TTR Deal Tracker

www.TTRecord.com

LATIN AMERICA

TTR Deal Tracker is a monthly email update identifying M&A trends in Latin America and compiling YTD rankings of leading financial and legal advisors

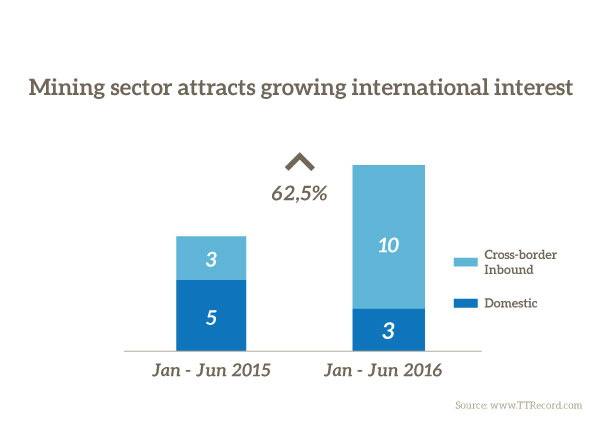

BRAZIL: Mining sector attracts growing international interest

Transaction volume in Brazil’s mining industry grew 62.5% in the first six months of 2016 relative to 1H15, according to TTR data (www.TTRecord.com).

International investment in the sector grew as well between the two periods, with 10 deals led by foreign buyers YTD compared to three in the first six months of 2015.

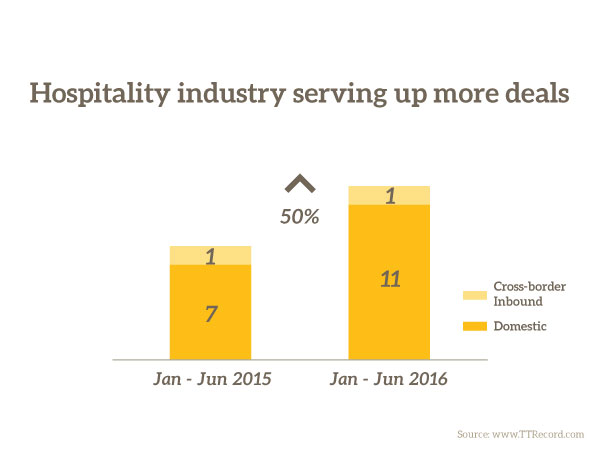

MEXICO: Hospitality industry serving up more deals

The number of transactions in Mexico’s hospitality sector grew by 50% in 1H16 compared to the same six-month period last year, according to TTR data (www.TTRecord.com).

As in 1H15, deals in the sector were dominated by Mexico-based companies.

|

Rankings / League Tables

|

Latin America Ranking – 2016*

Financial Advisory – Year to Date (YTD)

