Prologis, for USD 664.52m. In addition, City Express carried out a capital increase for approximately USD 176m.

After a year of growth in the M&A transactional market, it is estimated that 2015 will be a positive year. Several deals that were not completed this year should be closed in 2015, and the legislation reforms carried out by the Mexican Government, in sectors such as energy and telecommunications, will enable foreign investment in Mexico.

Consorcio Comex – Manufacturer of decorative and waterproofing paints.

Go to Report > http://www.ttrecord.com/en/publications/monthly-report-mexico/Mexico-First-second-Third-and-Fourth-Quarter-2014/1283/