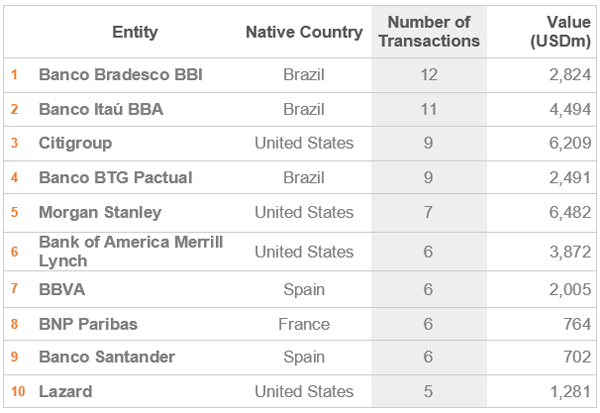

Banco Bradesco BBI leads TTR’s Latin America financial advisory ranking for 1H16 with 12 deal mandates YTD Worth a combined USD 2.8bn, doubling its volume of 1H15 when it ranked fifth in the chart with six mandates on transactions together worth USD 9.1bn, representing a 69% decline in aggregate value. Banco Itaú BBA was bumped from its lead of a year ago to take second place in the ranking, with 11 mandates worth a combined USD 4.5bn, representing a 56% decline in volume and a 68% decline in aggregate value compared to its 25 mandates worth a combined USD 14bn in the first six months of 2015. Citigroup ranks third with nine deal mandates region-wide in the first six months of 2015 worth a combined USD 6.2bn after not placing among the top 10 a year ago. Banco BTG Pactual fell from second place a year ago to take fourth in the chart, its deal volume down 40%, its aggregate deal value down 74% from 15 in the first six months of 2015 worth a combined USD 2.5bn. Morgan Stanley ranks fifth with seven deals under its belt YTD together worth USD 6.5bn. Morgan Stanley did not place among the top 10 banks in the region in 1H15. BAML is up three positions from ninth a year ago to take sixth, its volume up 50% and the aggregate value of its deals up by nearly 400% from USD 777m to USD 3.9bn. BBVA, in seventh, lost one position in the chart, but is up by one transaction compared to its performance in 1H15 while the aggregate value of its deals is up by 131% to USD 2bn. BNP Paribas follows in eighth, also with six deal mandates YTD, tied by volume with Banco Santander, in ninth. Neither BNP Paribas nor Santander where among the top 10 banks advising on M&A in the region at the close of 1H15, nor was Lazard, bringing up the rear with five mandates YTD worth a combined USD 1.3bn.

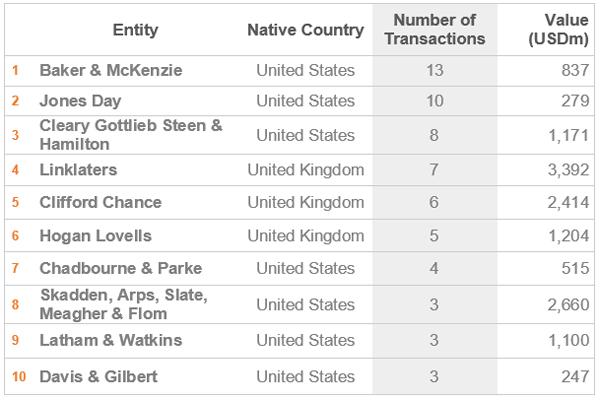

Baker & McKenzie leads TTR’s Latin America legal advisory ranking for the first six months of 2016 with 13 deal mandates YTD worth a combined USD 837m, up from second place a year ago when it had advised on 15 deals worth USD 1.3bn in aggregate. Jones Day was nudged to second by Baker, the firm’s 10 deals worth USD 279m, representing a 41% decline in volume and an 89% decline in aggregate value compared to its performance in the first six months of 2015. Cleary Gottlieb Steen & Hamilton ranks third with eight mandates under its belt in 1H15 worth a combined USD 1.2bn after not placing among the top 10 in the first six months of 2015. Linklaters, in fourth, was also absent from the top 10 a year ago, and nudged Clifford Chance from its fourth-place position of a year ago to fifth, despite the firm having added one deal to its tally of last year. Hogan Lovells, in sixth with five transactions under its belt YTD, was not among the top 10 in 1H15, nor was Chadbourne & Parke, in seventh with four mandates in the region in 1H16. Skadden, Arps, Slate, Meagher & Flom, in eighth, fell from its sixth-place ranking at the close of June 2015, its deal count down by two, the aggregate value of those transactions up by 207% to USD 2.7bn. Latham & Watkins, in ninth, also with three transactions under its belt region-wide YTD, was not among the top 10 at the close of June 2015, nor was Davis & Gilbert, in tenth.

Brazil Ranking* – 2016

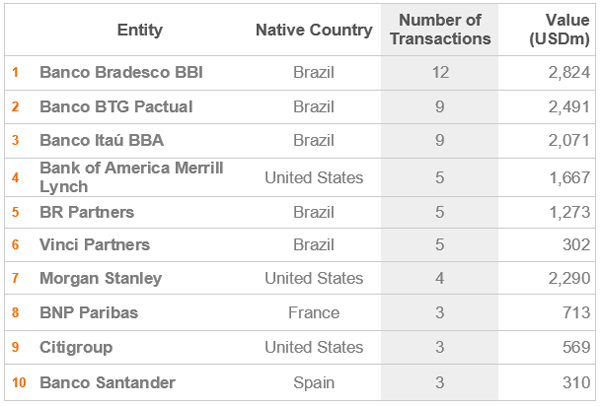

Financial Advisory – Year to Date (YTD)

Banco Bradesco BBI leads TTR’s Brazil financial advisory ranking with 12 deal mandates in the first six months of 2016 worth a combined USD 2.8bn, double its tally of a year ago when it ranked third with six mandates on transactions worth a combined USD 9.1bn. Banco BTG Pactual holds firm to its second-place ranking of 1H15 with the same number of mandates YTD as it had by the end of June 2015. The combined value of those deals is down by 70%, meanwhile, from USD 8.3bn. Banco Itaú BBA fell from its leading position a year ago to take third, its deal volume dropping 59% from 22 to 9, the aggregate value of those transactions down 85% from USD 9.1bn to USD 2bn. BAML, in fourth with five mandates YTD, was not among the top 10 banks advising on M&A deals in Brazil in 1H15. BR Partners, in fifth, is tied with BAML by volume, up by one deal from its tally of a year ago, the aggregate value of those transactions up by 625% to USD 1.3bn. Vinci Partners also advised on five transactions in 1H16 to place sixth, after not appearing among the top 10 a year ago. Morgan Stanley too was absent from the top 10 a year ago, as was BNP Paribas, Citigroup and Banco Santander, in seventh, eighth, ninth and tenth place, respectively.

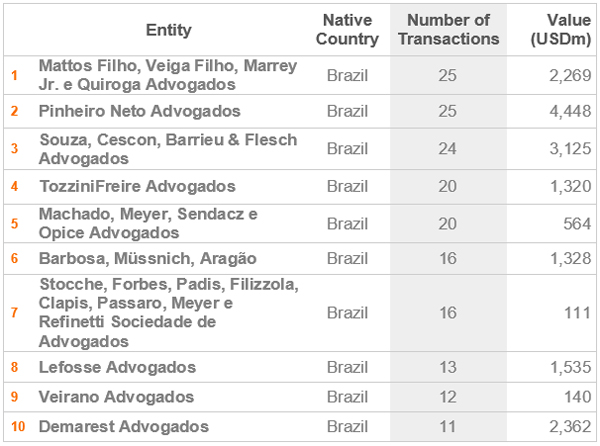

Legal Advisory – Year to Date (YTD)

Mattos Filho, Veiga Filho, Marrey Jr. e Quiroga Advogados tops TTR’s Brazil legal advisory ranking at the close of 1H15 with 25 deal mandates worth a combined USD 2.3bn, representing a 14% increase in volume and a 74% decline in the aggregate value relative to 1H15 when it had advised on 23 deals together valued at USD 12.5bn to rank third. Pinheiro Neto Advogados is tied by volume with 25 deals together worth USD 4.4bn, also up marginally in deal count from 1H15 when the firm had advised on 22 deals worth a combined USD 9.5bn and also ranked second. Souza, Cescon, Barrieu & Flesch Advogados follows in third with 24 transactions YTD, up 9% over 1H15 by volume and down 22% by aggregate value from 22 deals worth USD 4bn when it ranked fourth. TozziniFreire Advogados climbed two rungs in the ranking to take fourth in the chart, adding five deals to its tally of a year prior and bucking the trend by increasing aggregate transaction value by 72% from USD 767m to USD 1.3bn. Machado, Meyer, Sendacz e Opice Advogados fell from first place at the close of 1H15 to take fifth in the chart, it’s deal volume down 13% from 23, the aggregate value of its deals down 95% to USD 564m. Barbosa, Müssnich, Aragão, in sixth, fell one position in the chart relative to its performance in the corresponding period in 2015, its volume down 16% and aggregate value off 85% from 19 deals worth USD 8.8bn when it ranked fifth. Stocche, Forbes, Padis, Filizzola, Clapis, Passaro, Meyer e Refinetti Sociedade de Advogados ranks seventh at the close of 1H16 after not having placed among the top 10 at the close of 1H15. Lefosse Advogados, in eighth, was also absent from the top 10 a year ago. Veirano Advogados lost one deal from its tally of a year prior to close 1H16 in ninth place with 12 deals together worth USD 140m, representing an 8% dip in volume and a 55% decline in aggregate deal value. Demarest Advogados brings up the rear in tenth, its tally also down by a sole transaction, while its 11 deals are together worth USD 2.4bn representing an uptick in aggregate deal value of USD 2,889% from its 13 deals worth USD 71m combined a year ago.

Mexico Ranking* – 2016

Financial Advisory – Year to Date (YTD)

BBVA tops TTR’s Mexico financial advisory ranking at the close of June with four transactions under its belt YTD worth a combined USD 2bn, the same number of deals it’d advised on by the close of 1H15 when it also ranked first with four transactions then worth USD 869m in aggregate. Citigroup climbed from sixth to take second in the chart, its deal count up from a sole transaction a year ago worth USD 1.2bn. Deutsche Bank, in third, was not among the top 10 at the close of June 2015, nor was JPMorgan, tied by deal volume and aggregate value alongside Morgan Stanley, which was also absent from the chart at the close of 1H15. Lazard too was absent from the top 10 at the close of June 2015, as was Goldman Sachs, PC Capital and Buenos Aires Advisors, ranked sixth, seventh, eighth and ninth. Evercore Partners lost one deal compared to its tally of a year ago when it ranked fourth to round out the top 10 with a sole transaction of undisclosed consideration.

Creel, García-Cuéllar, Aiza y Enríquez leads TTR’s Mexico legal advisory ranking by a wide margin with 14 transactions to its name in 2016, holding firm to the top spot it held a year ago when it’d advised on 18 deals together worth USD 9.5bn. Galicia Abogados lost one deal compared to its volume a year ago when it ranked third but climbed one position in the chart nonetheless to take second place. Santamarina y Steta Abogados ranks third after not placing among the top 10 M&A firms in Mexico in 1H15. Ritch Mueller, in fourth, was also absent from the chart a year ago. Jones Day México lost three deals and one position in the chart relative to its seven deals worth a combined USD 2.2bn a year ago to rank fifth, its volume down 43%, its aggregate deal value off by USD 90%. Mijares, Angoitia, Cortés y Fuentes ranks sixth, down from second at the close of 1H15 when it’d advised on 12 deals together worth USD 2.4bn, representing a 75% dip in volume and a 74% fall in aggregate value. Von Wobeser y Sierra, in seventh, did not place among the top 10 M&A firms in Mexico as the first six months of 2015 came to a close, nor did Robles Miaja Abogados, in eighth, nor Greenberg Traurig México, in ninth. Basham Ringe y Correa lost 50% of its deal volume and 93% of its aggregate deal value falling one position in the chart to round out the top 10 with its two transactions worth a combined USD 91m.

* TTR Rankings are generated with transactions announced or closed in 2016 year-to-date. The ranking includes sales and acquisitions of shares and of assets, creation of joint ventures, and Private Equity/Venture Capital investments. The legal advisor rankings for Brazil and Mexico take into consideration advisory services regarding domestic laws. All rankings only include deals where a company of the respective country was the target of the transaction. In the case of LATAM, it would be a Latin American country. The LATAM ranking does not specify the origin of the advisory law, so the filter only considers firms from the UK/US.

In case of a draw, the adopted criteria will be the following: if the draw is due to number of transactions, the total deal value prevails; if it is due to deal value, the number of transactions prevail. When a draw of both number of transactions and deal value occurs, the same position will be retained and the deals will be arranged alphabetically.